The health coverage tax credit is a program in place for tax years from 2002 to 2013 and was later extended through 2019 to help eligible individuals and families by paying a portion of premiums for qualified health insurance programs. Once pbgc takes over my pensi on plan whats the earliest date i would be eligible to apply the for hctc tax credit.

how much is the health coverage tax credit

how much is the health coverage tax credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is the health coverage tax credit content depends on the source site. We hope you do not use it for commercial purposes.

2019 health coverage your federal taxes.

How much is the health coverage tax credit. How and when does the hctc get notified that im an eligible pbgc pension recipient. Reconcile your premium tax credit for 2019. Form 1095 a how to reconcile find and use form 1095 a.

Starting in 2014 if you get your health insurance coverage through the health insurance marketplace you may be eligible for the premium tax credit. Choose your 2019 health coverage status for step by step directions tax forms. The health coverage tax credit hctc is a federal tax credit administered by the irs for 725 percent of health care insurance premiums which may apply to certain individuals who are at least 55 and up to 65 years of age and are receiving benefits from pbgc.

The health coverage tax credit hctc a federal tax credit administered by the irs has been extended for months beginning after december 31 2019 through december 31 2020this means participants will receive a credit that they can use to offset the cost of their health coverage. Your tax credit is based on the income estimate and household information you put on your marketplace application. To clarify premium tax credits are available for people with household incomes as high as 400 percent of the poverty level.

The amount of your tax credit is based on the price of a silver plan in your area but you can use your premium tax credit to purchase any marketplace plan including bronze gold and platinum. What is an advanced hctc. How much is the credit.

Am i eligible for the tax credit. The open enrollment period to purchase health insurance coverage for 2014 through the. The premium tax credit is part of the affordable care act its often referred to as a premium subsidy and its designed to help make health insurance premiums more affordable for middle and low income people the terms low income and middle class are subjective.

If your estimated income. Health coverage tax credit hctc faqs what is the tax credit. This tax credit can help make the cost of purchasing health insurance coverage more affordable for individuals and families with low to moderate incomes.

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the health insurance marketplace.

Health Coverage Tax Credit Stock Photo Image Of Market

Health Coverage Tax Credit Stock Photo Image Of Market

The Health Coverage Tax Credit Hctc In Brief

The Health Coverage Tax Credit Hctc In Brief

Few Claim Health Insurance Tax Credit

Few Claim Health Insurance Tax Credit

Guidance On The Health Coverage Tax Credit Trusaic

Guidance On The Health Coverage Tax Credit Trusaic

10 Truths About The Health Insurance Premium Tax Credits

Form 8885 Health Coverage Tax Credit 2013 Free Download

Form 8885 Health Coverage Tax Credit 2013 Free Download

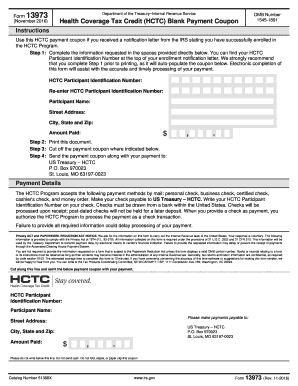

Form 13973 Health Coverage Tax Credit Blank Payment Coupon

Form 13973 Health Coverage Tax Credit Blank Payment Coupon

Fillable Online Form 13441 A Rev 5 2018 Health Coverage

Fillable Online Form 13441 A Rev 5 2018 Health Coverage

Fillable Online 2006 Form 8885 Health Coverage Tax Credit

Fillable Online 2006 Form 8885 Health Coverage Tax Credit