You have to qualify for head of household status. If the child didnt live with his father for more than half the year the father wouldnt be eligible to file as head of household.

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

Taxes From A To Z 2019 E Is For Earned Income Tax Credit Eitc

can you file earned income credit and head of household

can you file earned income credit and head of household is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you file earned income credit and head of household content depends on the source site. We hope you do not use it for commercial purposes.

Only one of you can claim hoh and that is her.

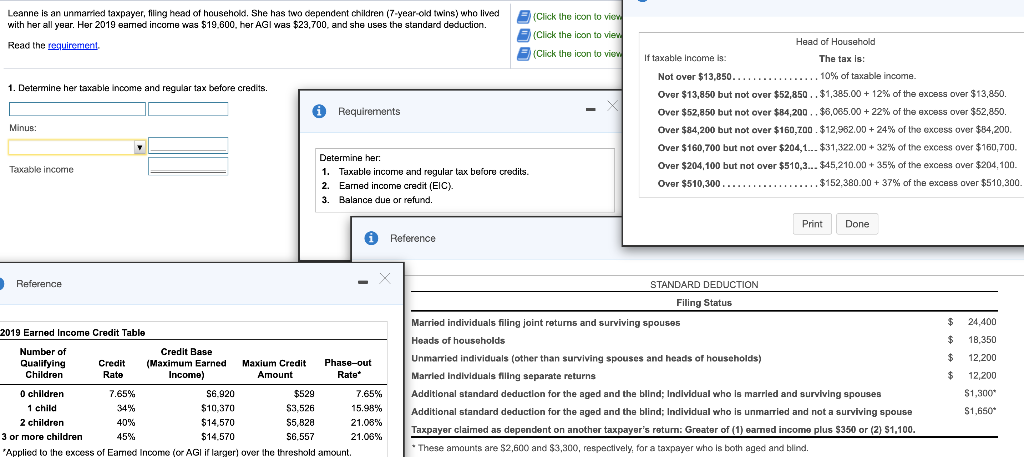

Can you file earned income credit and head of household. If you or your spouse are a nonresident alien see publication 519 us. Single parent with two children wages of 4000 no federal income tax liability before child tax credit. The custodial parent is still allowed to claim the same child for earned income credit head of household filing status and day care credit.

The earned income credit eic is especially beneficial for lower income taxpayers. Amanda it is possible that you can use head of household hoh filing status and be eligible for the earned income tax credit eitc. Then just add a qualifying dependent using the child or other dependent screen.

I will address filing status issues first. The head of household status is considered to be the most advantageous because taxpayers who qualify get a higher standard deduction and wider tax brackets compared to the single filing statusnumerous rules apply to qualifying however. Tax guide for aliens to find out if you are eligible for eitc.

When the non custodial parent is claiming the child as a dependentexemptionchild tax credit. Head of household with children. There is a special rule in the case of divorced separated including never married parents.

Tax preparation software usually includes questionnaires to help taxpayers determine whether theyre eligible to claim a dependent to file as head of household or to claim the earned income credit or other tax breaks. If you are the custodial parent you can have an agreement with the other parent 8332 and the other parent can claim the childs exemption but you still might be eligible for the filing status of head of household as well as receiving and earned income credit and claiming the child and dependency care credit. Examples of how the economic stimulus act of 2008 may effect taxpayers who are single file as head of household and have children who qualify for the child tax credit payment.

The internal revenue code offers five different filing status options and you must choose one of them when you complete your tax return. Income earned during 2018. The earned income credit.

You file a separate return married filing separate single or head of household. Many of these interview questions might seem repetitive but thats because the criteria can be slightly different in each case. You paid more than half the support to upkeep your home.

Just because you are legally married doesnt mean youre technically married for filing as head of household. You can be considered unmarried if all of the following apply to you. Your tax year investment income must be 3500 or less for the year.

Must not file form 2555 foreign earned income or form 2555 ez foreign earned income exclusion. Head of household rules dictate that you can file as head of household even if you dont claim your child as a dependent on your return. Individual rebate is 300.

Yes if you met the other qualifications to be head of household.

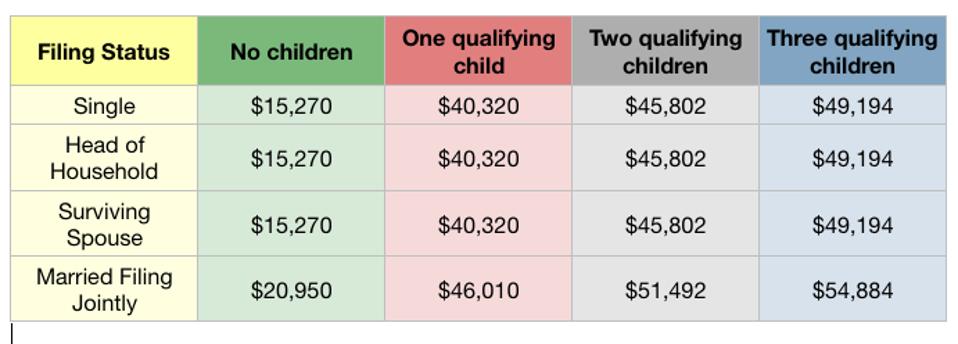

2018 Earned Income Tax Credit Eitc Qualification And

2018 Earned Income Tax Credit Eitc Qualification And

Puerto Rico On Verge Of Implementing An Eitc Center On

Puerto Rico On Verge Of Implementing An Eitc Center On

/head-of-household-filing-status-3193039-finalv4-ct-fa1b9cd4bb4a4b87adde82fa4c814ff5.png) The Rules For Claiming Head Of Household Filing Status

