The typical household in alaska carries the most credit card debt an average of 13048 this is 13 more than wyoming which is the next state carrying the highest average credit card debt. The average household in ohio holds just 5446 in credit card debt which is the least of.

What Credit Limit Will I Get When I Apply For A Credit Card

What Credit Limit Will I Get When I Apply For A Credit Card

average credit card limit for 18 year old

average credit card limit for 18 year old is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in average credit card limit for 18 year old content depends on the source site. We hope you do not use it for commercial purposes.

For those ages 18 to 24.

Average credit card limit for 18 year old. The average credit card limit. These days the card act credit card accountability responsibility and disclosure act requires consumers under the age of 21 to have a cosigner or steady income to obtain a credit card. Why a 33 year old turned to a risky loan when his babys premature birth left him broke.

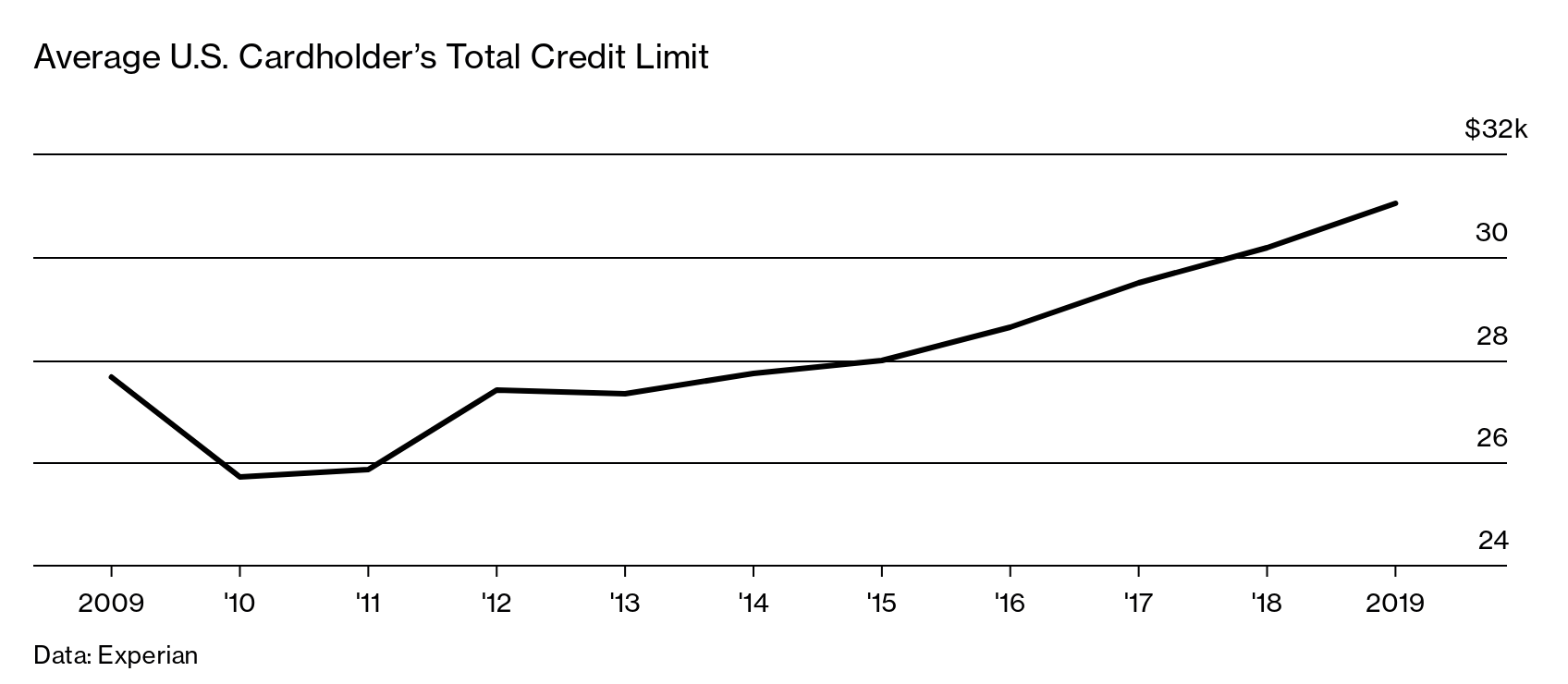

Average credit card debt varied widely by state or region. I was approved for the discover it card with a 500 limit. Thats relatively unchanged from december 2015 when the average credit card limit was 8042.

I got greedy so i applied for the bestbuy credit card because i had worked there for. How to get a credit card if youre between 18 and 21 years old. Over the course of the next year they inceased my limit to 1500.

