Income limit if 2 children. 3 limits you need to know.

Income Limits For The Earned Income Tax Credit How The

Income Limits For The Earned Income Tax Credit How The

how much is the limit for earned income credit

how much is the limit for earned income credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is the limit for earned income credit content depends on the source site. We hope you do not use it for commercial purposes.

This credit is meant to supplement the income you have earned through working whether for yourself self employed or for someone elseif you qualify for the earned income tax credit you can reduce your taxes and increase your tax refund.

How much is the limit for earned income credit. Single head of household or widowed. Claiming earned income tax credit eitc. A tax credit means more money in your pocket.

Earned income tax credit. The earned income tax credit eic or eitc is a refundable tax credit for taxpayers who earn low or moderate incomes. 2018 earned income tax credit.

Use the eitc assistant. Eitc earned income tax credit is a benefit for working people who have low to moderate income. See how it works how to qualify and how much you can get in 2019 2020.

There is also an earned income credit calculator to help you figure out your earned income credit amount. It reduces the amount of tax you owe and may also give you a refund. Eitc is also called eic or earned income credit.

Earned income credit worksheet calculator. The earned income tax credit worksheet can be used to calculate your eligibility and how much credit you qualify for. The earned income tax credit helps low to moderate income workers and families get a tax break.

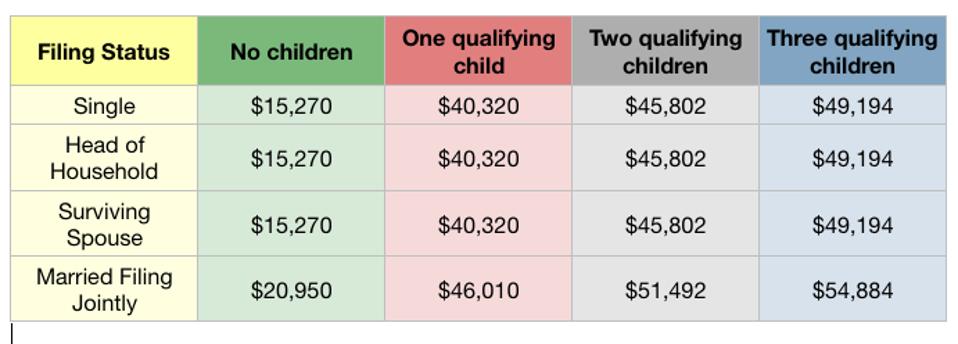

In addition to the aforementioned qualifications you must have earned income and adjusted gross income the greater of which is used within certain income limits in order to qualify for the earned income credit. And here is the earned income tax credit income limit threshold and phaseout table for the 2019 tax year. The worksheet can be found in the instruction booklet for irs form 1040.

Income limit if 3 children. Income limit if 1 child. The earned income tax credit eitc is a valuable tool for lower income taxpayers.

See if you qualify. Do i qualify for earned income tax credit eitc.

2018 Earned Income Tax Credit Eitc Qualification And

2018 Earned Income Tax Credit Eitc Qualification And

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

The Ins And Outs Of The Earned Income Tax Credit For 2018

Publication 596 2018 Earned Income Credit Eic

Publication 596 2018 Earned Income Credit Eic

Earned Income Tax Credit Eitc Qualification And Income

Earned Income Tax Credit Eitc Qualification And Income

Chart Book The Earned Income Tax Credit And Child Tax

Chart Book The Earned Income Tax Credit And Child Tax

States Can Adopt Or Expand Earned Income Tax Credits To

States Can Adopt Or Expand Earned Income Tax Credits To

Want To Keep People Working Longer Expand The Earned Income

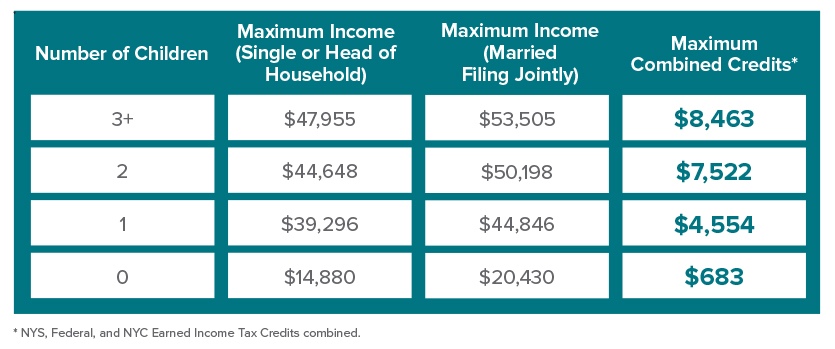

New York City Residents Eligible For Billions In Earned

New York City Residents Eligible For Billions In Earned

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit Tax Policy Center