The Rules For Claiming Head Of Household Filing Status

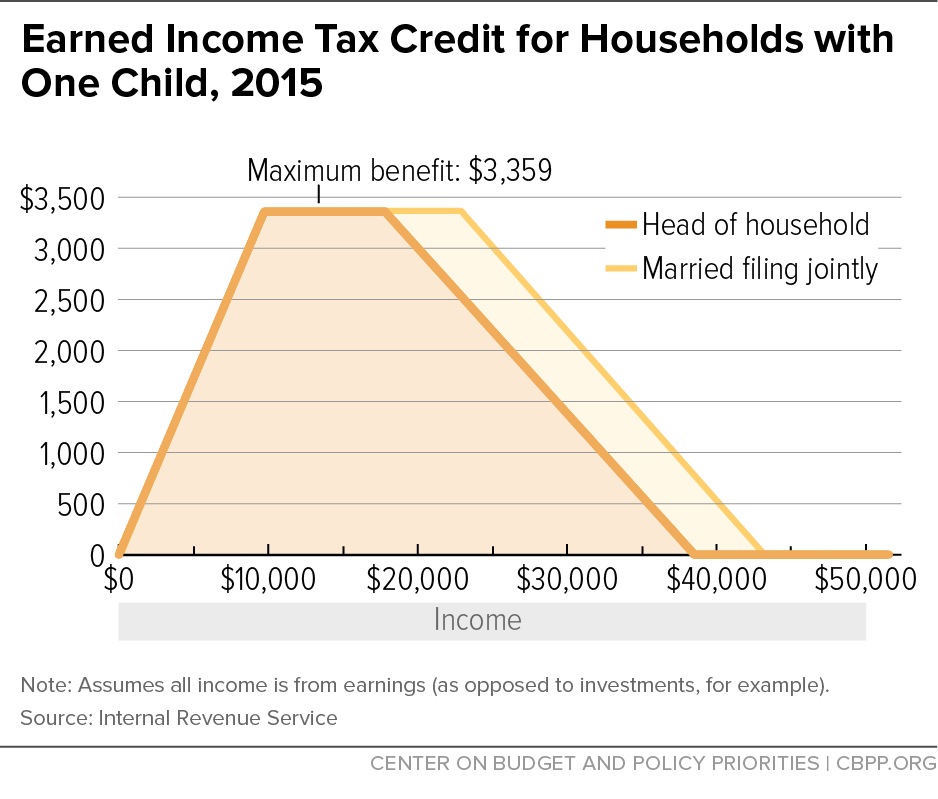

Earned Income Tax Credit For Households With One Child 2015

Earned Income Tax Credit For Households With One Child 2015

Publication 596 2018 Earned Income Credit Eic

Publication 596 2018 Earned Income Credit Eic

If You Qualify For The Earned Income Credit You Can Get A

If You Qualify For The Earned Income Credit You Can Get A

Tax Credit Guide Prepare Prosper

Tax Credit Guide Prepare Prosper

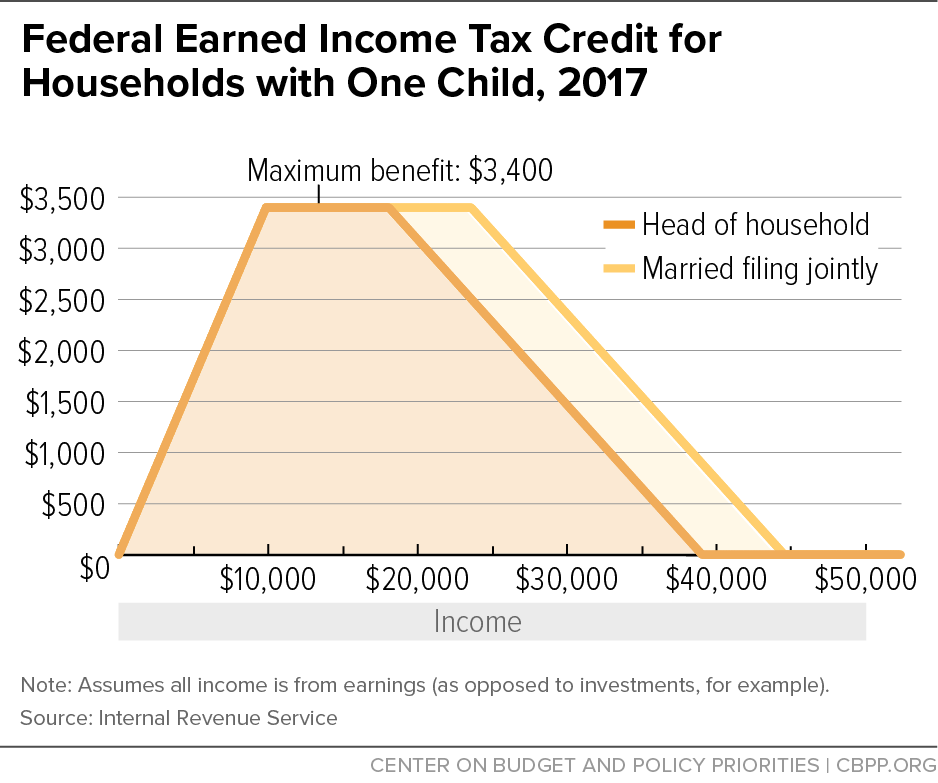

Federal Earned Income Tax Credit For Households With One

Federal Earned Income Tax Credit For Households With One

Publication 596 2018 Earned Income Credit Eic

Publication 596 2018 Earned Income Credit Eic

Do You Qualify For The Earned Income Tax Credit

:max_bytes(150000):strip_icc()/head-of-household-filing-status-3193039-finalv4-ct-fa1b9cd4bb4a4b87adde82fa4c814ff5.png) The Rules For Claiming Head Of Household Filing Status

The Rules For Claiming Head Of Household Filing Status