These types of loans are often beneficial for consumers performing home improvements or home repairs and who have fluctuating financing needs. The lenders goal is to vet you as a credit risk and know what your collateral is worth.

can you have 2 home equity lines of credit

can you have 2 home equity lines of credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you have 2 home equity lines of credit content depends on the source site. We hope you do not use it for commercial purposes.

With a chase home equity line of credit heloc you can use your homes equity for home improvements debt consolidation or other expenses.

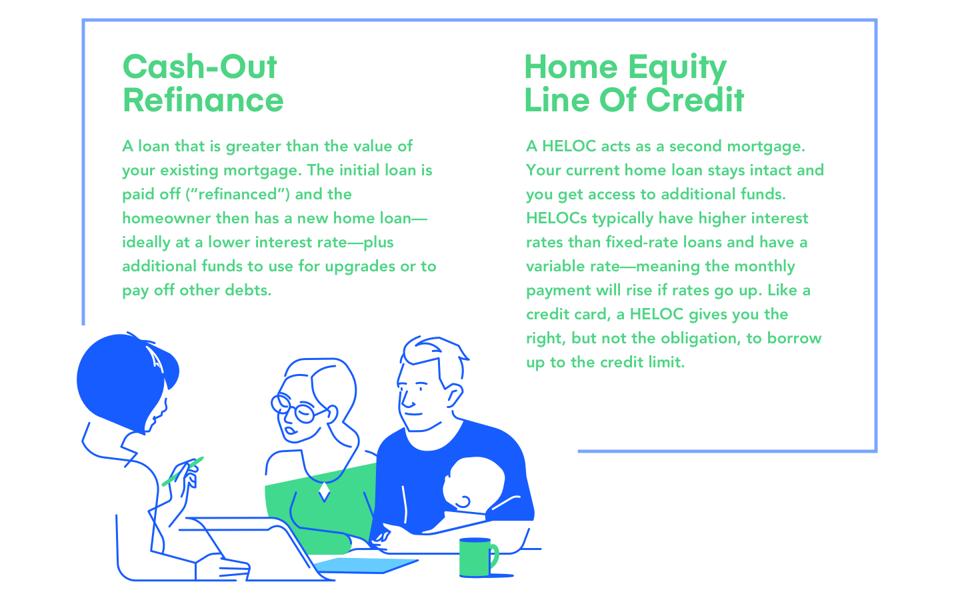

Can you have 2 home equity lines of credit. A traditional home equity loan is a one time loan that uses your homes equity as collateral. Home equity lines of credit are secured loans on a home that can be accessed repaid and then re accessed again. If the lenders prime interest rate is 285 then your home equity line of credit would have an interest rate of 385 285 1.

If you have a mortgage and a home equity line of credit now you. Its estimated that more than 10 million homeowners are expected to open home equity lines of credit from 2018 to 2022 according to a transunion studyhowever not all consumers are borrowing via. I heard that after 1 year you could get a home equity loan on the value of the house but before 1 year you have to get it on the purchase price.

