You can only make a new claim for child tax credit if you get the severe disability premium or got it in the past month and. Under the tax cuts and jobs act tcja the following new child tax credit rules went into effect in 2018 and apply to 2019 tax returns.

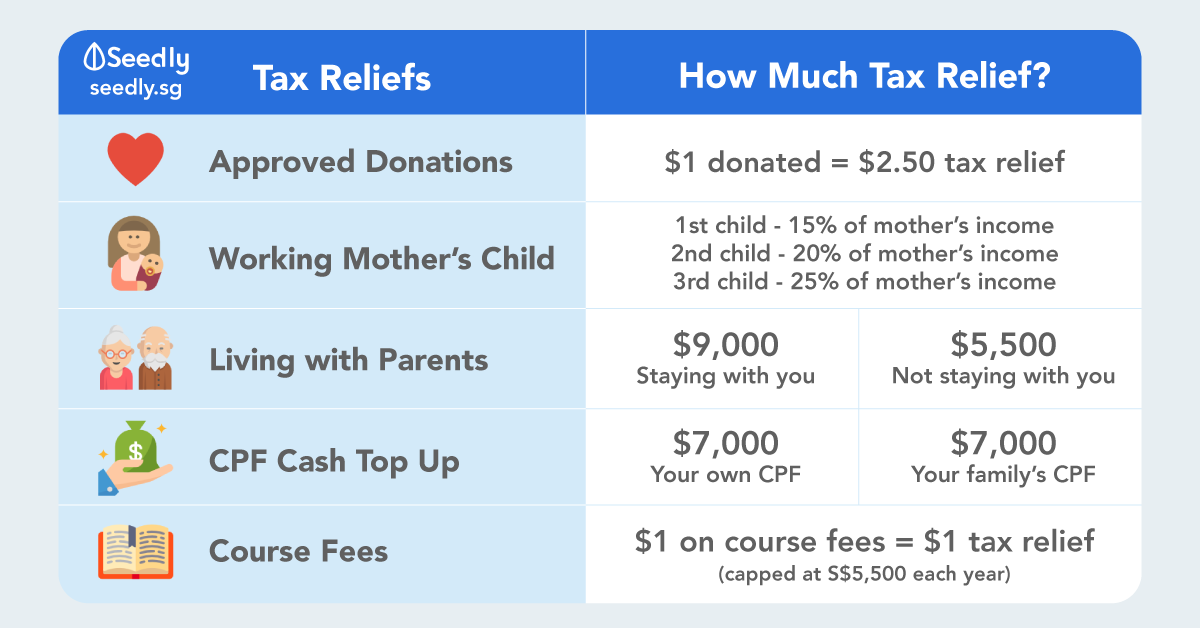

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

how much is child tax credit 2018 per child

how much is child tax credit 2018 per child is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is child tax credit 2018 per child content depends on the source site. We hope you do not use it for commercial purposes.

Child tax credit is a means tested benefit that tops up your income if youre a parent or responsible for a child however it is being replaced by universal credit.

How much is child tax credit 2018 per child. The maximum child tax credit topped out at 1000 per child through december 25 2017. You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers. What changes you should know about the child tax credit in 2019.

Find out how much you could get in child tax credit in 2019 20 and how the payments work. How much is the child tax credit phase out limit. The tcja increased that to 2000 per child beginning in tax year 2018 but this doesnt necessarily mean that all qualifying taxpayers will receive this much.

Certain terms and conditions can whittle away at this cap. Child tax credit has been replaced by universal credit for most people. In the past two years there have been notable changes to this tax credit.

This credit reduces your federal income tax bill by up to 2000 per child for the 2019 tax year what you file in early 2020. The child tax credit under tax reform is worth up to 2000 per qualifying child. These tables show rates and allowances for tax credits child benefit and guardians allowance by tax year 6 april to 5 april.

The child tax credit limit is locked in at 2000 per child. For 2018 the recently passed gop tax reform bill doubles the amount of the child tax credit from 1000 to 2000 per qualifying child. Working tax credit rates the maximum annual working tax credit.

In other words if you have one child youll be able to. If you have young children or other dependents there is a good chance you qualify for the child tax credit.

Report Strengthening Child Tax Credit Would Reduce Poverty

Report Strengthening Child Tax Credit Would Reduce Poverty

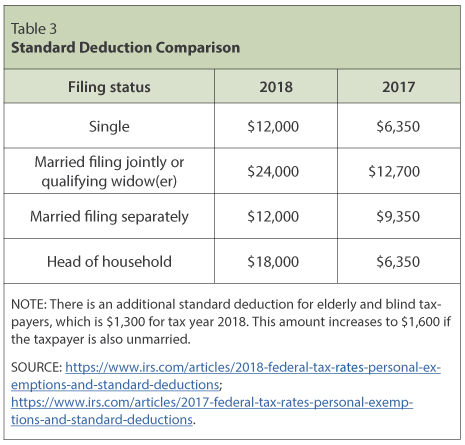

Individual Income Tax The Basics And New Changes St

Individual Income Tax The Basics And New Changes St

Chart Book The Earned Income Tax Credit And Child Tax

Chart Book The Earned Income Tax Credit And Child Tax

2018 Edition Complete Guide To Baby Grants In Singapore

2018 Edition Complete Guide To Baby Grants In Singapore

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

New Child Tax Credit Claiming Under 2018 Rules

New Child Tax Credit Claiming Under 2018 Rules

Chart Book The Earned Income Tax Credit And Child Tax

Chart Book The Earned Income Tax Credit And Child Tax

Tax Reform And Your Taxes Lutz Selig Zeronda L L P

Tax Reform And Your Taxes Lutz Selig Zeronda L L P

29 Info Child Tax Credit 2017 Vs 2018 2019

29 Info Child Tax Credit 2017 Vs 2018 2019

Policy Basics The Earned Income Tax Credit Center On

Policy Basics The Earned Income Tax Credit Center On

The Tax Break Down Child Tax Credit Committee For A