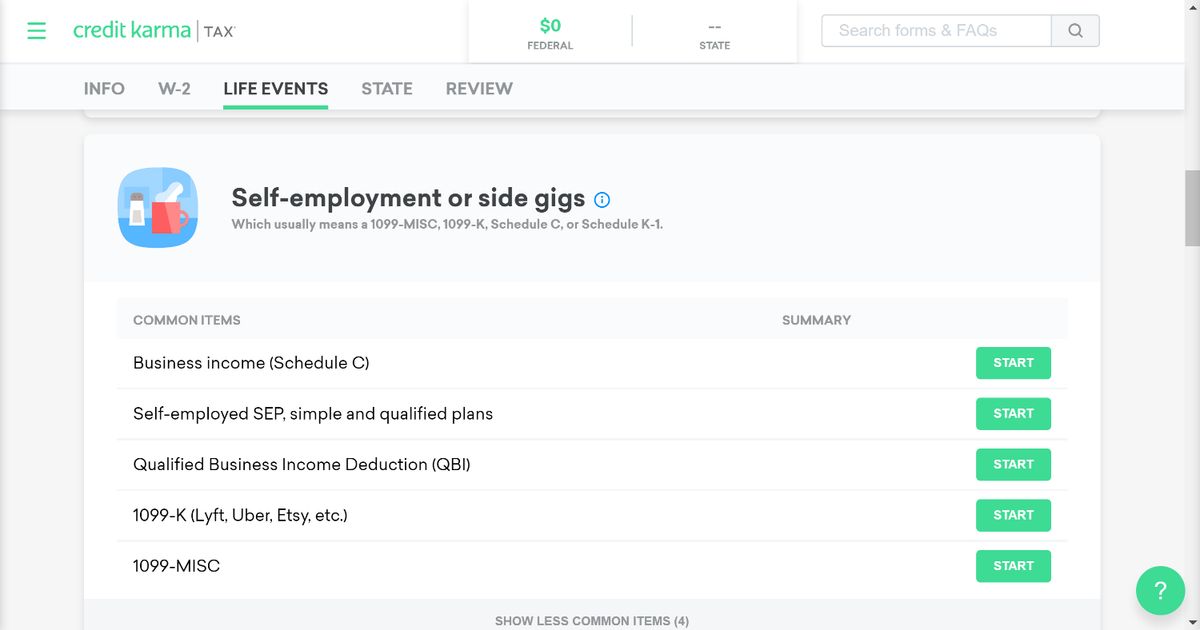

I am doing now too and thank god credit karma is free for us. Credit karma is offering free tax returns and their website lists forms that are included such as 1099 and schedule c.

You Can Report 1099 Income Using Credit Karma Tax Credit Karma

You Can Report 1099 Income Using Credit Karma Tax Credit Karma

how to file uber taxes on credit karma

how to file uber taxes on credit karma is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to file uber taxes on credit karma content depends on the source site. We hope you do not use it for commercial purposes.

Tax deductions for uber lyft and amazon flex drivers how to file the perfect tax return duration.

