Posted on may 28 2014 author david b. How much of your credit card limit should you use.

What Is The Credit Limit On A Credit Card

What Is The Credit Limit On A Credit Card

how much of a credit card should i use

how much of a credit card should i use is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much of a credit card should i use content depends on the source site. We hope you do not use it for commercial purposes.

To build good credit and stay out of debt you should always aim to pay off your credit card bill in full every month.

How much of a credit card should i use. Well also tell you when its best to use a debit card instead so that you don. Theres no one size fits all when it comes to the number of credit cards you should have in your wallet. If youre trying to increase your credit scores as much as possible then you should use as little of your available credit as possible.

Go through the last 12 months of credit card statements and find the biggest bill you. So whats the right amount of credit to use. Vantagescore recommends keeping your utilization rate below 30 but thats not necessarily a shortcut to better credit.

How many credit cards you should have depends on many factors such as your spending habits desire for rewards financial responsibility and willingness to pay annual fees. Heres a look at the basic protections and consequences of what happens in cases of debit card fraud vs. If you want to be really on top of your game it might seem logical to pay.

One key thing to keep in mind while using your credit cards is to make sure youre not using too much of your own credit. Your credit limit tells you exactly how much money your credit card issuer will let you use without paying a penalty. Heres an easy way to figure out how much available credit you should have to maintain a good credit score.

People often fall into credit card debt because lifes surprises pop up and its easier to just put the expenses on a credit card and pay them off later. Well help you work out when its best to use your credit card to make purchases in order to take advantage of all of the benefits on offer. Credit cards when used correctly can be an invaluable financial tool.

You can use as much of your limit as you want but that doesnt mean you should max out your card. It can be exciting when signing up for a new credit card you discover that the bank is offering you a higher borrowing limit than you first anticipated. Coulter credit cards 892.

But for many people later never really happens because emergencies keep popping up and those new expenses join the old on the credit card. For example you should use them in a way that helps boost your credit scoreswhich will in turn help you qualify for the best cards with the best perks and rewards. Places you should never use a debit card.

Credit cards can be wonderful tools if you know how to use them to your advantage. Heres a look at what you should know about your credit limit. Under federal law a debit card doesnt have the same protections that a credit card does.

Credit card fraud courtesy of the federal trade.

The Difference Between Credit Card And A Debit Card

The Difference Between Credit Card And A Debit Card

How Many Credit Cards Should I Have

How Many Credit Cards Should I Have

How Many Credit Cards Does The Average Person Have

How Many Credit Cards Does The Average Person Have

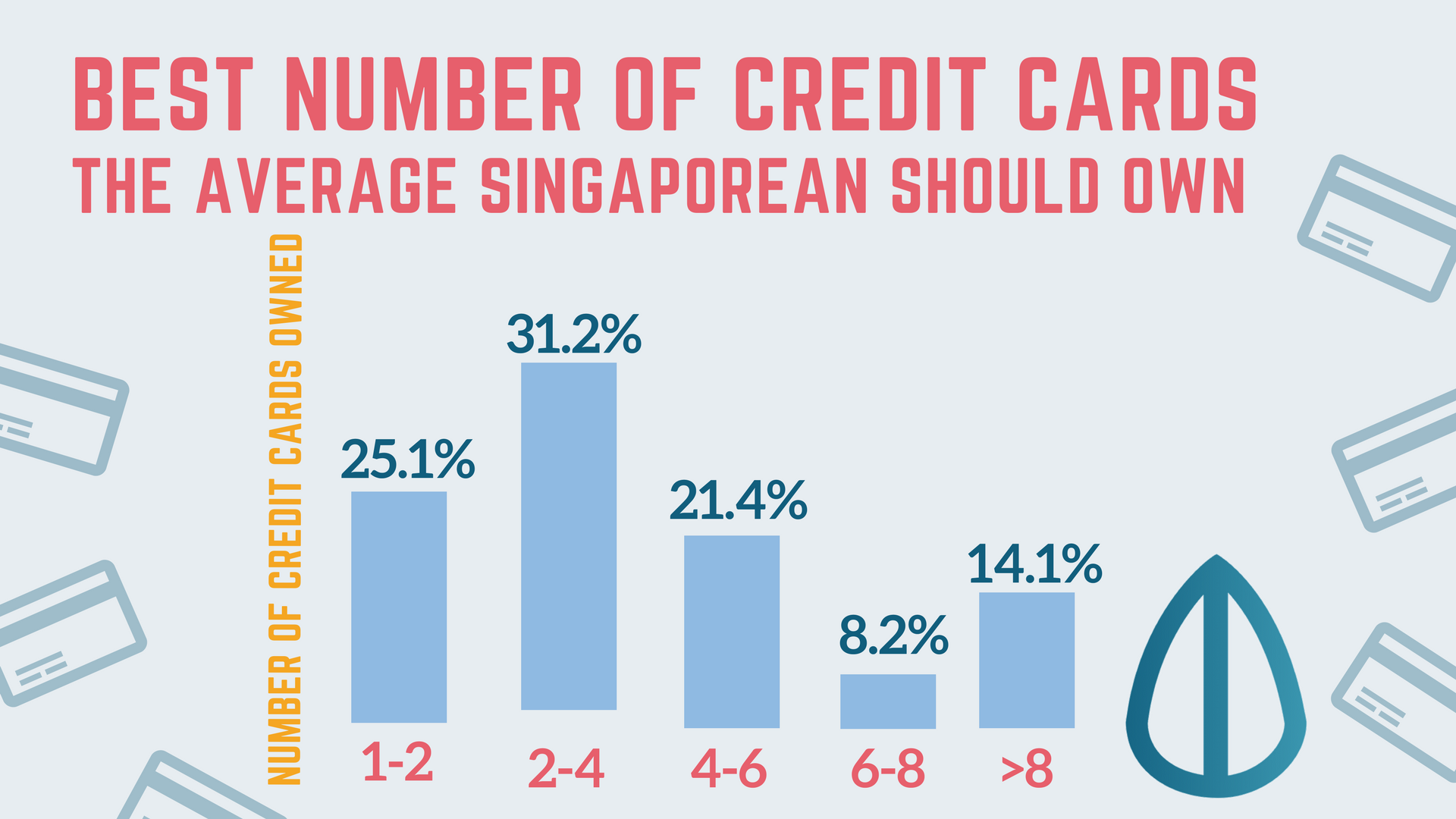

Number Of Credit Cards The Average Singaporean Should Own

Number Of Credit Cards The Average Singaporean Should Own

Credit Card Minimum Payment Calculator

Credit Card Minimum Payment Calculator

How Many Credit Cards Should You Really Have

How Many Credit Cards Should You Really Have

How Much Of Your Credit Limit Should You Use Ebc

How Much Of Your Credit Limit Should You Use Ebc

:max_bytes(150000):strip_icc()/how-long-does-it-take-a-credit-card-payment-to-post-960266-final-5b4fa00bc9e77c0037431490.png) How Long Does It Take A Credit Card Payment To Post

How Long Does It Take A Credit Card Payment To Post

What Are The Advantages Of Credit Cards Discover

What Are The Advantages Of Credit Cards Discover