Chapter 6 of laura madeiras quickbooks 2013 in depth offers more specific details for correcting aged item receipts. Get rid of unwanted billable expenses in batch trick in quickbooks online qbo show.

How To Un Apply Credits In Quickbooks

How To Un Apply Credits In Quickbooks

how to get rid of credits in quickbooks

how to get rid of credits in quickbooks is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to get rid of credits in quickbooks content depends on the source site. We hope you do not use it for commercial purposes.

How to apply allowance for bad debt to accounts receivable in quickbooks share on facebook quickbooks stores available credit as a credit memo when a customer receives a refund in the form of a store credit.

How to get rid of credits in quickbooks. 11 03 handling overpayments credits and discounts quickbooks pro 2013 atfal bokra. Some of these customers that we ga. We have discontinued this practice as we dont generate enough business that way.

Skip trial 1 month free. First class tax solutions. Find out why close.

First of all a word of warning. Looking for the best option to either clear out a credit memo or remove the value for a customer. How to use the billable expense feature in quickbooks online duration.

If you are completing these changes as part of a dated review from the menu bar select accountant client data review and launch client data review. In the past we gave our customers a referral credit for sending us a new customer. To delete an available credit on a customers account log into quickbooks and choose the customers menu customer center customers jobs.

Quickbooks allows users to void credit memos which erases the available credit from the respective customers account while still leaving a copy of the record in your transaction history. To fix unapplied vendor payments and credits follow these steps. Get youtube without the ads.

I am not sure where you are located but most states in the us have what are called escheat laws that technically say you cant write off customer over payments without some real reason to do so and after so long if the customer does not use it then you need to remit it to the state.