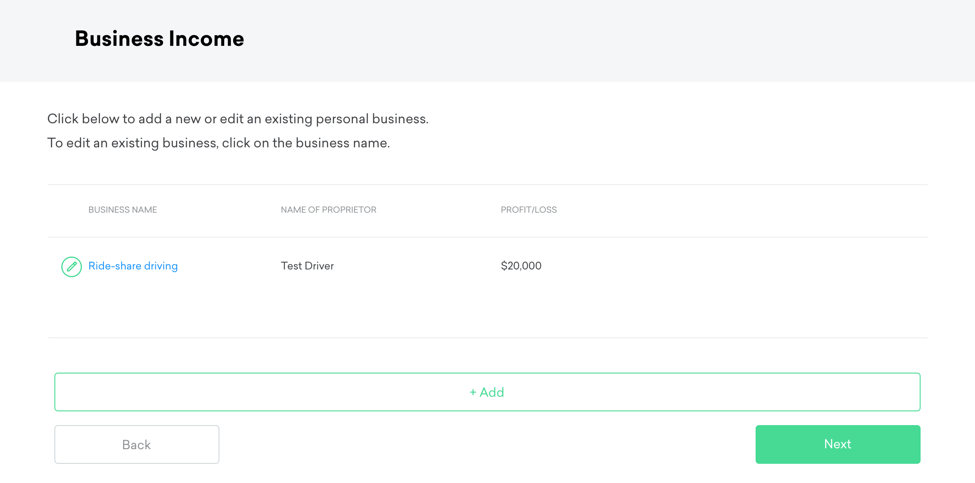

How to file uber taxes on credit karma. And if you earn 600 or more during the year youll also receive a 1099 tax form by january 31. I walk you through the steps you need to know how to understand your rideshare taxes and more in this vid. Not sure what youre looking at with your lyft tax info.

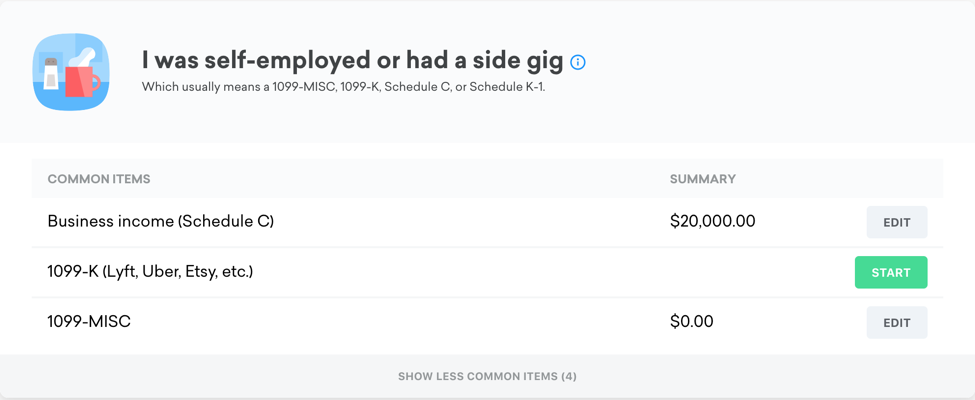

1 if you receive a larger federal tax refund amount or owe less in federal taxes using the same tax return information when filing an amended return through another online tax preparation service then you may be eligible to receive the difference in the refund or tax amount owed up to 100 minimum 25 in the form of a gift card from credit karma tax. The schedule c is an additional form that you send in with your tax return that reports your business income as well as your business deductions. When claiming education credits for your federal taxes on credit karma tax you must reduce the amount of expenses paid with any amounts you received from tax free grants scholarships and fellowships and other tax free education assistance.

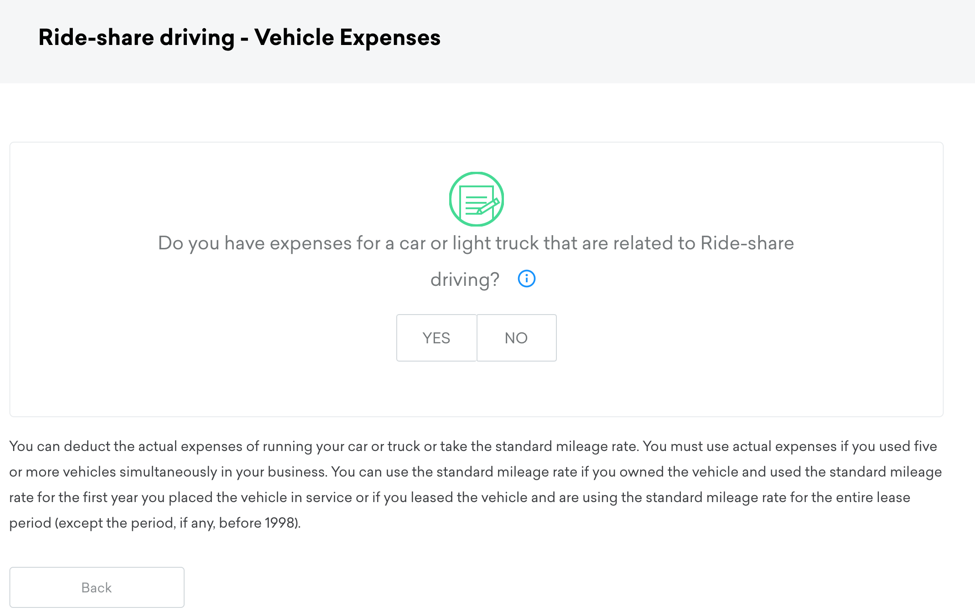

Uber reports your income to you on your 1099 k and potentially a 1099 misc as well if you had income from bonuses and referrals. The amounts in boxes 1 and 2 of form 1098 t may be different than what you actually paid. Check out our article on tax deduction tips for rideshare drivers for more useful tips for tax season.

