When you have your hands full raising kids making a living from home can seem impossible but dont fret. For this obama punishes her with the tax codethe perversely logical corollary to obamas desire to structure the tax code to the disadvantage of stay at home mothers is his desire to use tax dollars to replace working fathers with the government itselfas this column has noted before in each of the last six years on record 2008 through.

Iras Tax Savings For Married Couples And Families

Iras Tax Savings For Married Couples And Families

is there a tax credit for stay at home moms

is there a tax credit for stay at home moms is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in is there a tax credit for stay at home moms content depends on the source site. We hope you do not use it for commercial purposes.

His campaign is examining whether and how to allow.

:max_bytes(150000):strip_icc()/senior-man-cancer-patient-clenched-fist-wristband-hand-1036309938-5be4d11a46e0fb00511107e4.jpg)

Is there a tax credit for stay at home moms. 8 work at home tax credits worth taking sheknows. If you are married you and your husband will file a joint return. So stay at home moms.

The child must be age 16 or under by the end of the tax year in question and must be eligible to be claimed as a dependent on your tax returns. The plan would give low income households another tax credit worth as much as 1200 a year by expanding the earned. Its important to know whats available to you in order to properly claim tax breaks and parental benefits.

In this issue of working mom 30 we reveal the tax credit perks you dont want to miss as a working stay at home mom. Thousands of moms before you have figured out how to make money from home working online jobs while raising kids at the same time. If you are married you can file a joint return with your spouse.

Married filing joint returns receive a higher standard deduction along with a personal exemption for each of you. No there is no special tax credit for being a stay at home mother unfortunately. There are many government benefits available to both working and stay at home parents.

Donald trump just unveiled a huge tax break for stay at home moms news by. Stay at home parents already get a tax. The married filing jointly filing status gives you a higher tax break even if one spouse had little or no income.

Republican presidential candidate donald trump is considering allowing stay at home moms to claim his new deduction for child care expenses. Compared with 294 hours spent on those activities if they are employed full time outside the home. This tax break is often missed your tax professional will be able to determine if you qualify.

No specific deductions for stay at home moms. Because well paying jobs for stay at home moms do exist. In addition to the exemption all stay at home parents get a child credit added to their tax return for each of their children.

Why would there be a tax.

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

/cdn.vox-cdn.com/uploads/chorus_image/image/64729291/563596575.jpg.0.jpg) Tax Credit For Stay At Home Parents The New Proposal

Tax Credit For Stay At Home Parents The New Proposal

Iras Parent Relief Handicapped Parent Relief

Iras Parent Relief Handicapped Parent Relief

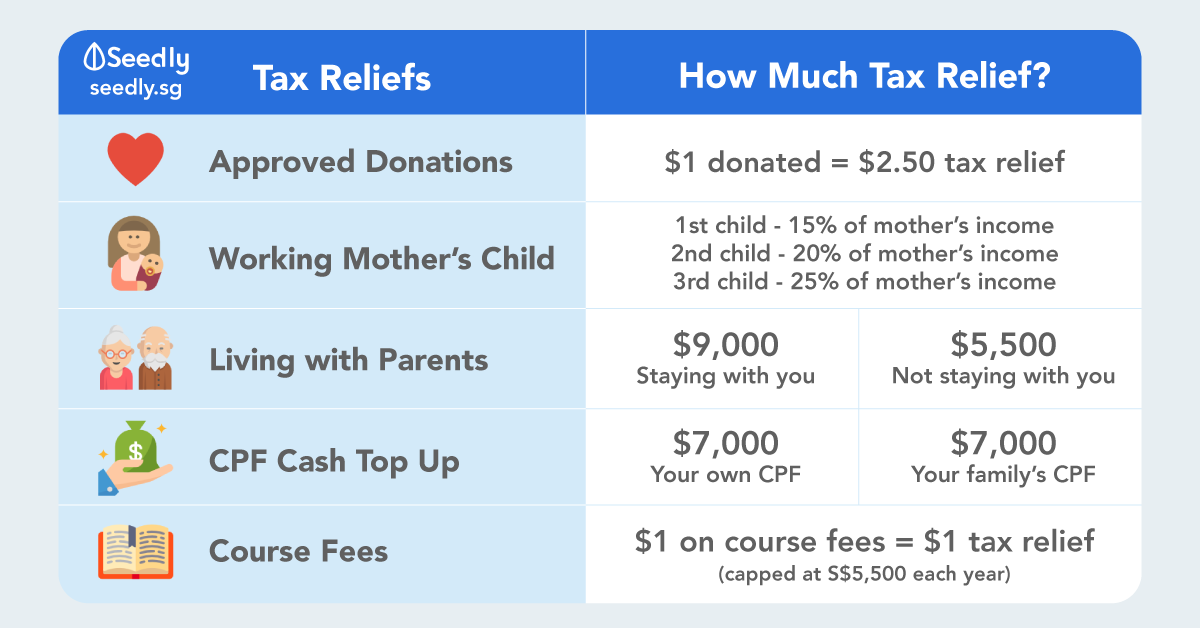

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

How To Reduce Your Income Tax In Singapore Make Use Of

Working Mums Hot Under The Collar Over 80 000 Tax Relief

Working Mums Hot Under The Collar Over 80 000 Tax Relief

/cdn.vox-cdn.com/uploads/chorus_asset/file/18305825/caretakereitc_illustration.png) Tax Credit For Stay At Home Parents The New Proposal

Tax Credit For Stay At Home Parents The New Proposal

Stay At Home Parents Work Hard Should They Be Paid The

Stay At Home Parents Work Hard Should They Be Paid The

Should Be A Tax Credit Family Stay At Home Mom Stay

Should Be A Tax Credit Family Stay At Home Mom Stay

Tax Credits And Deductions For Work At Home Moms Via Www

Tax Credits And Deductions For Work At Home Moms Via Www

.jpg) Iras Claiming Child Relief It S A No Brainer With Iras

Iras Claiming Child Relief It S A No Brainer With Iras