How much a retailer will pay per swipe when a customer pays with a credit card varies greatly. These fees are the most predictable.

The Complete Guide To Credit Card Processing Fees Rates 2020

how much do credit card companies charge per transaction

how much do credit card companies charge per transaction is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much do credit card companies charge per transaction content depends on the source site. We hope you do not use it for commercial purposes.

While more expensive up until recently amex has kept its pricing model simple meaning most merchants paid the same high credit card processing fees.

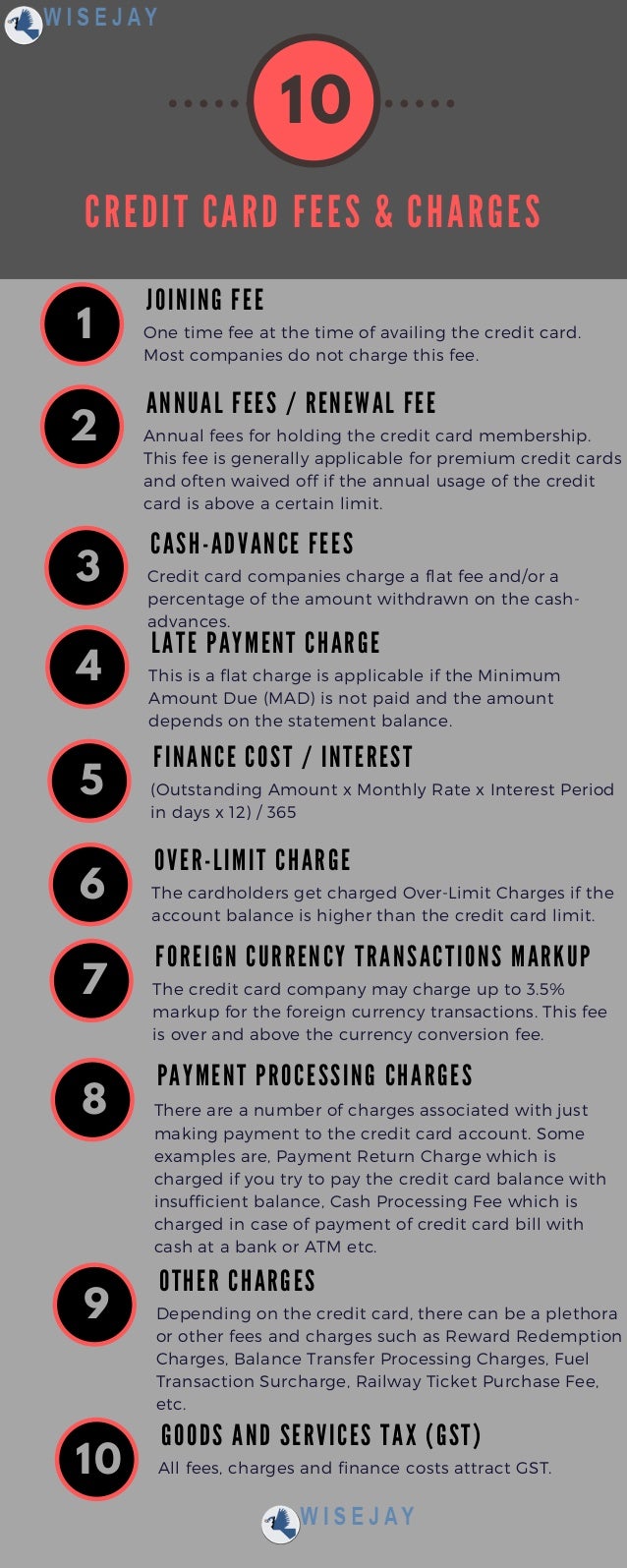

How much do credit card companies charge per transaction. The average credit card processing cost for a retail business where cards are swiped is roughly 195 2 for visa mastercard and discover transactions. My point being that these com. These are the fees the card issuing banks charge for each transaction and they represent the largest expense merchants should pay per sale and per month.

I mentioned this because you used the term card companies which might be interpreted a variety of different ways. Every banking or credit card institution has their own set of fees. The credit card company issuer and processor each charge their own fees and these may vary by how the card is processed which makes calculating the final fees charged per transaction rather complex.

Their high discount rates which often reach 35 are higher than that of competitors like mastercard and visa. Debit cards are the least expensive to the merchant. American express is considered the priciest in terms of credit card processing fees.

Some merchant providers such as square charge a flat fee per transaction. So what do businesses pay for credit card transactions. Merchant fees hurt small business but the companies that process these cards dont care.

It does not matter what brand credit card or type of credit card the consumer used. Average credit card processing fees. Visa and mastercard are next but it.

If youre looking for quick numbers here you go. For example square charges 275 of each swiped transaction. In this model the wholesale and markup fees are blended together.

Its important to understand that the companies youve mentioned are card networks not card issuers. Interchange fees typically consist of a percentage of each transaction accompanied by a flat per transaction fee eg 210 010.

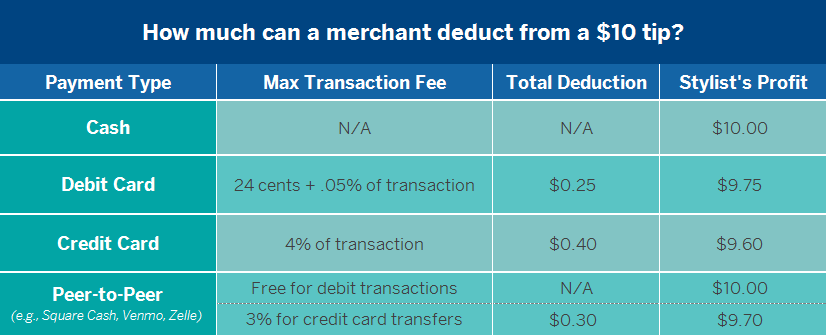

Tipping With A Card How Much Goes To The Service Provider

Tipping With A Card How Much Goes To The Service Provider

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

Credit Card Processing Fees And Rates Cardfellow

Credit Card Processing Fees And Rates Cardfellow

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

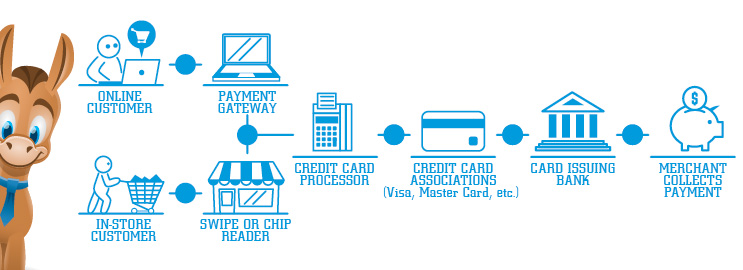

How Credit Card Processing Works Understanding Payment

How Credit Card Processing Works Understanding Payment

2020 Credit Card Processing Fees May Surprise You

2020 Credit Card Processing Fees May Surprise You

The Complete Guide To Credit Card Processing Fees Rates 2020

The Complete Guide To Credit Card Processing Fees Rates 2020

:max_bytes(150000):strip_icc()/debit-and-credit-card-tips-in-canada-1481710-Final2-5c2f73e546e0fb00015cfd9b.png) Tips For Using Debit Cards And Credit Cards In Canada

Tips For Using Debit Cards And Credit Cards In Canada

How Do Credit Card Companies As Well As Visa And Mastercard