Lc is a new method which is based on swift mt700 and is bank to bank authentication of a debt. My name is ozgur eker.

Sample Bill Of Exchange Letterofcredit Biz Lc L C

difference between bill of exchange and letter of credit

difference between bill of exchange and letter of credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in difference between bill of exchange and letter of credit content depends on the source site. We hope you do not use it for commercial purposes.

Bill of exchange is an old fashion method of debt settlement paper based and is not authenticated.

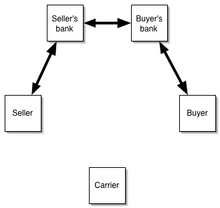

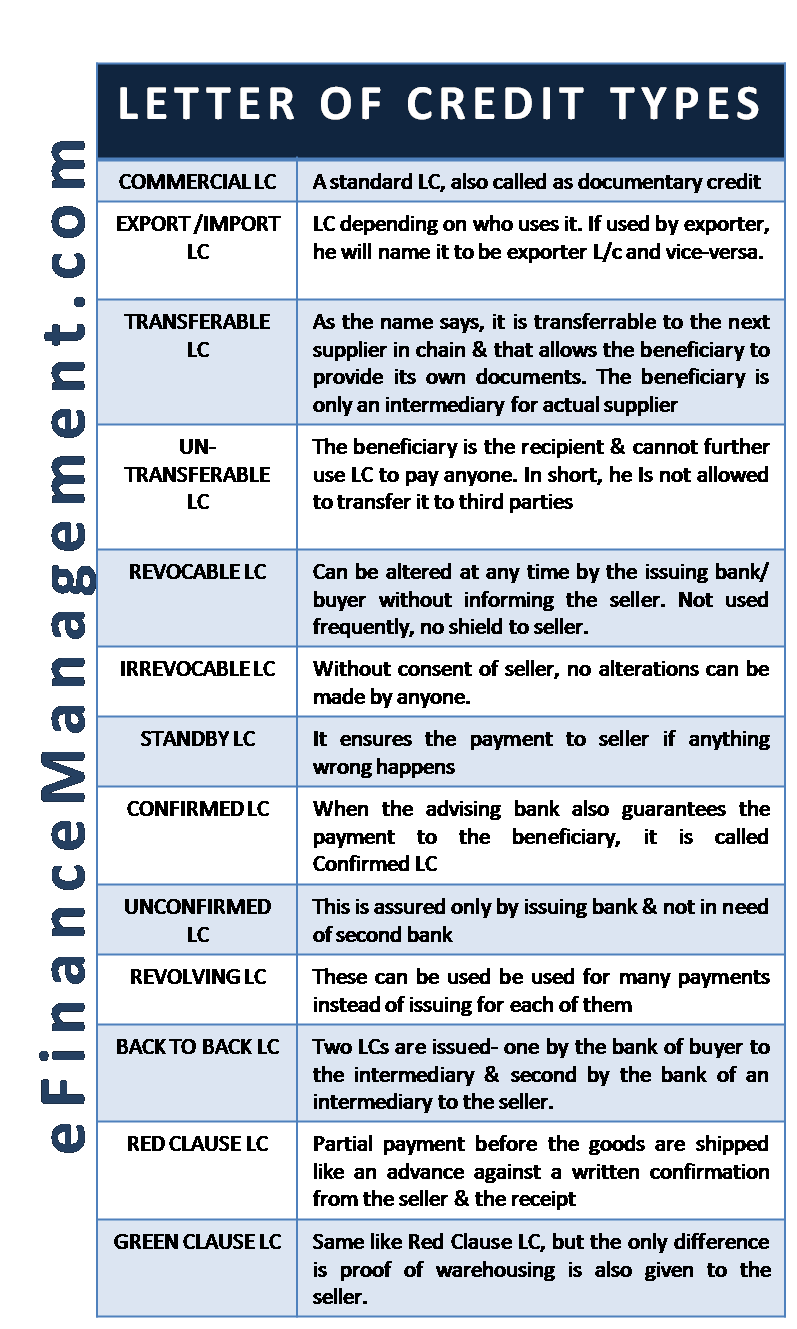

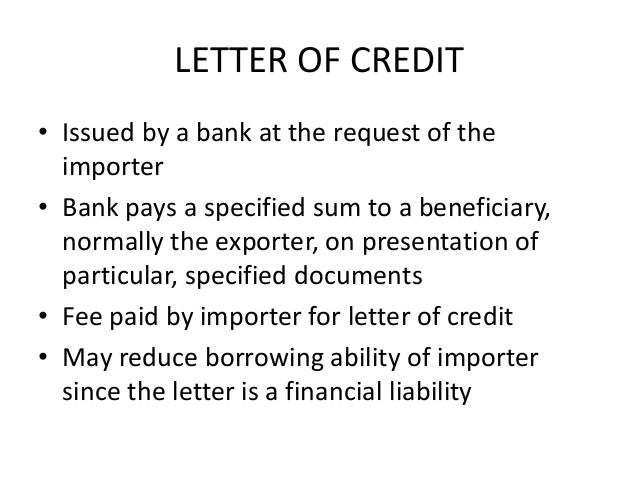

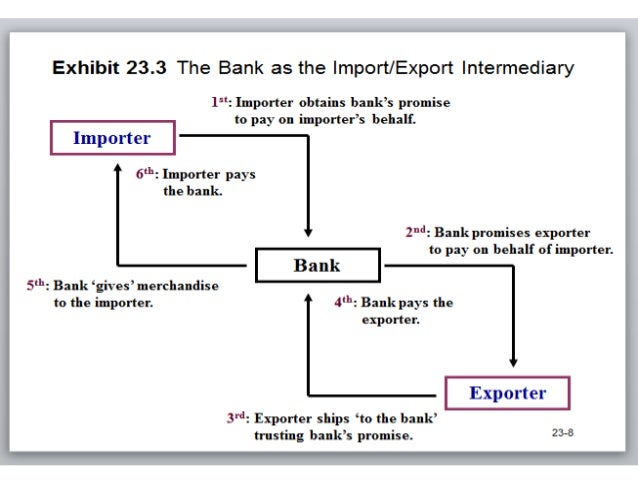

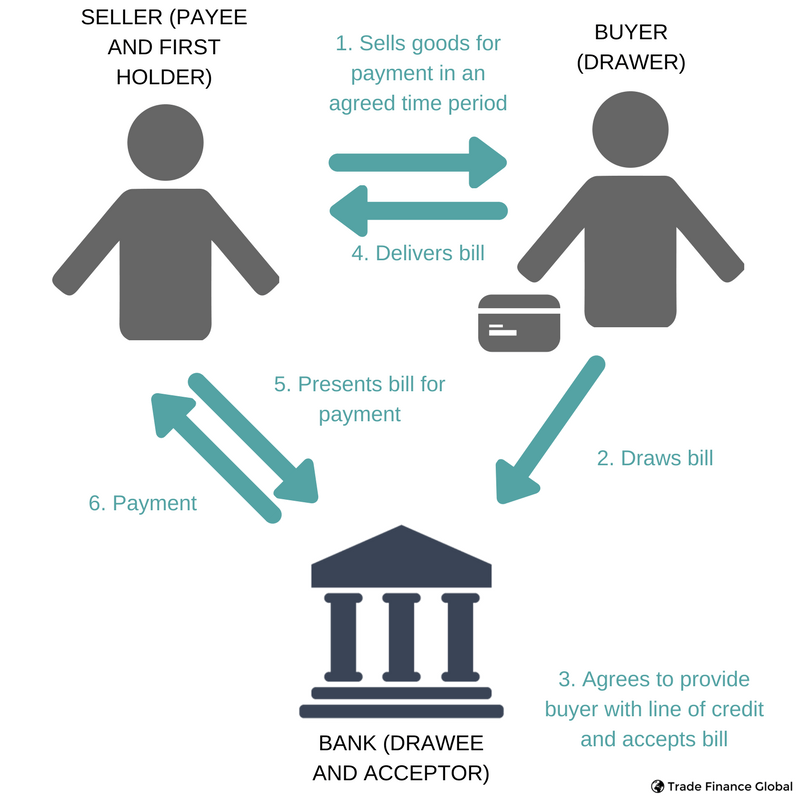

Difference between bill of exchange and letter of credit. Understanding a draft bill of exchange in a letter of credit transaction understanding a bill of exchange or draft in a letter of credit transaction. The main difference between the two is that a letter of credit is a payment mechanism whereas a bill of exchange is a. Difference between bill of exchange and letter of credit there are a number of payment mechanisms that are used when conducting international business.

Difference between bill of exchange and promissory note. Under the letters of credit the bill of exchange can be issued at sight or payable at a future date time draft. I have a bachelors degree in business administration and masters degree in international trade and finance.

Ive never heard of a bill of exchange and ive been a tax accountant for 20 years. Difference between sight letter of credit and usance. Both letters of credit and bill of exchange facilitate lines of credit for the buyer and provide assurance to the seller that the payment will be made regardless of whether the buyer is able to meet his payment obligations.

Let us assume that seller x sells goods to a buyer y on credit terms of 90 days. In simple terms export bill discounting with banks takes place under the shipments where in no letter of credit is involved. The following example illustrates the basics of a bill of exchange be.

