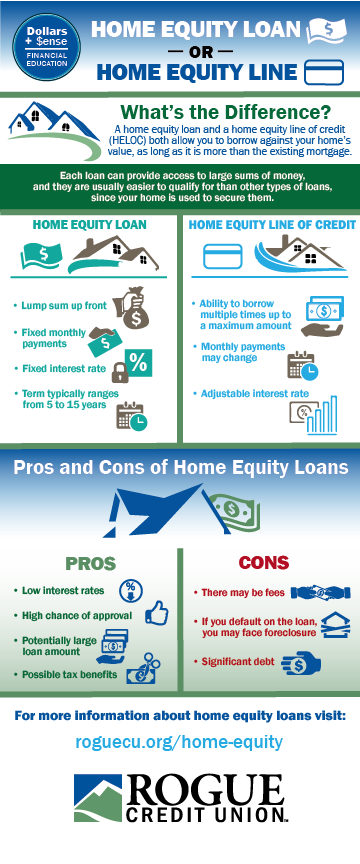

The loan is a lump sum the heloc draws money as you need it. Pros and cons helocs and home equity loans extract value from your home but add to your debt.

Homeequity Loan Vs Home Equity Lineofcredit Sue Irwin Realtor

Homeequity Loan Vs Home Equity Lineofcredit Sue Irwin Realtor

home equity line of credit vs home loan

home equity line of credit vs home loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in home equity line of credit vs home loan content depends on the source site. We hope you do not use it for commercial purposes.

A home equity line of credit is a one time loan that you repay with fixed payments over a certain number of years.

