How applying for a credit card may affect your credit. 10 things not to do before applying for a credit card and how it will affect your credit score 1.

How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

applying for a credit card affect your credit score

applying for a credit card affect your credit score is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in applying for a credit card affect your credit score content depends on the source site. We hope you do not use it for commercial purposes.

Let your credit score slip.

Applying for a credit card affect your credit score. Inquiries fall into the new credit category according to fair isaac and new credit factors into about 10 percent of your fico credit score. A hard inquiry will appear on your report showing that the company requested it. If you already have a credit card applying for a new credit card shouldnt have an impact on.

What about applying for other types of loans. Too many recent applications can be perceived as desperation for credit and desperation is almost always a turn off. Each time you apply for a credit card a record of your application goes onto your credit report.

Applying for a new credit card affects your credit score but generally not by much. How big is the impact and how long does it last. A hard credit inquiry is performed when you apply for a loan or credit card and it will stay on your credit report for up to two years though it generally does not affect your score after six.

If youre worried about your credit score you wonder if applying for a credit card could hurt your credit score. Your credit score doesnt factor in whether youre approved for the credit card or not but making the application can have a negative affect on your credit score. Whenever you apply for a mortgage credit card or any other kind of loan your lender will send a request for information to a credit bureau to verify your creditworthiness.

Even if your credit score isnt hurt by the additional inquiries a card issuer might deny your credit card application simply because youve applied for several other cards recently. When you apply for a credit card the company will check your credit report as part of the approval process. These inquiries are known as hard inquiries and they are included in credit score calculations.

You may have heard that applying for credit can affect your credit score but you might not know exactly what the effects will be. The best thing you can do to make sure accepting your your apple card offer doesnt affect your credit score in a substantial way is to have a solid credit score built alreadyalways pay your bills on time keep low or no balances on your cards pay off your balance every month and dont apply for a ton of cards around the time you want to also apply for apple card. Putting in several applications in a.

We added a credit damage gauge which shows how much each mistake may hurt your application for new credit and your score in the future. The final factor in determining your credit score is credit mix which accounts for 10 of your score. Does applying for a credit card hurt your credit.

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

/CreditCardApplication_teekid_E--56a1dead3df78cf7726f5c3c.jpg) How A Credit Card Application Affects Your Credit Score

How A Credit Card Application Affects Your Credit Score

Will Opening A New Credit Card Hurt My Credit Score

Will Opening A New Credit Card Hurt My Credit Score

How Does Applying For Credit Cards Affect Your Credit

How Does Applying For Credit Cards Affect Your Credit

How Credit Cards Affect Your Credit Scores Indialends

How Credit Cards Affect Your Credit Scores Indialends

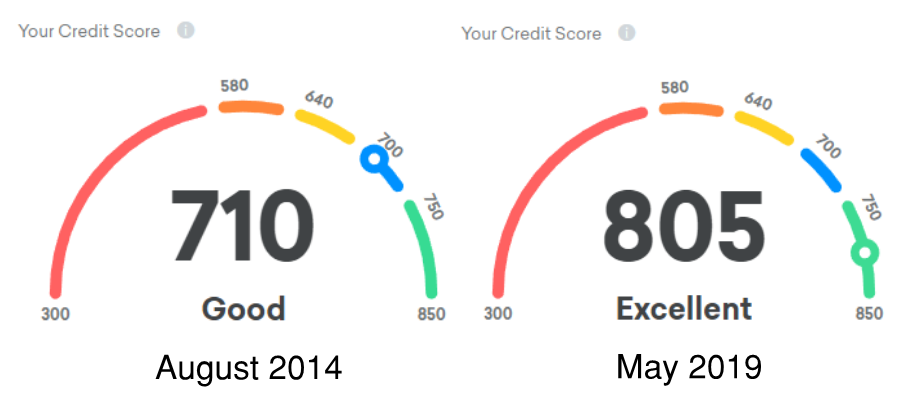

How Do Credit Card Signups Affect Your Credit Part 1

How Do Credit Card Signups Affect Your Credit Part 1

Learn How Canceling Credit Cards Affects Your Credit Score

Learn How Canceling Credit Cards Affects Your Credit Score

How Does Applying For A New Credit Card Affect My Credit Score

How Does Applying For A New Credit Card Affect My Credit Score

What Are Debt Collections And How Do They Affect You

What Are Debt Collections And How Do They Affect You

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

Do Credit Cards Hurt Your Credit Score Million Mile Secrets

Do Credit Cards Hurt Your Credit Score Million Mile Secrets