Generally credit scoring software does not reward or punish you for paying off an old collection account. Expect any charge off to stay on your credit report for seven years.

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-v3-5b8814c0c9e77c0025a6f156.png) Tactics For Paying Off Debt Collections

Tactics For Paying Off Debt Collections

how much will paying off collections raise credit score

how much will paying off collections raise credit score is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much will paying off collections raise credit score content depends on the source site. We hope you do not use it for commercial purposes.

Paying off a collection will cause the account to be reported to the bureaus again to show its new status which will result in a drop in your credit score unless the account is very recent.

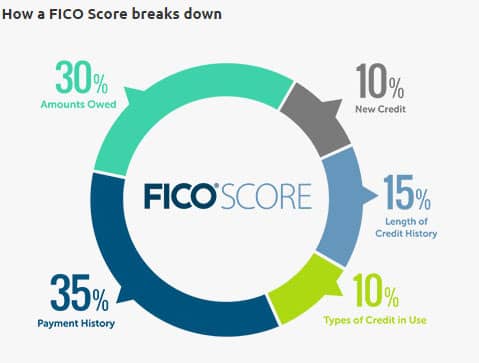

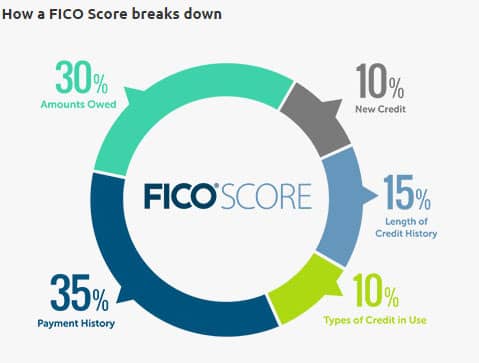

How much will paying off collections raise credit score. Talk to the creditor and ask if they can remove th. The fact that you have collections listed on your credit report will almost certainly lower your fico score. The average credit score for credit sesame members who have at least one delinquent account is 551.

Your credit score is damaged when a creditor reports negative things about you to equifax experian and transunion. Just paying off a delinquent debt isnt likely to affect your credit history in the short term. Paying off debt collections.

In fact in the short term doing so can cause it to drop by moving the account to the front of the credit line. Here are five tactics for paying your debt collections. A fresh collection account harms your credit score more than one that is 6 years old.

Paying off collections will improve your score we will report the account status as paid in full and that helps your score our legal department will file a lawsuit threatening a consumer with a lawsuit is against the law. To boost your score negotiate the reporting status on the account with the collection agency before you send in the funds and check your credit report afterward to confirm the creditor followed through. But i did not see my credit score go up through credit karma but it did go on when i purchased my schore on equifax.

If you have one or more collections accounts on your credit report you are probably wondering if paying them off will improve your credit score. Helpful to 6 out of 8 people. And the majority of collection companies will not go through the trouble to file one.

I will pay they if it will raise my score back up or should i just go straight to transunion and dispute it like you suggested. Your score weighs collections on your credit report according to when the collection occurred. At myfico we always recommend paying off your.

The average credit score for credit sesame members who do not have any delinquent or collection accounts is 621. Generally the more recent the collection the more its going to hurt your fico score. When you pay off a debt collection you can do so in a way that actually helps your credit.

Paying off collections accounts dont always help your credit score. If you have a charge off on your credit report it will have a negative effect regardless of status though paid charge offs and settled charge offs will hurt your score less. The answer is it depends collections accounts are those accounts you have defaulted on or stopped making payments on that have been turned over from the original creditor to a.

Will Paying Off Collections Improve My Credit Score

Will Paying Off Collections Improve My Credit Score

Will Paying Off Collections Improve My Credit Score

Will Paying Off Collections Improve My Credit Score

Will Paying Off Collections Improve My Credit Score

Will Paying Off Collections Improve My Credit Score

Can Paying Off Collections Raise Your Credit Score Go

Can Paying Off Collections Raise Your Credit Score Go

Ask Stacy Will Paying Old Unpaid Debts Improve My Credit

Ask Stacy Will Paying Old Unpaid Debts Improve My Credit

Study How Much Will Paying Off Credit Cards Improve Score

Study How Much Will Paying Off Credit Cards Improve Score

Raise Credit Score Quickly Repair Credit Score Ideas Of

Raise Credit Score Quickly Repair Credit Score Ideas Of

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

How Can I Improve My Credit Score Do S And Don T Finance

How Can I Improve My Credit Score Do S And Don T Finance

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

When Do Debt Collections Fall Off Your Credit Report

When Do Debt Collections Fall Off Your Credit Report