Learn what it takes to qualify for an fha home loan summary. You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply.

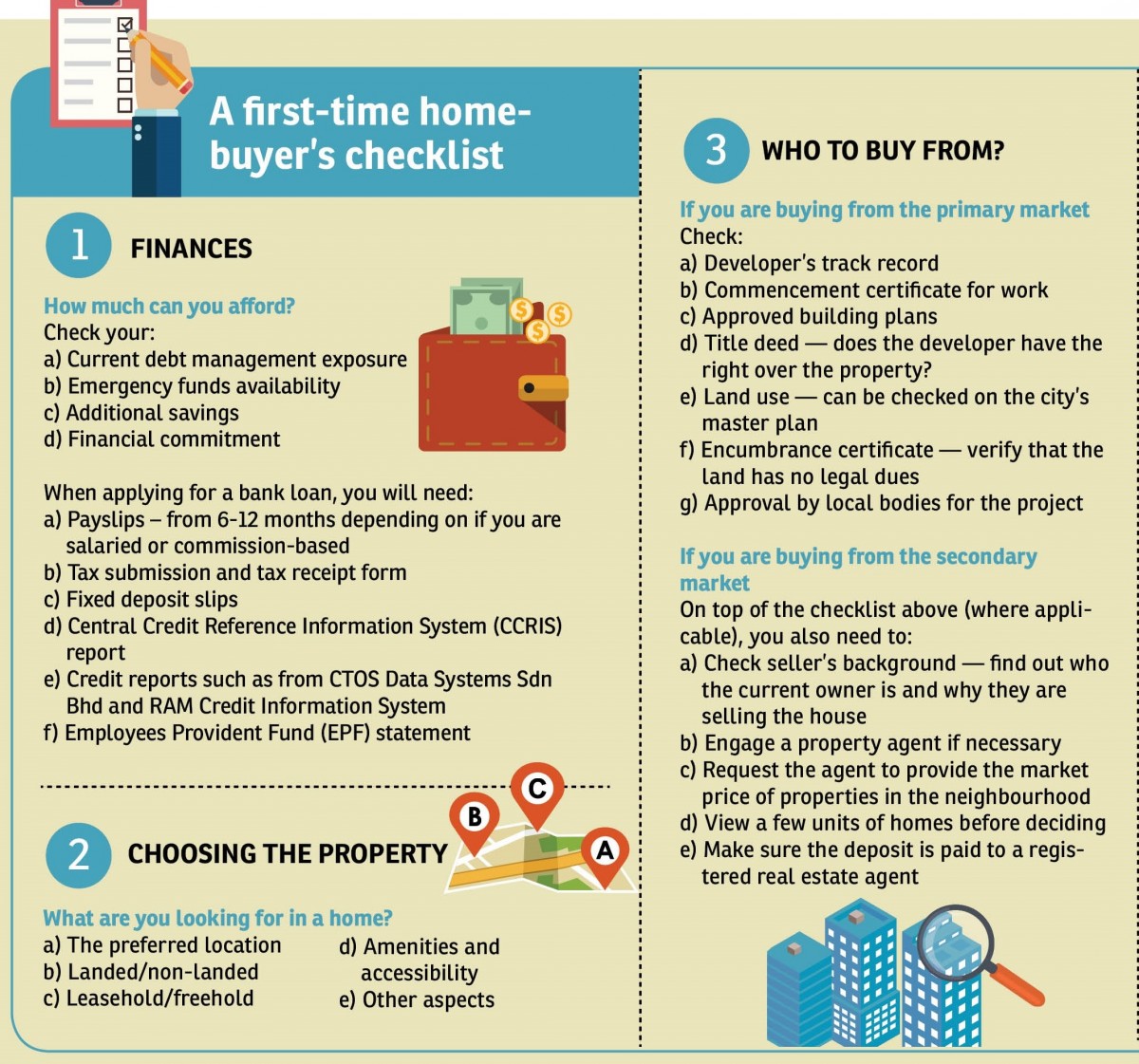

First Time Homebuyers What You Need To Know Edgeprop My

First Time Homebuyers What You Need To Know Edgeprop My

first time home buyer tax credit building home

first time home buyer tax credit building home is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in first time home buyer tax credit building home content depends on the source site. We hope you do not use it for commercial purposes.

This page sets out the requirements to qualify for and the procedures to apply for a refund of land transfer tax on the purchase of a qualifying home by a first time purchaser.

First time home buyer tax credit building home. Eligible first time homebuyers who have the minimum down payment for an insured mortgage can apply to finance a portion of their home purchase through a shared equity mortgage with the government of canada. If you qualify for the program you may be eligible for either a full or partial exemption from the tax. The ohio mortgage tax credit allows a tax credit of up to 40 of the mortgage.

The first time home buyer incentive helps first time homebuyers without adding to their financial burdens. The answers you provide will enable them help you claim the home buyer tax credits and deductions you qualify for. Under certain circumstances this refund applies on the purchase of either a newly constructed home or a resale.

You or your spouse or common law partner acquired a qualifying home. If one or more of the purchasers dont qualify only the percentage of interest that the first time home buyers have in the property is eligible. First time home buyer incentive.

When you turn to hr block online for help it will be like an interview. They will ask easy to answer questions while filling in the correct tax forms for you behind the scenes. You may be thinking of the federal program implemented under the obama administration.

Looking for the first time home buyer tax credit. Turning to hr block for help at tax time. You did not live in another home owned by you or your spouse or common law partner in the year of acquisition or in any of the four preceding years first time home buyer.

The first time home buyers program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. We hate to be the bearer of bad news but it doesnt. 2020 ohfa first time home buyer programs.

How The First Time Homebuyer Tax Credit Worked Howstuffworks

How The First Time Homebuyer Tax Credit Worked Howstuffworks

Get The Most Out Of Your Home Buying Tax Credit

Get The Most Out Of Your Home Buying Tax Credit

All About The First Time Home Buyer S Tax Credit

All About The First Time Home Buyer S Tax Credit

First Time Home Buyer Tax Credit In The Works Curb Appeal

First Time Home Buyer Tax Credit In The Works Curb Appeal

9 Tax Breaks Every First Time Homebuyer Must Know The

9 Tax Breaks Every First Time Homebuyer Must Know The

3 Reasons Why Renting A Home May Beat Buying

3 Reasons Why Renting A Home May Beat Buying

A Fresh New Look At The Homebuyer Tax Credit And How To

A Fresh New Look At The Homebuyer Tax Credit And How To

Delaware First Time Homebuyer Tax Credit Brochure

Delaware First Time Homebuyer Tax Credit Brochure

The B C First Time New Home Buyers Bonus Budget

The B C First Time New Home Buyers Bonus Budget

Guide To Buying A Home In The Uk Expat Guide To The United

Guide To Buying A Home In The Uk Expat Guide To The United