Since 2009 i am a professional and independent letter of credit consultant from izmir turkey. To pay for credit sales a buyer may make a written promise in form of a promissory note or a bill of exchangebelow is a compilation of the major points of difference between bill of exchange and promissory note. A bill of exchange is drawn for financing trade whereas the liability of the maker of is a promissory note is primary.

Under the letters of credit the bill of exchange can be used with at sight acceptance and negotiation payment options. Under the letters of credit the bill of exchange must be drawn on a bank that is specified in the credit. Difference between bill discounting and bill negotiation.

A letter of credit is simply an introduction from one financial institute to another stating that you have good credit with them. If not what is the difference between export bill negotiation and export bill discounting. Awarded with cdcs certified documentary credit specialist two times between 2010 2013 and 2013 2016.

Letters of credit and bills of exchange are two such mechanisms commonly used in interna tional trade that facilitate lines of credit for the buyer. But i can tell you what a letter of credit is.

Trade Finance What Is Trade Finance And How Does It Work

Trade Finance What Is Trade Finance And How Does It Work

Export Documents Letter Of Credit Bill Of Exchange

Export Documents Letter Of Credit Bill Of Exchange

Export Documents Letter Of Credit Bill Of Exchange

Export Documents Letter Of Credit Bill Of Exchange

Export Documents Letter Of Credit Bill Of Exchange

Export Documents Letter Of Credit Bill Of Exchange

Letter Of Credit Documents Letterofcredit Biz Lc L C

Letters Of Credit And Bills Of Lading In Commercial

Letters Of Credit And Bills Of Lading In Commercial

What Is The Difference Between Letter Of Credit And

Letter Of Credit Documentation New York District Export

Letter Of Credit Documentation New York District Export

Promissory Notes And Bills Of Exchange

Promissory Notes And Bills Of Exchange