Get ready for the next tax season by knowing what home improvements you can make to qualify for energy tax credits. Home improvements are more affordable and beneficial for you if you go with ones that fall under the non business energy property credit and the residential energy efficient property credit.

5 Tax Deductible Home Improvements For 2018 Budget Dumpster

5 Tax Deductible Home Improvements For 2018 Budget Dumpster

is there a tax credit for home improvements

is there a tax credit for home improvements is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in is there a tax credit for home improvements content depends on the source site. We hope you do not use it for commercial purposes.

There are both tax credits and deductions that can be taken when the purchase was made or afterwards.

Is there a tax credit for home improvements. Solar wind geothermal and fuel cell technology are all eligible. Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency. But many homeowners end up leaving this money on the table.

Lets look at them. Each year there are new federal provincial and municipal programs to support ottawa homeowners with renovations and upgrades to their home. This is known as the residential renewable energy tax credit.

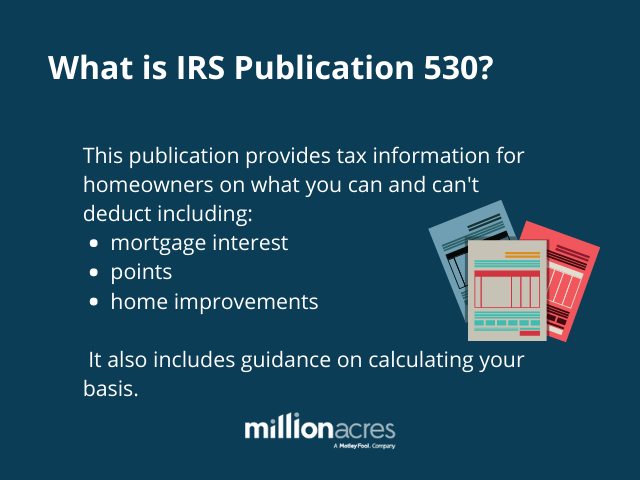

However first time home buyers and sellers and even seasoned homeowners may not know about other tax breaks for home improvements. These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Most homeowners know that their home entitles them to some federal tax breaks chief among them deductions based on mortgage interest and property taxes that they pay annually.

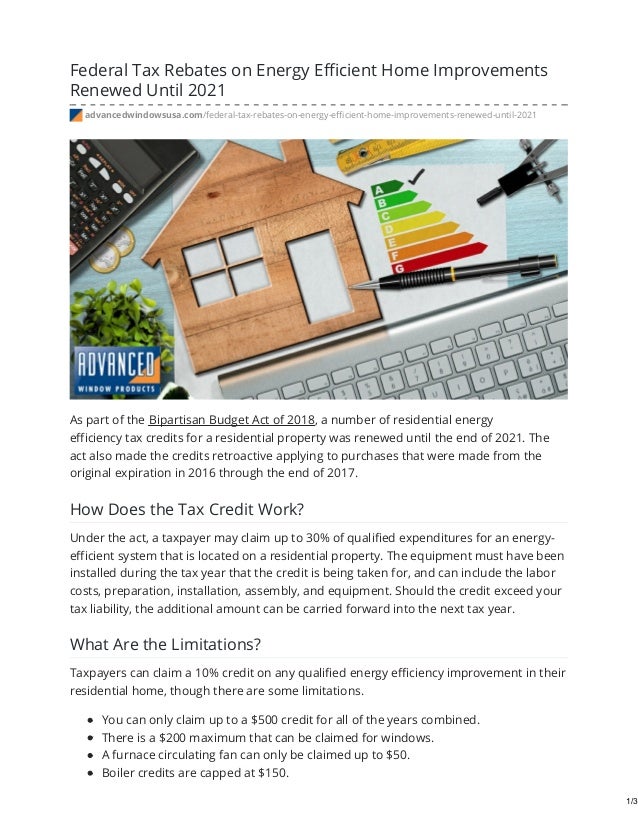

You will add up your various energy credits on irs form 5965. Like that other credit the amount you can get back is still 30 with a decline until the tax credit expires after 2021. For 2019 this is no different there are multiple rebates and tax credits available to homeowners.

This includes the solar energy tax credit. How do i get a tax credit for home improvements. Although the official 2018 tax credits for window installation have not yet been officially released we know theyre coming.

Certain home improvements are tax deductible and can be utilized to reduce the amount of tax you pay to uncle sam. Always consult a qualified tax adviser when. And theres a good chance theyll look much like the tax credits over the last five to seven years.

Using your mortgage to make home improvements one way to save on the costs of home renovation is to make the improvements to the home at the time it is purchased. This credit is worth a maximum of 500 for all years combined from 2006 to its expiration. Details of the nonbusiness energy property credit extended through december 31 2019 you can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

You can finance up to 30 percent of your energy efficient home improvement with tax credits. Every year the federal government gives homeowners tax credits for specific home improvements. The renewable energy tax credit is for solar geothermal and wind energy installments and improvements.

Are Home Improvements Tax Deductible It Depends On Their

Energy Tax Credit Which Home Improvements Qualify

Energy Tax Credit Which Home Improvements Qualify

/200253982-001-F-56a938335f9b58b7d0f959d2.jpg) 2020 Home Improvement And Residential Energy Tax Credits

2020 Home Improvement And Residential Energy Tax Credits

7 Home Improvement Tax Deductions Infographic

7 Home Improvement Tax Deductions Infographic

Federal Tax Rebates On Energy Efficient Home Improvements

Federal Tax Rebates On Energy Efficient Home Improvements

7 Home Improvement Tax Deductions Infographic Tax

7 Home Improvement Tax Deductions Infographic Tax

What Is Irs Publication 530 Millionacres

What Is Irs Publication 530 Millionacres

Martha Macquarrie For Kings Hants On Twitter We Don T Have

Martha Macquarrie For Kings Hants On Twitter We Don T Have

Interest On Home Equity Loans Is Still Deductible But With

Interest On Home Equity Loans Is Still Deductible But With

Are Home Improvement Loans Tax Deductible Not Always

Are Home Improvement Loans Tax Deductible Not Always