Late payments remain in your credit history for seven years from the original delinquency date which is the date the account first became late. It can remain on your credit report for seven years from the date you filed the case if you completed the plan.

/credit-report-157681670-5b740d0246e0fb00502fd857.jpg) How Long Does Negative Information Stay On Your Credit Report

How Long Does Negative Information Stay On Your Credit Report

how long are delinquencies on a credit report

how long are delinquencies on a credit report is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how long are delinquencies on a credit report content depends on the source site. We hope you do not use it for commercial purposes.

Opinions expressed here are authors alone not those of any bank credit card issuer or other company and have not been reviewed approved or otherwise endorsed by any of these entities.

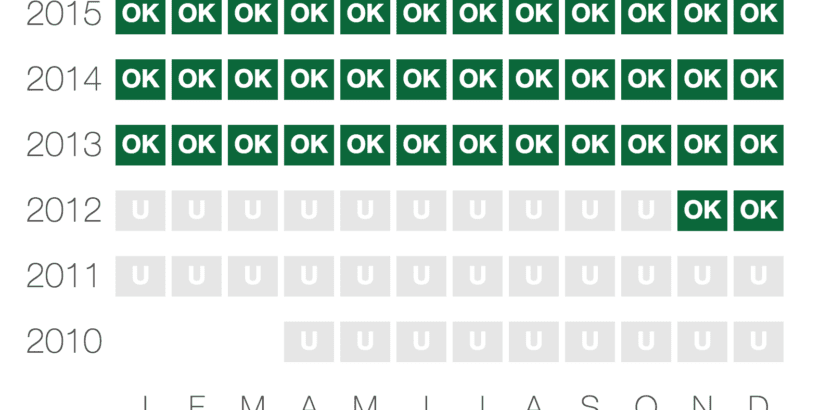

How long are delinquencies on a credit report. If you make a mistake or run into financial obstacles that result in negative items on your credit report those derogatory marks will remain there for years. Child support delinquencies can also result in judgments. How long doe settled accounts stay on your credit report.

It is frustrating to have paid delinquencies on your credit reports. The information contained in ask experian is for educational purposes only and is not legal advice. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your equifax credit report.

Sometimes they even have incorrect information like the wrong pay date or amount. Late payments remain on a credit report for up to seven years from the original delinquency date the date of the missed payment. Check my equifax and transunion scores now the majority of negative items will stay on your credit reports for up to seven years says randall yates credit expert and ceo of the lenders network.

So exactly how long do late payments stay on your credit reports. Heres the bad news. Working on your credit.

In the past tax liens could remain on your credit report for up to 15 years if they went unpaid. The good news is they will carry less weight in credit scoring formulas as they get older. How long does a tax lien stay on your credit report.

7 years from the date of final discharge. How long do late payments remain on the report. However as of april 2018 all three credit bureaus stopped reporting tax liens on consumer.

This includes late payments. They cannot be removed after two years but the further in the past the late payments occurred the less impact they will have on credit scores and lending decisions. Delinquencies and judgments can remain on the credit report for seven years.

They show you took responsibility for an old bill yet they look bad to creditors and bring down your credit score. Chapter 13 is a repayment plan bankruptcy. How long do things stay on your credit report.

How to pay your credit card bill how do i remove a delinquent account from my report. So its usually in your best interest to fulfill at least the minimum payment due each month and if you do end up with delinquent accounts to eventually pay those off especially if theyve gone into collections.

When Do Debt Collections Fall Off Your Credit Report

When Do Debt Collections Fall Off Your Credit Report

How Long Will A Collection Stay On A Credit Report The

How Long Will A Collection Stay On A Credit Report The

How To Remove A Charge Off From Your Credit Report

How To Remove A Charge Off From Your Credit Report

How Does Payment History Affect Your Credit Score

How Does Payment History Affect Your Credit Score

How Long Does Stuff Stay On Your Credit Report Debt Com

How Long Does Stuff Stay On Your Credit Report Debt Com

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How Long Does It Really Take To Improve Your Credit Abc News

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

How I Got 4 Late Payments Removed From My Credit Report In

How I Got 4 Late Payments Removed From My Credit Report In