However it is a critical part of your overall credit health and can have a direct impact in a credit application if you apply for a mortgage or major loan. Carrying a lot of debt especially high credit card debt hurts your credit score and your ability to get approved for new credit cards loans and an increased credit limit.

How Debt To Income Ratio Affects Mortgages

How Debt To Income Ratio Affects Mortgages

does debt to income ratio affect credit score

does debt to income ratio affect credit score is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in does debt to income ratio affect credit score content depends on the source site. We hope you do not use it for commercial purposes.

They review your debts and income to calculate a ratio of the two that is one factor in determining whether you qualify for a mortgage.

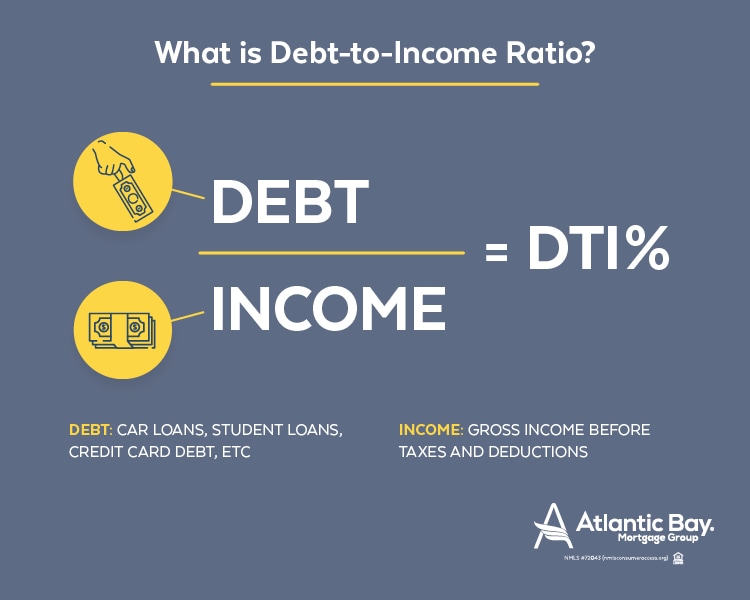

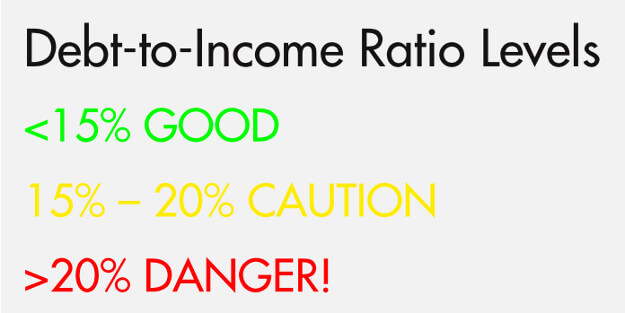

Does debt to income ratio affect credit score. Lenders may consider your debt to income ratio in tandem with credit reports and credit scores when weighing credit applications. Even if your debt to income ratio is low if your debt hurts your credit score you could still be denied. Expressed as a percentage your debt to income or dti ratio is your all your monthly debt payments divided by your gross monthly income.

Note that your income isnt a factor in your credit score. Lenders approve loans based on several factors including your earnings and your credit score but those are separate pieces of the puzzle. Credit utilization and debt to income ratios can both affect whether you get approved for a loan or credit card.

While researching your credit score you may have come across the term debt to income ratio on its own debt to income ratio wont affect your credit score. Your income does not directly affect your credit score but it does affect your ability to qualify for a loan. But only one affects your credit score.

Your debt to income ratio dti compares the total amount you owe every month to the total amount you earn.

How Debt To Income Ratio Affects Mortgages

How Debt To Income Ratio Affects Mortgages

How Do Credit Utilization And Debt To Income Ratios Affect

How Do Credit Utilization And Debt To Income Ratios Affect

What Is Debt To Income Ratio And Why Does It Matter Experian

What Is Debt To Income Ratio And Why Does It Matter Experian

How Debt To Income Ratio Affects Mortgages

How Debt To Income Ratio Affects Mortgages

What Is Debt To Income Ratio And Why Does It Matter

What Is Debt To Income Ratio And Why Does It Matter

What To Do If Your Loan Application Is Rejected

What To Do If Your Loan Application Is Rejected

How Does Your Debt To Income Ratio Affect Your Interest Rate

How Does Your Debt To Income Ratio Affect Your Home Loan

How Does Your Debt To Income Ratio Affect Your Home Loan

/credit_score-643151098-5bcc77e3c9e77c0051101890.jpg) How Income Affects Your Credit Score

How Income Affects Your Credit Score

Loans Credit Score Why Debt To Income Ratio Is As

Loans Credit Score Why Debt To Income Ratio Is As

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)