Solved Deleting A Credit Memo Quickbooks Community

Solved Deleting A Credit Memo Quickbooks Community

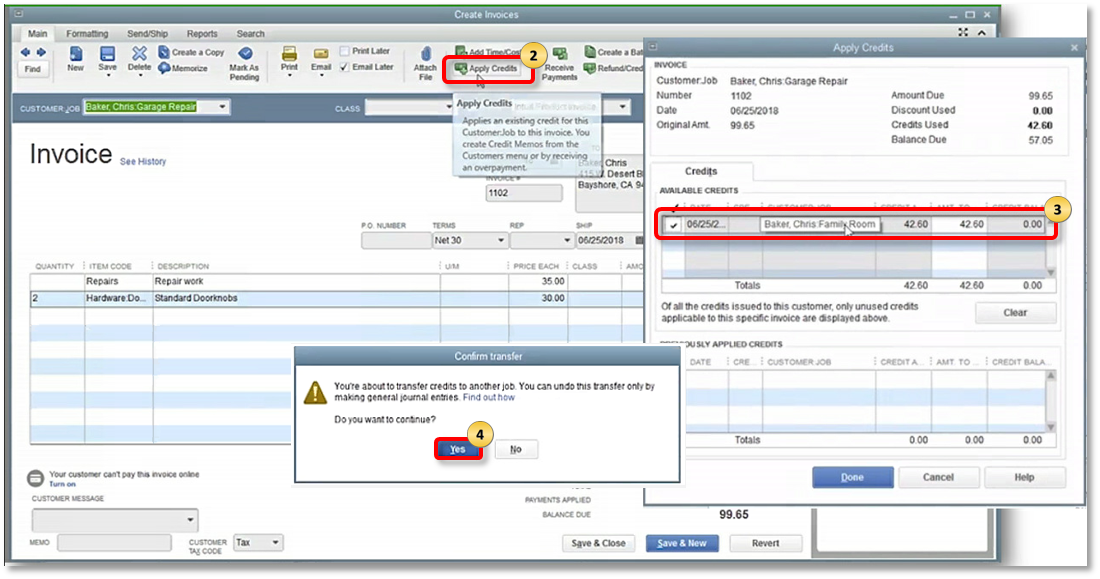

Transfer Customer Credit From One Job To Another

Transfer Customer Credit From One Job To Another

How To Fix A Customer Payment In Quickbooks

How To Fix A Customer Payment In Quickbooks

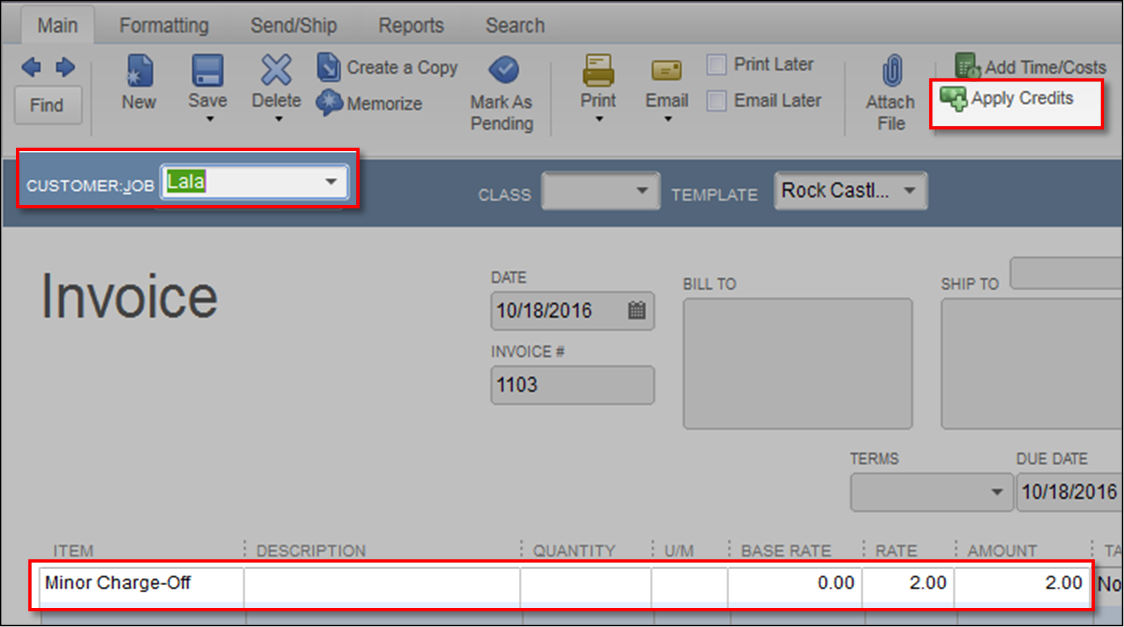

Write Off Customer And Vendor Balances Quickbooks Community

Write Off Customer And Vendor Balances Quickbooks Community

How Do I Create A Quickbooks Refund Receipt Or Credit Note Stryde

How Do I Create A Quickbooks Refund Receipt Or Credit Note Stryde

Quickbooks Refund Customer Overpayment What To Do When

Quickbooks Refund Customer Overpayment What To Do When

Quickbooks Refund Customer Overpayment What To Do When

Quickbooks Refund Customer Overpayment What To Do When

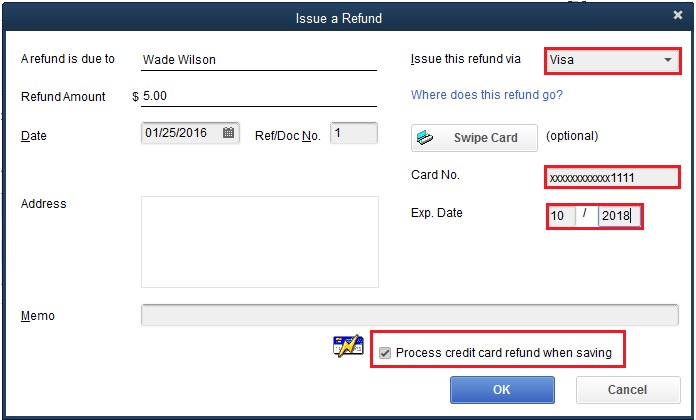

Void Or Refund Credit Card Payments In Quickbooks

Void Or Refund Credit Card Payments In Quickbooks