You can use a small business line of credit to help finance ongoing operating expenses cover cash flow gaps take advantage of unexpected opportunities and provide a cushion to protect against emergencies. A small business line of credit helps entrepreneurs maintain a constant supply of cash to keep up with recurring expenses and the ebb and flow of seasonal changes in business.

Small Business Financing Invoices Funding Line Of Credit

Small Business Financing Invoices Funding Line Of Credit

how does a small business line of credit work

how does a small business line of credit work is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how does a small business line of credit work content depends on the source site. We hope you do not use it for commercial purposes.

If your business has a low season and a high season you may consider spending on credit during the low season to push through to the high season states the article.

How does a small business line of credit work. A small business line of credit is subject to credit review and annual renewal and is revolving like a credit card. How small business owners use credit. For the 50 of businesses owner who have experienced cash flow problems a small business line of credit can be a necessary lifeline.

And this might be significantly underestimating the degree to which small businesses rely on short term borrowing. If your business has very good credit the bank may approve you for a signature line in which case you can simply write yourself a check for an amount of money up to your preapproved limit. According to a report from usa today a line of credit can help small businesses navigate the ebbs and flows of a calendar year.

A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. This article helps you understand how a line of credit works and gives you an idea of the qualification requirements. A business line of credit can be a valuable tool for small businesses that take a strategic approach to making sure they have access to the resources they require to meet day to day working capital needs and fill other short term financial necessities.

Interest begins to accumulate once you draw funds and the amount you pay except for interest is again available to be borrowed as you pay down your balance. Our picks for the best business lines of credit come with limits ranging from 10000 to 3 million. Or it may require completion of a borrowing base certificate each month or upon each draw.

For example if you miss a few credit card payments on your personal account you dont want that to reflect on your business credit and vice versa. The biggest advantage of a business line of credit is its renewability. Consider establishing business credit for one reason.

You can draw out funds pay them back and draw again. More importantly it helps you decide if a business line of credit is the right solution for your business. Not only do 56 of small businesses have an open line of credit but 15 of small businesses are relying on borrowed funds as a primary funding source.

Doing so separates your personal credit from your business. This will prevent either one from affecting the other. The article also discusses three alternative solutions that have many of the benefits of a line of credit.

How To Get A Small Business Loan That Works For You

How To Get A Small Business Loan That Works For You

Business Line Of Credit A Primer For Small Business Owners

Business Line Of Credit A Primer For Small Business Owners

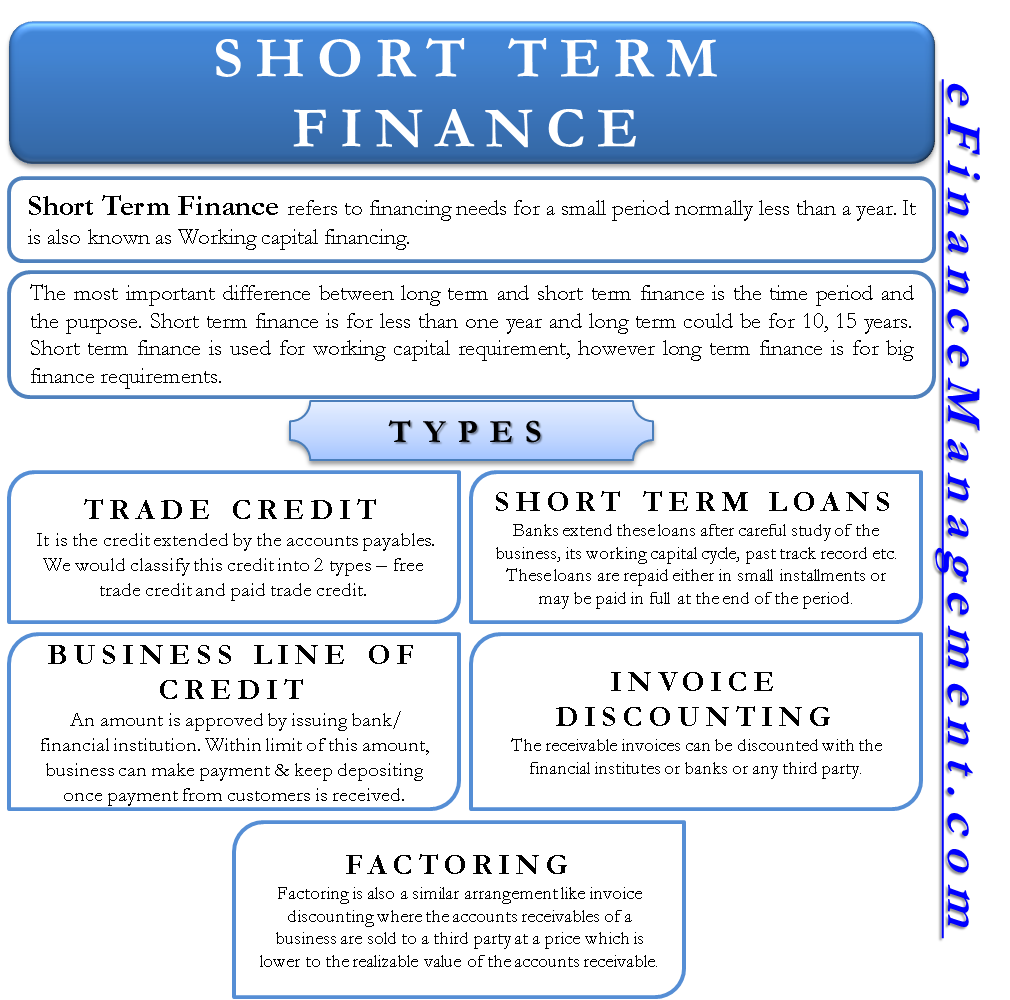

Short Term Finance Types Sources Vs Long Term

Short Term Finance Types Sources Vs Long Term

Merchant Funding Tutorials Small Business Capital U S

No Nonsense Guide To Applying For Credit For Small

No Nonsense Guide To Applying For Credit For Small

6 Best Line Of Credit Loans For Your Small Business

6 Best Line Of Credit Loans For Your Small Business

Line Of Credit For Small Business

Line Of Credit For Small Business

Where To Get A Small Business Line Of Credit Financing

Where To Get A Small Business Line Of Credit Financing

Unsecured Business Line Of Credit What Are The Advantages

Unsecured Business Line Of Credit What Are The Advantages

What Is A Business Credit Line Lendver Best Business

What Is A Business Credit Line Lendver Best Business

Seeking For A Begin Up Online Business Line Of Credit

Seeking For A Begin Up Online Business Line Of Credit