With the ever increasing cost of accepting credit cards debit cards and even prepaid cards this question of is it legal to charge a credit card processing fee is being asked more frequently than ever. The companies may post a single price then charge an extra fee when you pay with a credit card.

Can You Charge Customers A Fee For Using A Credit Card As

is it illegal to charge a credit card processing fee

is it illegal to charge a credit card processing fee is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in is it illegal to charge a credit card processing fee content depends on the source site. We hope you do not use it for commercial purposes.

All credit card issuers frown upon surcharges though most have no problem with offering a discount for using cash.

Is it illegal to charge a credit card processing fee. The closest corollary was a survey put out by the australian government. Of course it is possible some retailers will choose to raise their standard prices to cover the cost of processing debit or credit card payments or some could stop accepting cards altogether. The survey found that 68 of respondents believe retailers and other businesses should not be allowed to charge customers extra for credit card payments.

Card surcharge ban means no more nasty surprises for shoppers. Are capped at the cost to the retailer for processing the. We believe that surcharging credit card purchases is harmful to consumers said faust.

For example if you use a credit card to buy a car or pay a wedding venue you could end up paying 2 on a transaction costing thousands of pounds. It is legal to charge a credit card processing fee in 40 out of 50 states if its a surcharge and in all states if its a convenience fee. This is a great question.

Many business owners have just eaten these credit card fees and consider them just part of the cost of running a business. Merchants say surcharges allow them to recover the 2 percent to 3 percent transaction fees that card networks charge. Consumers are frustrated as some merchants charge illegal fees on card.

Card surcharge ban laws take another blow in california court. For many merchants credit card fees have become the cost of doing business. The biggest reason merchants have for adding credit card surcharges is to deal with high credit card processing costs.

Can i charge credit card fees to my customers at checkout. Hidden charges for paying with a debit or credit card will be. State law says its illegal to charge a convenience fee a processing.

A surcharge is an added cost just for using a credit card while a convenience fee is a charge for doing a transaction thats unusual for the merchant eg. Credit gift card or ebt card the fee is. Convenience fees are not surcharges which are costs added simply for the privilege of using a credit card.

Still the million dollar merchant question remains. There are both simple and complex answers to this question.

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

/GettyImages-875409638-5a20c5f6c7822d001a08c984.jpg) Businesses And Credit Card Convenience Fees

Businesses And Credit Card Convenience Fees

Credit Card Surcharging Adding Fees To Card Purchases

Credit Card Surcharging Adding Fees To Card Purchases

/GettyImages-500500849-56a066985f9b58eba4b044ed.jpg) Credit Card Surcharges When Merchants Charge You Extra

