When you originally applied for your credit card the bank determined your credit line based on your financial history and creditworthiness at that time. Requesting a credit line increase from capital one doesnt impact your credit score.

What Is The Credit Limit On A Credit Card

What Is The Credit Limit On A Credit Card

how often does your credit card limit increase

how often does your credit card limit increase is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how often does your credit card limit increase content depends on the source site. We hope you do not use it for commercial purposes.

Your credit limit increase may be denied for a few different reasons.

How often does your credit card limit increase. Youll need to have proven to yourself and the bank that you know. Find out the best and the worst time to request a credit line increase. First and foremost ask yourself why you want to increase your credit limit.

Understanding the factors that go into your credit limit can help you know when its time to ask for an increase. As a new credit card holder you may start off with a smaller limit. Your account may be too new it may be too soon since the last change in your credit limit your income may be too low to qualify you for an increase or you may have an account that doesnt receive credit limit increases such as a secured credit card account.

Are you interested in learning how to increase your credit limit. Time your request with our guidelines. An easy way to increase your credit rating is to get a higher spending limit on your credit card.

Capital one does allow credit limit. As you make payments on time maintain a healthy credit utilization debt to limit ratio and perhaps increase your income level you may become eligible for a credit limit increase. While some creditors issue occasional automatic increases as long as you keep your account in good standing you can usually request an increase manually when you want one.

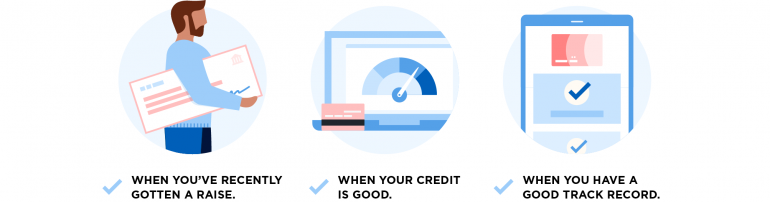

Timing is everything when you ask a credit card issuer for a credit limit increase. The easiest way to increase your chase credit limit is to open a new credit card. An easy way to increase your credit rating is to get a higher spending limit on your credit card.

If its to go on a shopping spree or purchase things you cant afford without credit stop right there. The reasons in your letter were factors used to determine your eligibility for a credit line increase so fixing them may increase your chances for a future increase. How often you get a credit limit increase depends on the card companys policies and your financial and credit standing.

Your credit limit does not have to remain permanent. We cant guarantee approval but youre welcome to request an increase anytime. Chase has some of the best points earning cards available so as long as you are under 524 5 or fewer cards in the previous 24 months opening a new card is a great way to increase your overall credit limit with chase.

Increasing the credit limit on your capital one credit card can be a great way to add more flexibility to your budget and possibly increase your score. Apply for a new chase credit card.

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

6 Expert Tips Increase Your Credit Limit Get Approved Now

6 Expert Tips Increase Your Credit Limit Get Approved Now

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png) What Is The Credit Limit On A Credit Card

What Is The Credit Limit On A Credit Card

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

How To Increase Your Credit Card Credit Limit When To Do It

How To Increase Your Credit Card Credit Limit When To Do It

How Do You Know When To Request A Credit Line Increase

How Do You Know When To Request A Credit Line Increase

6 Expert Tips How To Increase Credit Limit Discover

6 Expert Tips How To Increase Credit Limit Discover

Pro S Con S Of Updating Annual Income For Credit Card

Pro S Con S Of Updating Annual Income For Credit Card

8 Tips To Increase Your Amex Credit Limit And What To Do If

8 Tips To Increase Your Amex Credit Limit And What To Do If

3 Easy Tips How To Increase Credit Card Limit Intuit

3 Easy Tips How To Increase Credit Card Limit Intuit

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think