You can pay by internet phone or mobile device whether you e file paper file or are responding to a bill or notice. The irs the internal revenue service doesnt actually accept credit card payments directly.

Can I Pay My Taxes With A Credit Card Credit Card Insider

Can I Pay My Taxes With A Credit Card Credit Card Insider

can u pay irs with a credit card

can u pay irs with a credit card is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can u pay irs with a credit card content depends on the source site. We hope you do not use it for commercial purposes.

2019 credit card bulk provider requirements effective september 21 2015 software providers requesting to partake in integrated file and pay ifp processing must be partnered with irs stand alone credit card bulk providers.

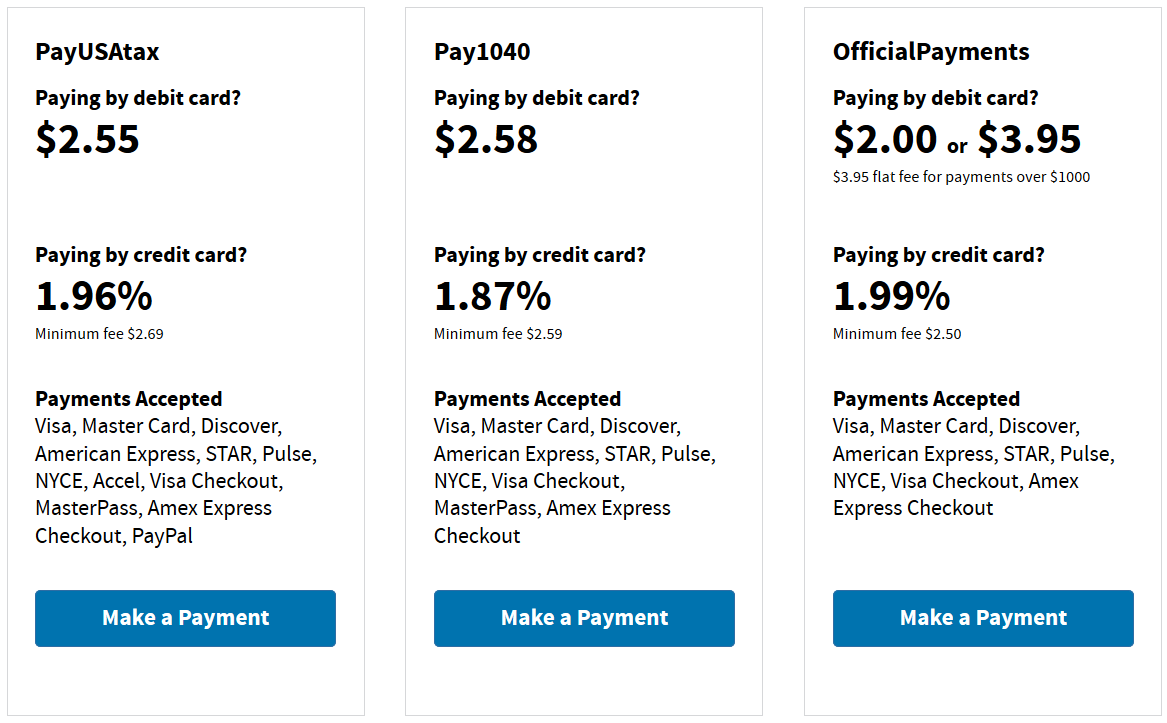

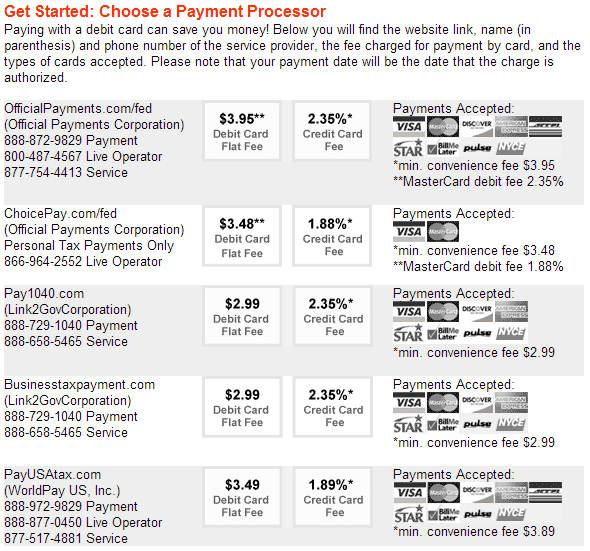

Can u pay irs with a credit card. Can i pay my taxes with a credit card. But you can pay the irs through a third party payment processorfor a processing feefor the convenience of paying your federal taxes with a credit card debit card or digital wallet. The irs gave consumers the right to pay with a credit card under the taxpayer relief act of 1997.

Paying the irs with a credit card can result in additional fees but some savvy credit card holders are making back the cost in the form of rewards. The short answer is yes you can pay the irs online with a credit card but there are some things you should keep in mind before you hand over your credit card information. Yes you can pay federal taxes with a credit card.

Most states will allow you to pay state income tax with a credit card too. However you will need to use a payment processor and pay a fee to the processor. Its safe and secure the irs uses standard service providers and businesscommercial card networks and your information is used solely to process your payment.

Visit e file or free file your taxes for information about irs e file. Can you pay your taxes on a credit card. Using a rewards credit card to pay the irs.

Visit pay your taxes by debit or credit card for more information on card payments. The short answer is that you can pay most types of taxes on a credit card. To pay federal taxes with a credit card you have to use one of the irs third party credit card processors which charge fees of 187 percent to 2 percent of the amount you put on the card.

Its not always the wisest idea for reasons well get into below.

Pros And Cons Of Paying The Irs With A Credit Card

Pros And Cons Of Paying The Irs With A Credit Card

Complete Guide To Paying Taxes Via Credit Card 2017 Edition

Complete Guide To Paying Taxes Via Credit Card 2017 Edition

Pay Taxes Via Credit Card 2020 Edition

Pay Taxes Via Credit Card 2020 Edition

Paying Taxes With Your Credit Card In 2020

Paying Taxes With Your Credit Card In 2020

How Using Cash Back Cards For Everyday Expenses Can Help You

How Using Cash Back Cards For Everyday Expenses Can Help You

Pay Taxes With A Credit Card Million Mile Secrets

Pay Taxes With A Credit Card Million Mile Secrets

How To Pay Your Tax Bill In 2019

How To Pay Your Tax Bill In 2019

Should You Pay The Irs With A Credit Card Credit Karma

Should You Pay The Irs With A Credit Card Credit Karma

Why Credit Card Tax Payments Are Usually A Bad Idea Taxact

Why Credit Card Tax Payments Are Usually A Bad Idea Taxact

How To Pay Quarterly Taxes If You Re A Business Owner

Should You Ever Pay Your Taxes With A Credit Card Us News

Should You Ever Pay Your Taxes With A Credit Card Us News