Confused by your uber taxes. Always wait until you receive your 1099 before filing your taxes. I was planning on buying turbo tax deluxe cd but i am hoping to hear from people who may use credit karma for uberlyft filing and if they have success or not.

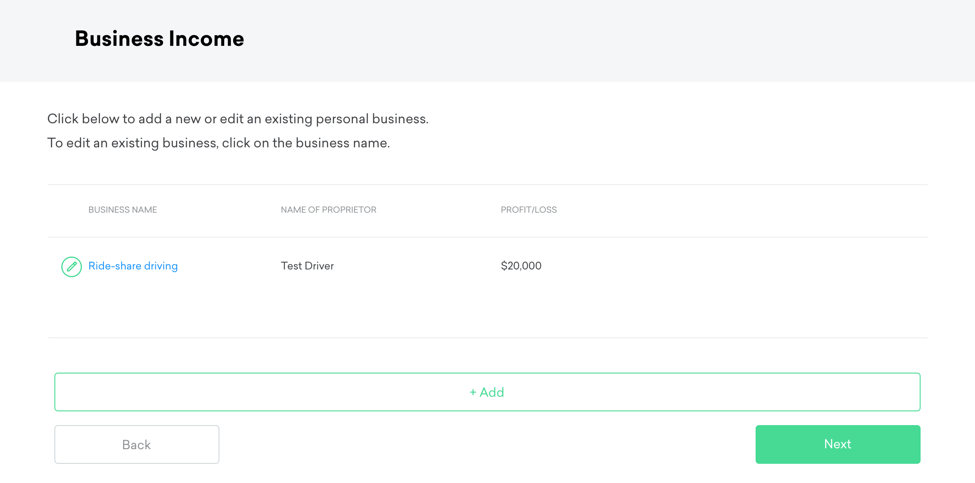

Credit karma tax can help you file your taxes as a self employed worker and identify deductions you may be eligible for as a rideshare driver. I made 86k this year between lyft uber and my other jobs and i will actually find a local person which i will pay to look over this stuff thoroughly for me because i later dont want irs troubles. Go to this section in credit karma tax.

The self employed tax guy 46921 views. The 1099 form includes how much you made what fees uber took out and how many miles you drove while on the app. Every uber partner receives a monthly tax statement.

When you file your taxes youll need to include those income totals on a schedule c. Find out if youre getting a refund file my taxes related articles. Ordinary expenses are those that are common and accepted in your trade or business and necessary expenses are those that are helpful and appropriate for your business.

Tax Expenses Zohre Horizonconsulting Co

Tax Expenses Zohre Horizonconsulting Co

Credit Karma Tax Review File Your Taxes For Free Tom S Guide

Credit Karma Tax Review File Your Taxes For Free Tom S Guide

Credit Karma Tax 2018 Tax Year 2017

Credit Karma Tax 2018 Tax Year 2017

You Can Report 1099 Income Using Credit Karma Tax Credit Karma

You Can Report 1099 Income Using Credit Karma Tax Credit Karma

The Latest Credit Karma Review Pcmag Uk Template From The 7

The Latest Credit Karma Review Pcmag Uk Template From The 7

Credit Karma Tax 2017 Tax Year 2016

Credit Karma Tax 2017 Tax Year 2016

Latest Business Finance Trending News Business Insider

Latest Business Finance Trending News Business Insider

Credit Karma Tax Review File Your Taxes For Free Tom S Guide

Credit Karma Tax Review File Your Taxes For Free Tom S Guide

Date With Uncle Sam Here Are 7 Of The Best Sites For E

Silver Lake Buys 500 Million Stake In Credit Karma Wsj

Silver Lake Buys 500 Million Stake In Credit Karma Wsj