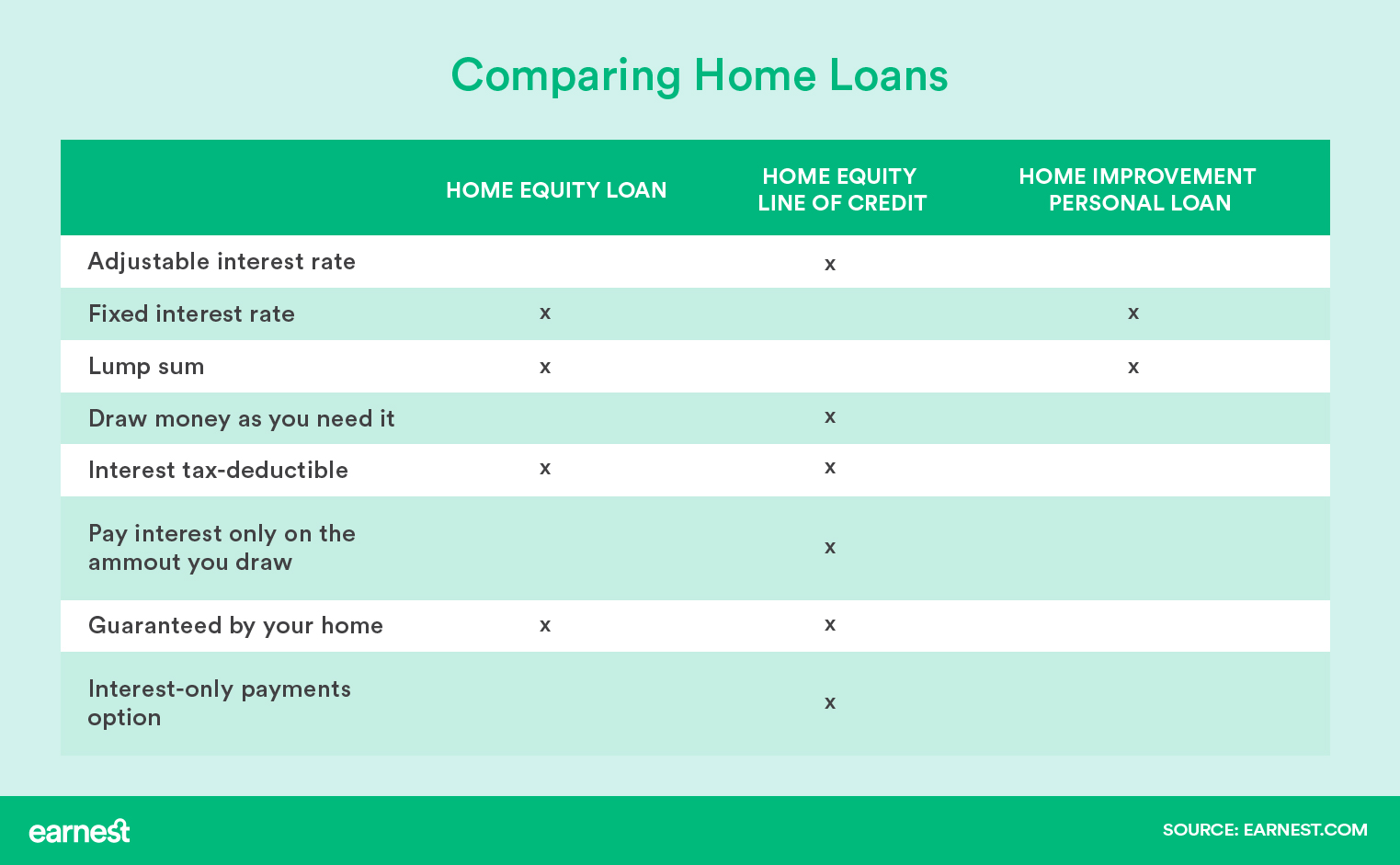

Home equity line of credit vs home loan. Home equity loans and home equity lines of credit let you borrow against the value of your home but they work differently. A home equity line of credit is better suited to home improvement projects that will be incurred in stages or for college tuition payments that will be paid over time rather than the lump sum. Terms for a home equity loan vs.

Compare home equity loan rates. Home equity loan versus line of credit. Whichever option you choose both heloc and home equity loans do come with closing costs.

A home equity line of credit. Heres a primer on the differences between home equity loans and home equity lines of credit along with the pitfalls of each and when its typically best to use one over the other. Closing costs can include a home appraisal an application fee title search and attorneys fees.

Mortgages and home equity loans are two different types of loans you can take out on your home. In a nutshell a home equity loan or a heloc is based on the the current value of your home minus any outstanding loans plus the new one youre getting. Home equity financing is a low cost option because there are no closing costs for installment loans or lines of credit.

These may be similar to what you paid when you took out your first mortgage. Home equity lines of credit. Home equity line of credit vs home equity loan.

This percentage varies between lenders and the type of home equity financing that you choose as well as your credit history and income. Find out about both options here. In some ways home equity loans and helocs are similar.

Taking out a home equity loan or a home equity line of credit demands that you submit various documents to prove that you qualify and either loan can impose many of the same closing costs as a. Just like a credit card a home equity line of credit is revolving credit that allows you to draw from an. A first mortgage is the original loan that you take out to purchase your home.

Both loans are often second mortgages that you can use in addition to an existing home purchase loan. Rates for an installment loan may be marginally higher than for a credit line but the term also is usually longer so your monthly payments may be similar for both. Home equity loans.

Home Equity Loan Or Line Of Credit Which Is Right For You

Home Equity Loan Or Line Of Credit Which Is Right For You

What S The Difference Between A Home Equity Line Of Credit

What S The Difference Between A Home Equity Line Of Credit

Home Equity Loan Vs Line Of Credit Vs Home Improvement

Home Equity Loan Vs Line Of Credit Vs Home Improvement

Home Equity Loan Versus Cash Out Refinance 2017 07

What Is A Home Equity Line Of Credit Heloc How Does It

What Is A Home Equity Line Of Credit Heloc How Does It

Mortgage Loans Vs Home Equity Loans What You Need To Know

Mortgage Loans Vs Home Equity Loans What You Need To Know

Home Equity Line Of Credit Vs Reverse Mortgages Austin

Home Equity Line Of Credit Vs Reverse Mortgages Austin

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)