This disability tax credit certificate is completed by both the person with a prolonged mental or physical disability as well as a qualified medical practitioner. You can only make a new claim for child tax credit if you get the severe disability premium or got it in the past month and.

how to apply for child disability tax credit

how to apply for child disability tax credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to apply for child disability tax credit content depends on the source site. We hope you do not use it for commercial purposes.

Youll already be getting child tax credits if you have a child under 16 or under 20 in eligible education or training.

How to apply for child disability tax credit. There are four steps in applying for the disability tax credit dtc download the dtc form here also called the t2201 note that the dtc form was shortened in late 2015. Tax benefits canada can make the application process easy for you. The purpose of this tax credit is to offset the financial burdens that people with disabilities are faced with.

Fill out the initial assessment form below for the person making a claim and well send the forms paperwork that enables us to represent you and make a claim on your behalf. People who find themselves in need of financial or other assistance and receive benefits can apply for the disability tax credit. Your family doctor optometrist audiologist occupational therapist.

What is the disability child tax credit. If your child is disabled you should be getting extra help. A child is eligible for the disability tax credit when a medical practitioner certifies on form t2201 disability tax credit certificate that the child has a severe and prolonged impairment in physical or mental functions and the canada revenue agency cra approves the formyou can send the form to the cra at any time during the year.

Depending on your disability take the form to one of these people. The first step in claiming disability benefits is determining child disability tax credit disability tax credit eligibility. Retroactive payments for child disability tax credit and child disability benefit.

There is no longer a part a of the form for you or your family member to complete. An individual may claim the disability amount once they are eligible for the dtc. You may get extra child tax credits if your child either gets disability living allowance or pips.

When you are approved for your childs disability tax credit and child disability benefit you will be able to receive up to the amount 10 years before of both as a retroactive payment. The disability tax credit dtc is a non refundable tax credit that helps persons with disabilities or their supporting persons reduce the amount of income tax they may have to pay. Disabled canadians can apply for disability tax credit which is provided by the government of canada.

The disability tax credit is managed by canada revenue agency and is a non refundable tax credit that people who meet eligibility requirements can claim on their income tax each year. Child tax credit has been replaced by universal credit for most people. To apply for the disability tax credit in canada you must complete the disability tax credit certificate form t2201.

Child Disability Tax Credit Guide Eligibility Requirements

Child Disability Tax Credit Guide Eligibility Requirements

Disability Tax Credit Certificate

Disability Tax Credit Certificate

Child Disability Benefit By Andrea Lau Issuu

Child Disability Benefit By Andrea Lau Issuu

Arthritis Disability Tax Credit Benefits Disability

Arthritis Disability Tax Credit Benefits Disability

Child Disability Tax Credit Benefit Ontario Disability

Child Disability Tax Credit Benefit Ontario Disability

.jpg) Iras Claiming Child Relief It S A No Brainer With Iras

Iras Claiming Child Relief It S A No Brainer With Iras

2017 Disability Tax Credit Guide T2201 Form Eligibility

2017 Disability Tax Credit Guide T2201 Form Eligibility

Issuing Receipts For The Children S Art Tax Credit Bc Girl

Issuing Receipts For The Children S Art Tax Credit Bc Girl

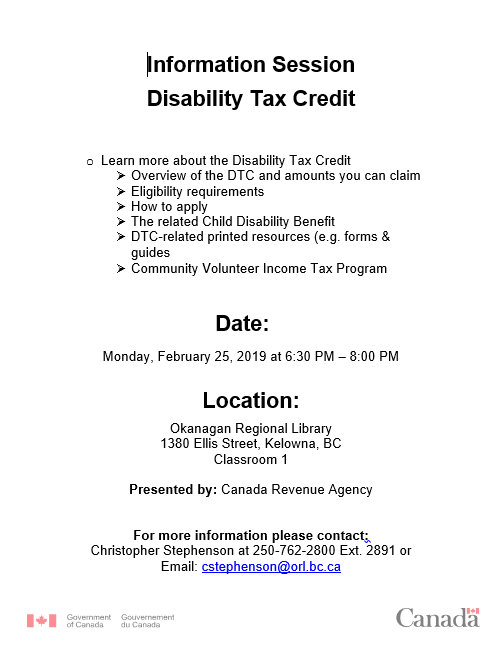

Kelowna Library On Twitter The Canadian Revenue Agency

Kelowna Library On Twitter The Canadian Revenue Agency