You can use an unsecured personal loan to consolidate debt or finance large purchases. Mathematically by consolidating your debt to a lower interest rate personal loan you will put yourself in a much better position to get out of debt faster.

Is Converting Credit Card Debt Into Personal Loan A Good

Is Converting Credit Card Debt Into Personal Loan A Good

consolidating credit card debt into a personal loan

consolidating credit card debt into a personal loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in consolidating credit card debt into a personal loan content depends on the source site. We hope you do not use it for commercial purposes.

A credit card.

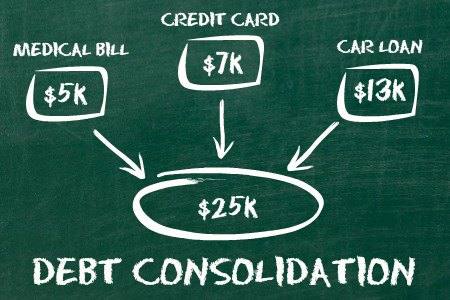

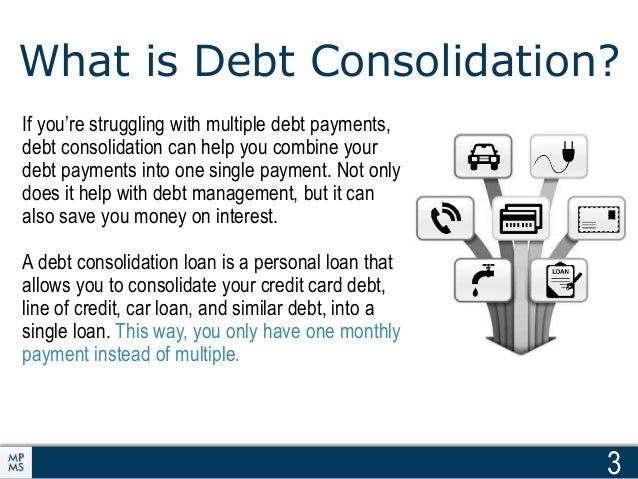

Consolidating credit card debt into a personal loan. By consolidating your credit card debt into a personal loan youll have a definite plan for paying off your old card debt. The majority of our personal loan customers will get the headline rate or a lower rate. Credit cards offer you a convenient way to spend but they can leave you with a hefty bill at the end of the month.

Personal loans for debt consolidation. Is a debt consolidation loan for you. Plus they often charge transfer fees and require a high credit score to obtain.

Thats where a credit card debt consolidation loan can come in. The amount includes the monthly loan service fee and nab personal loan cover if selected for the first year. Advantages of debt consolidation loans.

Fortunately a personal loan can be another smart option for consolidating your credit card debt. However there is a big risk to using. You can use an unsecured personal loan from a credit union online lender or bank to consolidate credit card or other types of debt.

You may be able to consolidate your debt with a personal loan from your bank or credit union. The loan should give you a lower apr on your debt or help you. The interest rate you get may be different from the headline rate and will be based on a number of factors including the information you provide and our credit assessment.

There are pros and cons to using a personal loan to tackle credit card debt. However those low interest rates are soon replaced with higher regular rates. Interest rates and terms can vary based on your credit score and.

A secured loan is when the debt is held against an asset usually property think carefully before securing other debts against your home because your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. You can also look at consolidating the debt into your home loan if you have equity in your home since there are lenders who will. Apply for a personal loan.

So instead of making multiple credit card payments each month you make one payment for the personal loan. How to consolidate personal loan and credit card debt. But before applying be sure to ask about the lenders credit requirements.

A personal loan can be used to consolidate debt and the funds from a debt consolidation loan can be used to pay off your credit card balances.

When To Use A Personal Loan To Pay Off Credit Card Debt

When To Use A Personal Loan To Pay Off Credit Card Debt

Consolidate Credit Card Debt With A Personal Loan Earnest

Consolidate Credit Card Debt With A Personal Loan Earnest

Consolidate Credit Card Debt And Save Money On Interest

Consolidate Credit Card Debt And Save Money On Interest

Credit Card Consolidation Archives Debt Consolidation For

How Can I Consolidate My Credit Card Debt Into A Loan

How Can I Consolidate My Credit Card Debt Into A Loan

Having Trouble With Debts In Singapore Here Is Your Roadmap

Having Trouble With Debts In Singapore Here Is Your Roadmap

Payoff Personal Loan 2019 A Savior For The Debt Ridden

Payoff Personal Loan 2019 A Savior For The Debt Ridden

How To Consolidate Debt And Boost Your Credit Score

How To Consolidate Debt And Boost Your Credit Score

How To Consolidate Credit Cards Debt Easily

How To Consolidate Credit Cards Debt Easily

How To Consolidate Credit Card Debt To Simplify Your Monthly

How To Consolidate Credit Card Debt To Simplify Your Monthly