Finally judging by the fact that people with high fico scores have an average total credit limit of 33371 when their average credit limit for each card is only 9543 that means that those high scorers either have several credit cards or one or two on which they aggressively seek credit limit increases. According to experian data the average credit card limit as of december 2016 was 8071. I have an annual income of between 5000 7000 from a job ive had for about three years.

As youll see below there is a wide range in credit card limits because consumers with low credit scores cant access high. I was happy i was using it and reaping rewards left and right. Federal lawmakers didnt want young consumers to accumulate mountains of debt so they passed the card act of 2009.

Credit card utilization for those ages 18 24 is 31 percent with an average credit limit of about 5700 compared with 20 percent for all age groups. In one fell swoop the card act limited the options for 18 year olds to obtain credit from the entire consumer marketplace down to a handful of issuers and. Looking at the 25 34 age group those more likely to have established employment history utilization drops to 24 percent and credit limits rise to just over 11000.

My mom loved her discover card and they have had it for over 10 years. How to get higher credit limits. Im 18 years old and looking to get my first credit card.

Once you turn 18 youre allowed to get a credit card on your own. Credit card debt is the no. I had a 1000 loan for my car that was paid off within a year and had no late payments.

Your first credit limit may be as low as 100 if your first credit card is a retail store credit cardyou might be approved for a slightly larger credit limit of 300 or 500 if your first credit card is a visa or mastercard issued by a bank or credit card company. However its a little more difficult to get one when youre under 21.