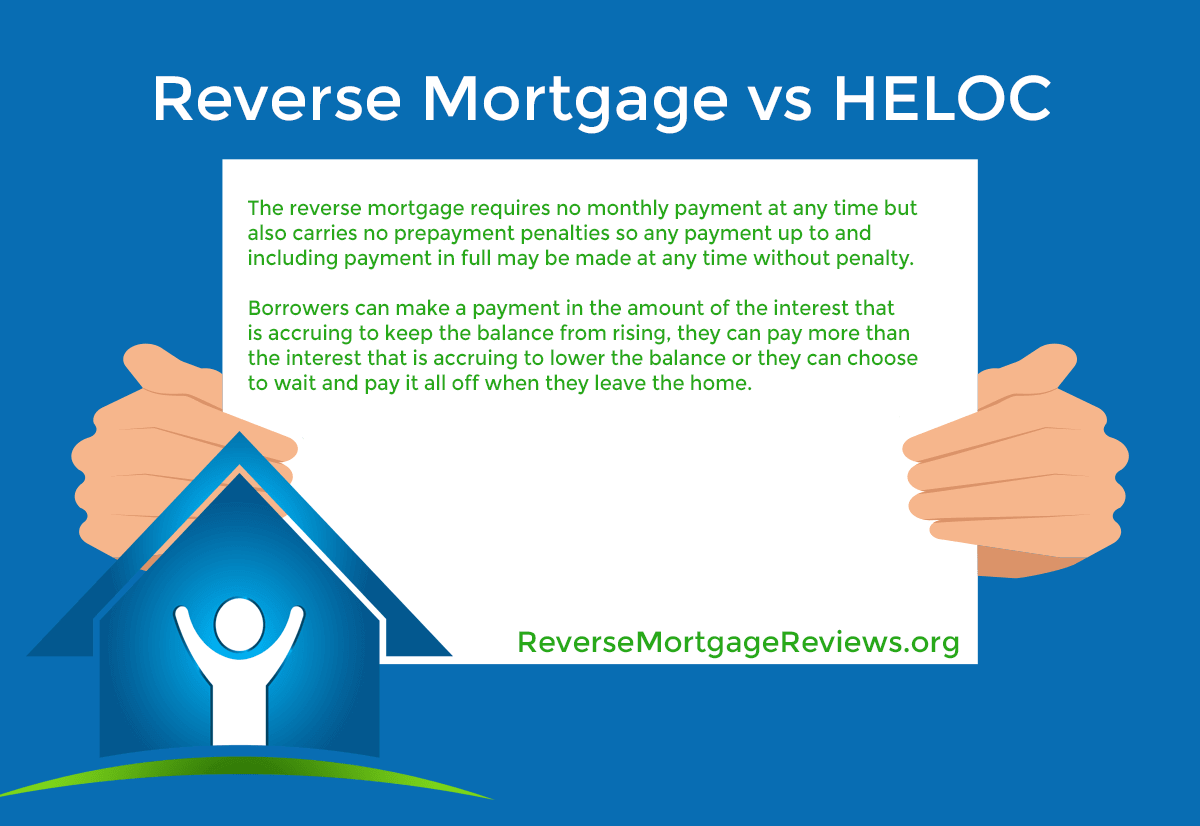

Canadians love to use home equity lines of credit helocs. A home equity line of credit or heloc turns your homes value into cash you can borrow as needed. Can you have two home equity lines of credit a home equity line of credit also known as a heloc is a revolving line of credit much like a credit card.

For example a home equity line of credit can have an interest rate of prime plus one percent. Lenders will want to know how much equity you have in your home what its appraised value is how much money you earn what your outstanding debts are and your credit score. Applying for a home equity line of credit is a lot like getting a primary mortgage.

You can try to negotiate interest rates with your lender. You can borrow as much as you need any time you need it by writing a check or using a credit card connected to the account. In fact you can have multiple options.

A home equity line of credit heloc also uses your equity as collateral but credit lines can be used over and over again. While home equity loans use your homes equity as collateral youre not limited to housing related purchases. Find out if tapping equity with a heloc is right for you and how to get the best rate.

If you have a house with no mortgage on it and you want to move to the other end of the country you can sell your house and move. Before you apply see our home equity rates check your eligibility and use our heloc calculator plus other tools. A fixed rate mortgage term a variable.

Chase Home Lending Brandvoice How To Tap Into Your Home S

Chase Home Lending Brandvoice How To Tap Into Your Home S

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png) How Home Equity Loans And Second Mortgages Differ

How Home Equity Loans And Second Mortgages Differ

:max_bytes(150000):strip_icc()/shutterstock_499759978.home.equity.cropped-5bfc30ec46e0fb005145d2a0.jpg) 5 Ways A Home Equity Line Of Credit Heloc Can Hurt You

5 Ways A Home Equity Line Of Credit Heloc Can Hurt You

How To Use Home Equity 12 Steps With Pictures Wikihow

How To Use Home Equity 12 Steps With Pictures Wikihow

Home Equity Loans And Home Equity Lines Of Credit Heloc

Home Equity Loans And Home Equity Lines Of Credit Heloc

Hecm Vs Heloc Loan Comparison Which Is Best For You

Hecm Vs Heloc Loan Comparison Which Is Best For You

5 Things To Know About Equity In The Home Credit Union

5 Things To Know About Equity In The Home Credit Union

Home Equity Line Of Credit Home Equity Loan Cooperative Bank

Home Equity Line Of Credit Home Equity Loan Cooperative Bank

Heloc Vs Home Equity Loan The Differences And What You Must

Heloc Vs Home Equity Loan The Differences And What You Must

How The New Tax Law Will Affect Your Home Equity Line Of

How The New Tax Law Will Affect Your Home Equity Line Of

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)