To build good credit and stay out of debt you should always aim to pay off your credit card bill in full every month. Used well a credit card is a secure and flexible way to pay and can be a good way to spread the cost of major purchases.

:max_bytes(150000):strip_icc()/how-long-does-it-take-a-credit-card-payment-to-post-960266-final-5b4fa00bc9e77c0037431490.png) How Long Does It Take A Credit Card Payment To Post

How Long Does It Take A Credit Card Payment To Post

how much do you pay back on credit cards

how much do you pay back on credit cards is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much do you pay back on credit cards content depends on the source site. We hope you do not use it for commercial purposes.

Each month when you sit down to pay your bills you have to decide the best amount to send your credit card issuer whether its the minimum payment the full balance or something in betweenits important to put some serious thought into how much youre paying rather than come up with an arbitrary number.

How much do you pay back on credit cards. If you want to be really on top of your game it might seem logical to pay. You should be able to find it on your statement usually in a summary box on the back. Payment history is a key component of your credit scores and missing even one payment could have an impactfortunately it doesnt take too much effort to manage once you know what to look out for.

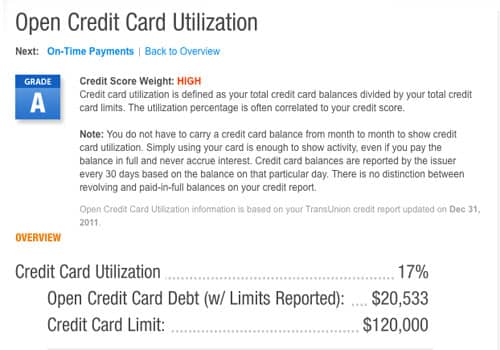

Choosing a credit card. Staying on top of your credit card bills is a key part of building and maintaining strong credit. Find out more about how credit cards work and if they would be the best.

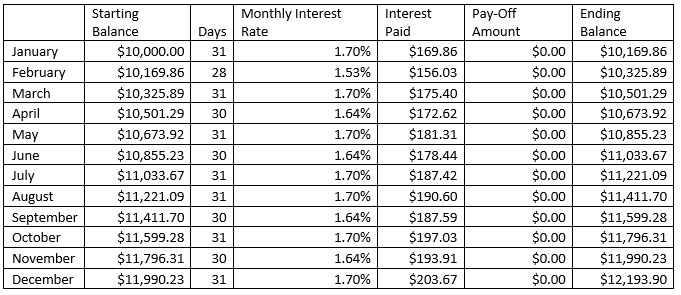

The first step to paying off your debt even before choosing which debt to pay is to figure out how much you can afford to pay on your credit card debt each month. Your monthly budget is your best way to know how much you can afford to pay. Banking and credit.

This rate of interest determines how much it costs for you to borrow on the credit card. I cant afford to increase my repayments how can i pay my balance off faster. If you dont already have a budget nows a good time to start one.

Unless you have changed cards recently its likely to be between about 149 and 299. If you keep paying the same amount as your current repayment instead of paying lower repayments as the balance reduces you will repay your debt much faster and save money. Saving money on credit cards.

But if you only make minimum payments or run up a bill you cant pay back credit cards can be costly.

What Happens If I Pay Only The Minimum On My Credit Card

What Happens If I Pay Only The Minimum On My Credit Card

Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

How Much Should I Pay Back On My Credit Card Each Month

How Much Should I Pay Back On My Credit Card Each Month

Study How Much Will Paying Off Credit Cards Improve Score

Study How Much Will Paying Off Credit Cards Improve Score

:max_bytes(150000):strip_icc()/CalculateCardPayments2-544eed4848c94d4bb6f1f9956822af38.jpg) Calculate Credit Card Payments Costs Examples

Calculate Credit Card Payments Costs Examples

Paying Your Credit Card On Time Benefits You Never Knew

Paying Your Credit Card On Time Benefits You Never Knew

10 Best Options How Do You Get Cashback On A Credit Card

10 Best Options How Do You Get Cashback On A Credit Card

11 Simple Steps To Help You Pay Off Any Kind Of Debt Debt

11 Simple Steps To Help You Pay Off Any Kind Of Debt Debt

:max_bytes(150000):strip_icc()/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png) How And When Is Credit Card Interest Charged

How And When Is Credit Card Interest Charged

Experts This Is The Highest Paying Cash Back Card On The Market

Experts This Is The Highest Paying Cash Back Card On The Market

Paying Back Student Loans How To When How Much Each Month

Paying Back Student Loans How To When How Much Each Month