Advance credit payments were paid to your health insurer for you or someone else in your tax family. Either way you will complete form 8962 premium tax credit ptc and attach it to your tax return for the year.

Repaying Aca Tax Credits Maineoptions

Repaying Aca Tax Credits Maineoptions

does the premium tax credit have to be paid back

does the premium tax credit have to be paid back is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in does the premium tax credit have to be paid back content depends on the source site. We hope you do not use it for commercial purposes.

The health insurance marketplace estimates your premium tax credit based on estimates of your household income for the year when.

Does the premium tax credit have to be paid back. In this process you compare the amount of subsidy the government actually paid your health insurance company with the amount it should have paid based on your. This collection of frequently asked questions explains who will be eligible for this tax credit how the size of an individual or. If you dont pay back the amount due when you file your taxes the irs will deduct it from your tax refund if any.

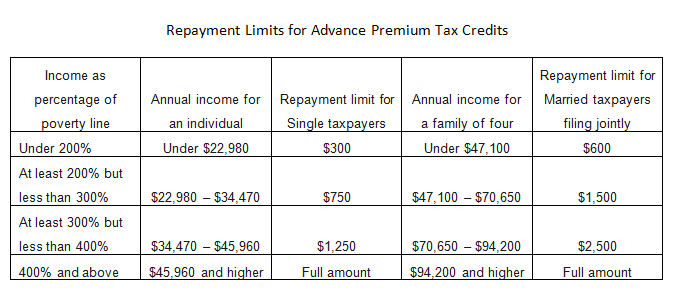

How much people will have to pay for coverage depends on the plan they choose. The following chart shows how much individuals and families will be required to pay back for premium assistance payments received in 2019. If youre eligible for the premium tax credit subsidy you can choose to have it paid in advance directly to your health insurance company each month.

More of a credit than you deserved if your income goes up during the year for example. When you receive the premium tax credit health insurance subsidy part of preparing your federal income tax return is a process called reconciliation. Well refund the applicable turbotax federal andor state purchase price paid.

Do people who receive a premium tax credit ever have to pay more than their expected contribution. Or you can choose to get it as a lump sum included with your federal income tax refund. The premium tax credit took effect beginning in the 2014.

If you chose to get your credit at. For purposes of the premium tax credit your tax family is every individual you claim on your tax return yourself your spouse if filing jointly and your dependents. Answers to frequently asked questions beginning in 2014 millions of americans will become eligible for a new premium tax credit that will help them pay for health coverage.

In this case youd have to pay back the over payment in your tax return. If you received too much in premium tax credits youll generally have to pay some or all of. If you choose to have advance payments of the premium tax credit made on your behalf you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return.

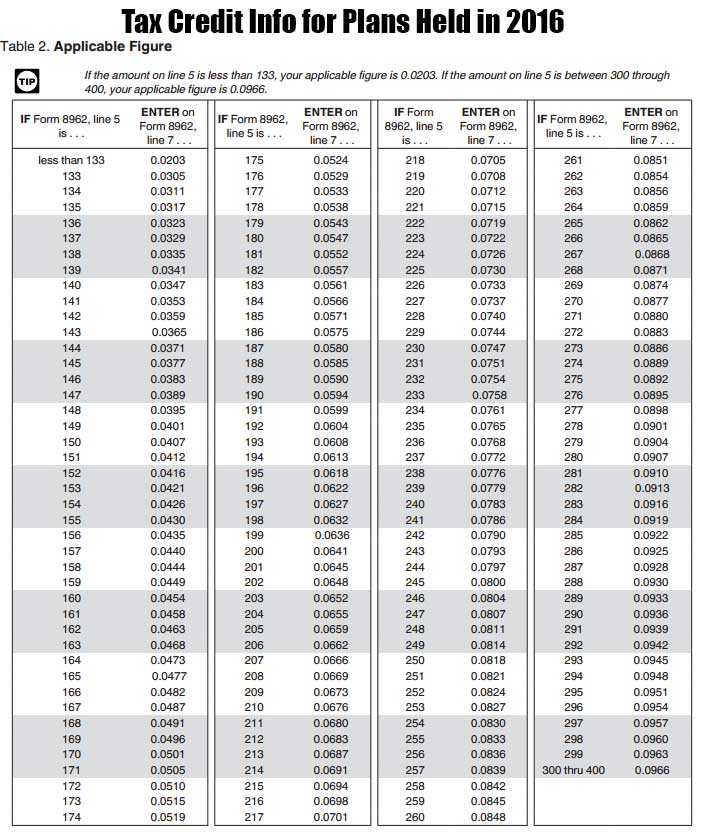

Advance payments of the premium assistance tax credit. If the marketplace made a mistake in figuring our tax credit do we still have to pay the money back. You calculate the amount you have to repay by completing irs form 8962 premium tax credit.

You are claiming the premium tax credit. This will lower the amount youll have to pay for premiums each month. As a result even with a premium tax credit it would cost him an additional 2500 to purchase the benchmark plan.

Finally the irs might have paid out exactly the right amount in which case you wont owe money to the irs but you wont receive any extra tax credit either.

2018 Premium Tax Credits Obamacare Facts

2018 Premium Tax Credits Obamacare Facts

Key Facts Premium Tax Credit Beyond The Basics

Key Facts Premium Tax Credit Beyond The Basics

Premium Tax Credits Health Affairs

Premium Tax Credits Health Affairs

What Is The Premium Tax Credit Turbotax Tax Tips Videos

What Is The Premium Tax Credit Turbotax Tax Tips Videos

Premium Tax Credits Answers To Frequently Asked Questions

Premium Tax Credits Answers To Frequently Asked Questions

Do I Have To Pay Back The Premium Tax Credit

Do I Have To Pay Back The Premium Tax Credit

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction

Irs Releases 2020 Tax Rate Tables Standard Deduction

Private Health Insurance Early Evidence Finds Premium Tax

Private Health Insurance Early Evidence Finds Premium Tax

Health Insurance Premium Tax Credit Us Internal Revenue

Health Insurance Premium Tax Credit Us Internal Revenue

Tax Benefit Is Your Single Premium Life Insurance Policy

Tax Benefit Is Your Single Premium Life Insurance Policy