Credit Card Surcharges When Merchants Charge You Extra

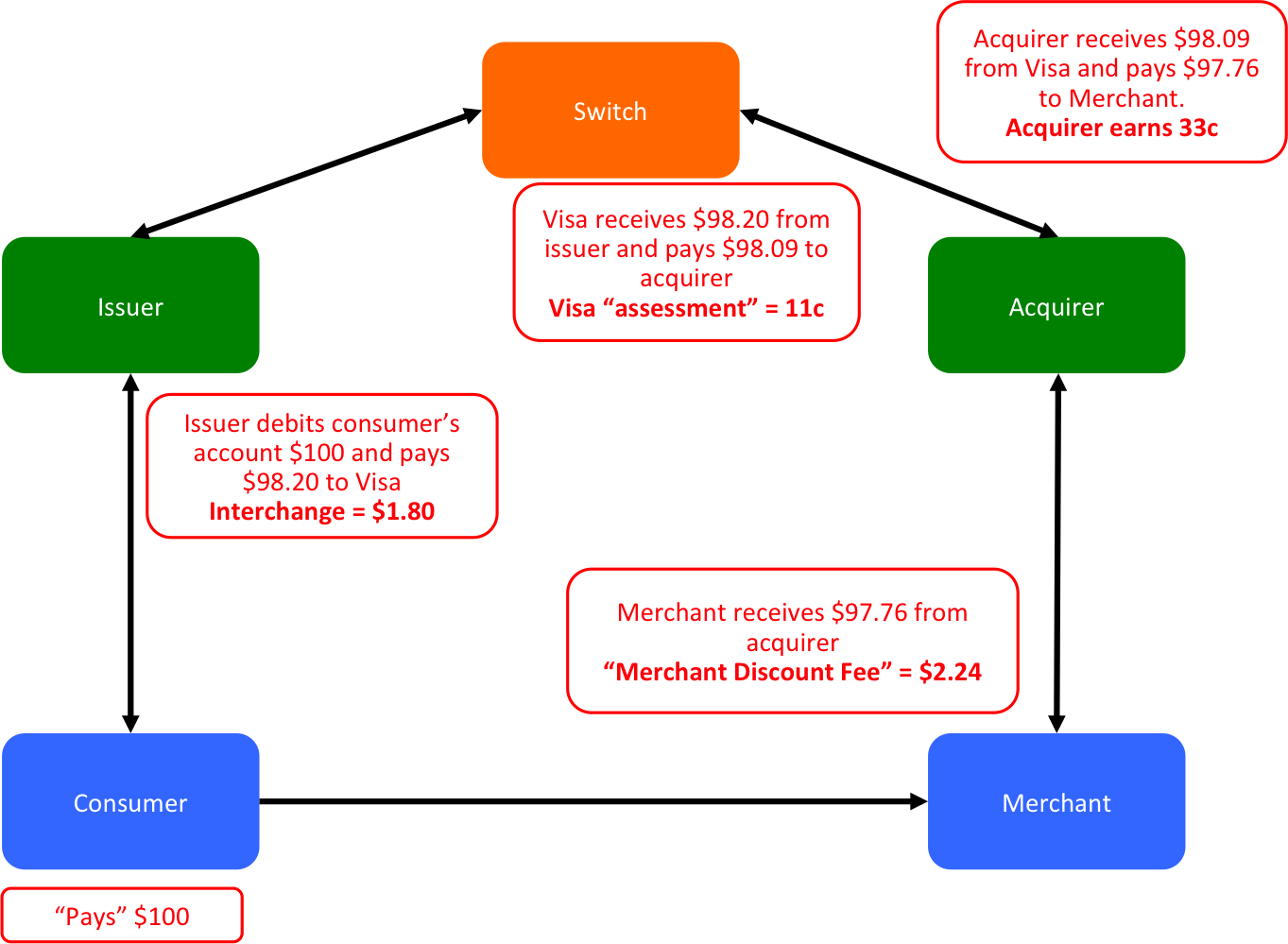

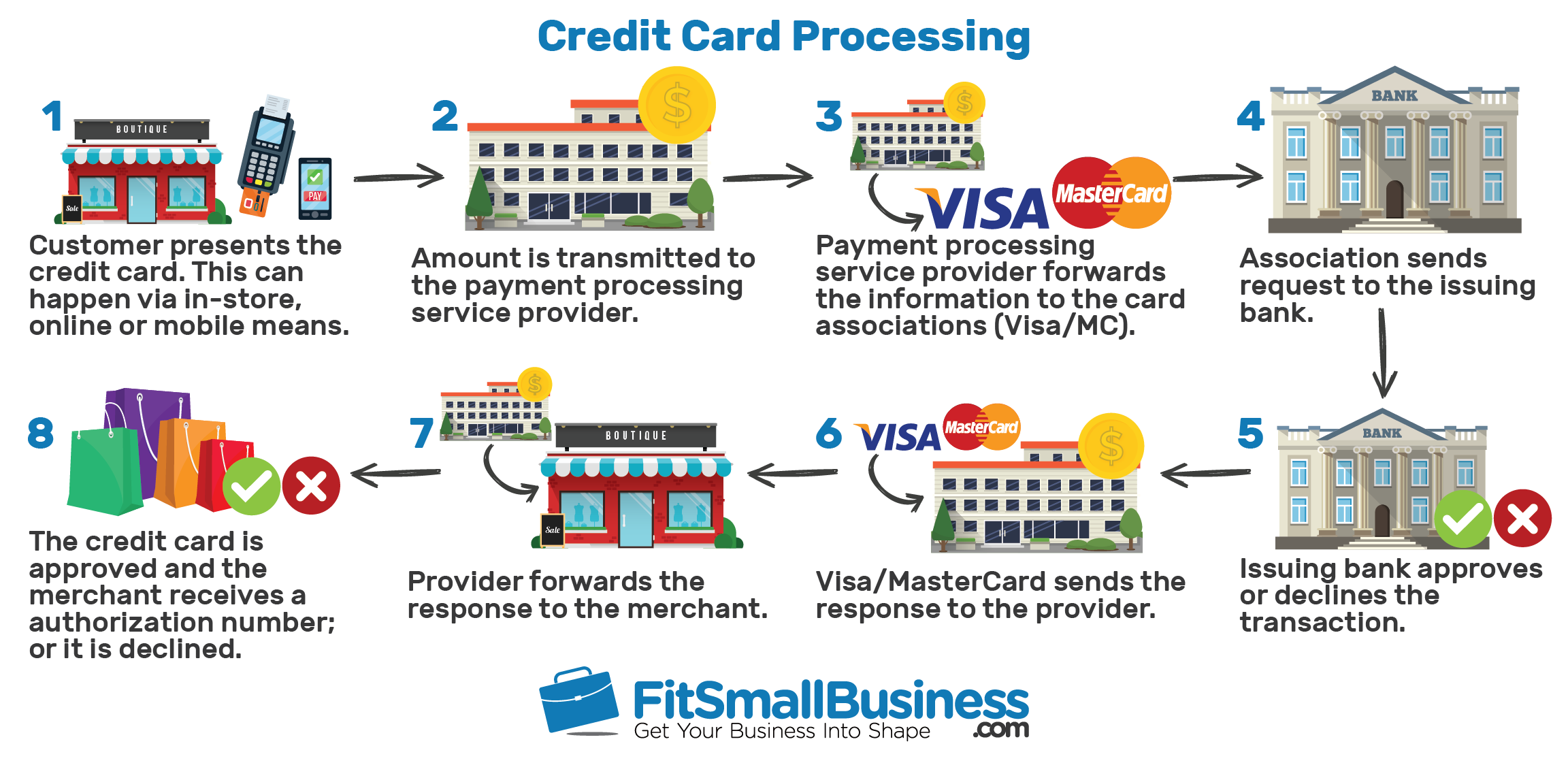

How Credit Card Processing Fees Work The Ultimate Guide

How Credit Card Processing Fees Work The Ultimate Guide

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

Is It Legal To Charge A Credit Card Surcharge Cardswitcher

Is It Legal To Charge A Credit Card Surcharge Cardswitcher

Uae Shoppers Seek Clarity On Illegal Credit Card Fee

Uae Shoppers Seek Clarity On Illegal Credit Card Fee

Are Credit Card Convenience Fees Legal Nerdwallet

Are Credit Card Convenience Fees Legal Nerdwallet