Most people dont know that credit card companies actually charge interest on a daily not monthly or yearly basis. But how does it work.

Understanding How Credit Card Interest Works Discover

Understanding How Credit Card Interest Works Discover

how does interest accumulate on a credit card

how does interest accumulate on a credit card is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how does interest accumulate on a credit card content depends on the source site. We hope you do not use it for commercial purposes.

Most credit card variable interest rates can change with the prime rate.

How does interest accumulate on a credit card. And there begins the debt cycle. When this doesnt happen which is often the case the cardholder is charged interest on their balance and the finance charges are added to the principal to accumulate more interest in the next billing cyclethis is known as compound interest and is the primary reason why credit card companies are in business today. For example your 13000 balance likely accrues almost 60 in interest charges before you make your monthly payment of 300.

Because this interest rate can increase. This compounds each day and you wont touch the principle until you pay down the interest. Americans are paying more in credit card interest.

If you apply for a credit card the lender may use a different credit score when considering your application for credit. Knowing how and when credit card interest is charged is the best way to avoid paying interest and keep your credit card free. Getting a credit card with no annual fee is a start but if you carry a balance you could still incur a cost in the form of interest.

By understanding how credit card interest works you comprehend the true cost of debt and possibly avoid it. If you carry a balance from month to month your goal should always be to use a credit card with the lowest interest rate possible so you rack up the least amount of interest on your outstanding debt. What many people do not understand regarding payments on credit card accounts is how the daily accumulation of interest affects your balance.

This fee is the price a person pays for the ability to spend money today that would otherwise take time to accumulate. Credit card interest is calculated with a few mathematical steps. How do credit cards really work.

With 0 deferred interest you still get an interest free period but interest continues to accrue or accumulate during the promotional period. Which is typically the maximum balance you can accumulate on the card. Deferred interest financing is another type of interest promotion but its not the same as 0 balance transfer.

Do they accumulate interest right away. I want to explain how credit card interest works in canada. Find out how to.

The prime rate is an interest rate that is three percentage points above the federal funds rate which is set by the federal reserve bank. Most people aim to keep their credit card cost at 0.

How Does Credit Card Interest Work

How Does Credit Card Interest Work

How Minimum Payments And Credit Card Interest Are Calculated

How Minimum Payments And Credit Card Interest Are Calculated

Credit Card Interest How It S Calculated How To Avoid

Credit Card Interest How It S Calculated How To Avoid

How Does Credit Card Interest Work In Canada

How Does Credit Card Interest Work In Canada

Credit Card Interest Calculator Find Your Payoff Date

Credit Card Interest Calculator Find Your Payoff Date

3 Ways To Calculate Credit Card Interest With Excel Wikihow

3 Ways To Calculate Credit Card Interest With Excel Wikihow

:max_bytes(150000):strip_icc()/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png) How And When Is Credit Card Interest Charged

How And When Is Credit Card Interest Charged

3 Ways To Calculate Credit Card Interest With Excel Wikihow

3 Ways To Calculate Credit Card Interest With Excel Wikihow

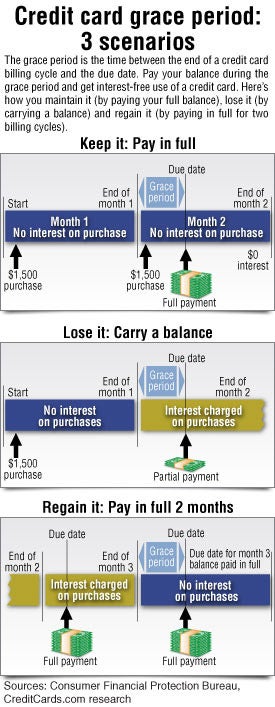

What S A Grace Period For A Credit Card The Secret To

What S A Grace Period For A Credit Card The Secret To

How To Use The Grace Period To Avoid Paying Interest

How To Use The Grace Period To Avoid Paying Interest