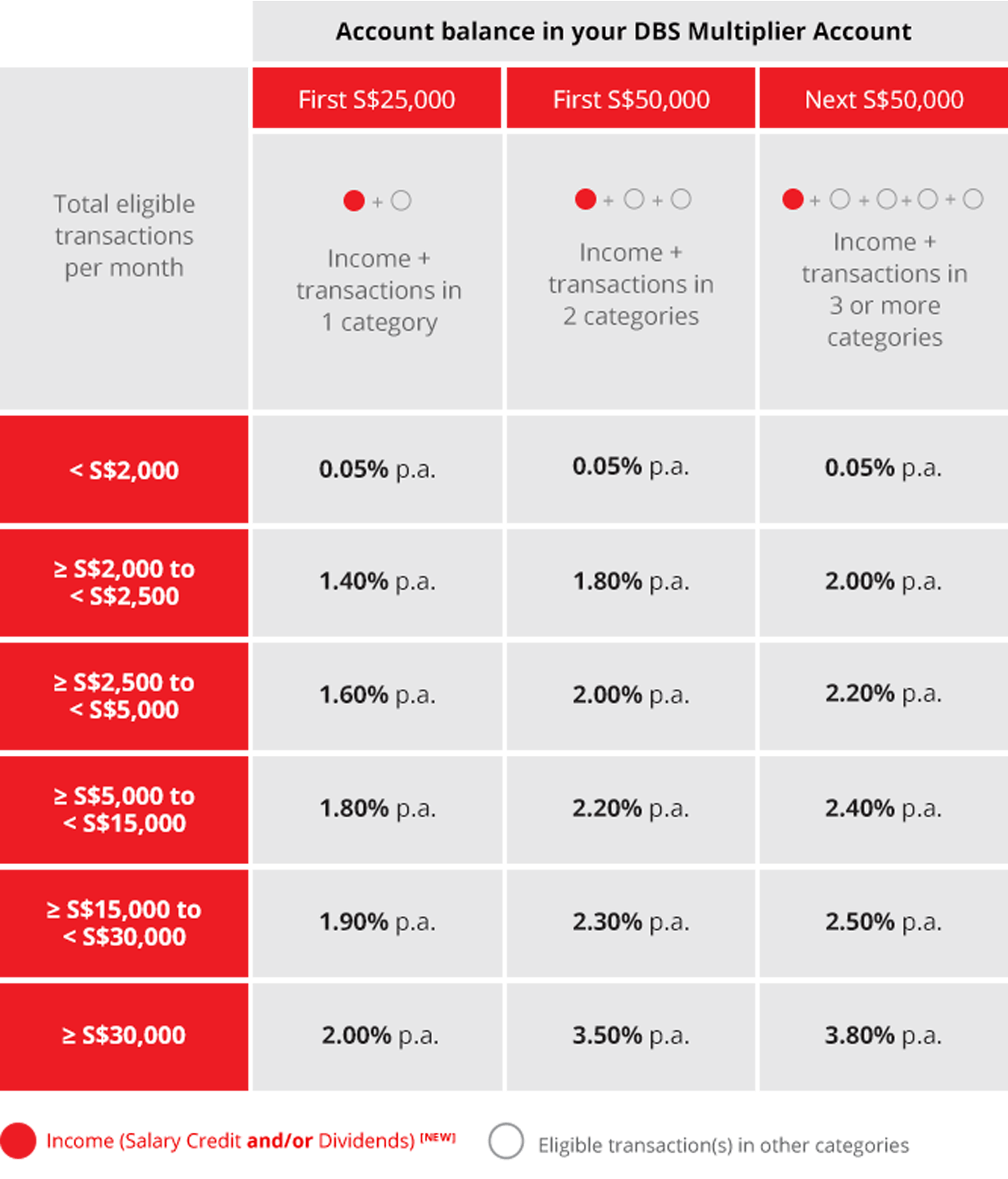

7 Most Popular Student Credit Debit Cards In Singapore

7 Most Popular Student Credit Debit Cards In Singapore

Banks Are Handing Out Beefed Up Credit Lines No One Asked

Banks Are Handing Out Beefed Up Credit Lines No One Asked

15 Best Credit Cards For 18 Year Olds In 2020

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

What Kind Of Debt Do You Think Is Good For Building Credit

Credit Scores This Is The Average For Every Age Group Money

Credit Scores This Is The Average For Every Age Group Money

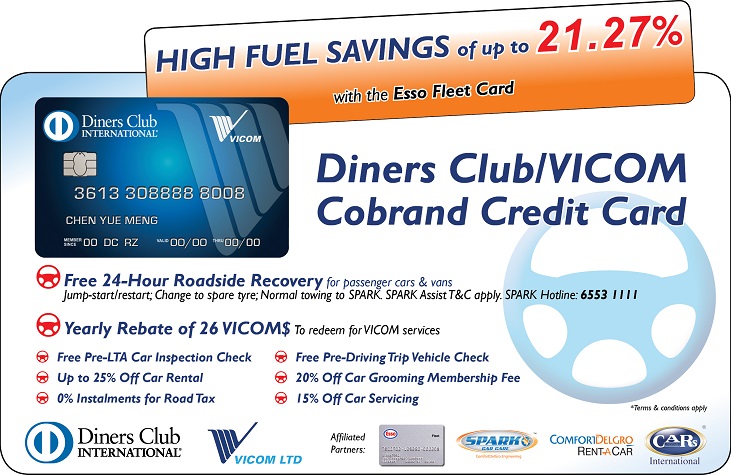

Apply Diners Club Vicom Credit Card Diners Club Singapore

Apply Diners Club Vicom Credit Card Diners Club Singapore

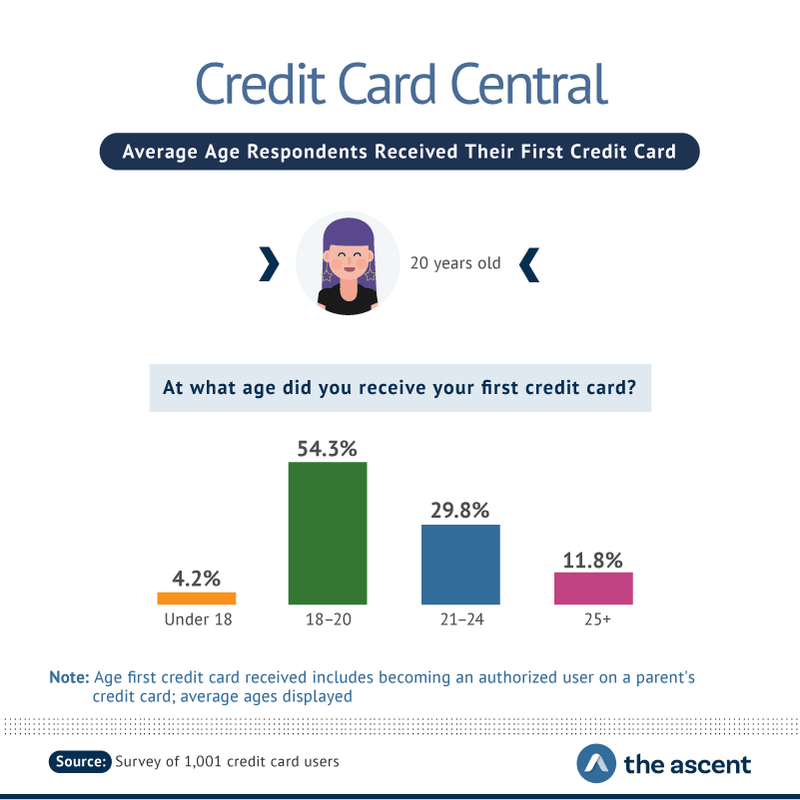

Study When Does The Average American Get Their First Credit

Study When Does The Average American Get Their First Credit

![]() 11 Things Working Adults In Singapore Should Know Before

11 Things Working Adults In Singapore Should Know Before