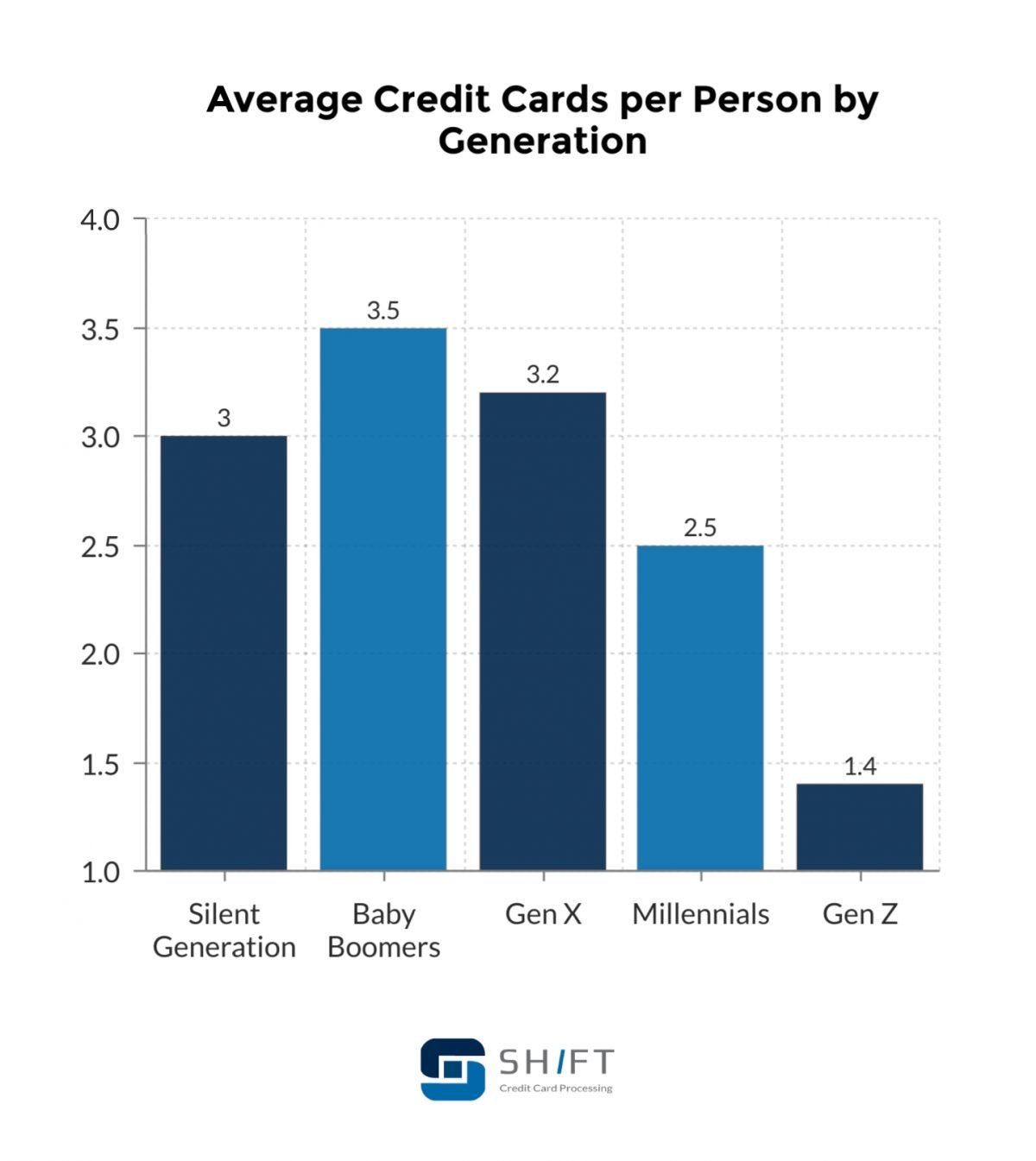

The average number of credit cards per person is 31. Average credit card balance.

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

average number of credit cards per american household

average number of credit cards per american household is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in average number of credit cards per american household content depends on the source site. We hope you do not use it for commercial purposes.

Average number of credit cards by region.

Average number of credit cards per american household. Nerdwallets 2019 american household credit card debt study. Diving into the total credit card debt of 764 billion it turns out that the average american household carried approximately 6063 in credit card debt through the first quarter of 2017. The average american has this many credit cards.

6358 according to experian excludes retail credit cards which have lower balances. The average amount of credit card accounts held by a person and the average total balance on those credit cards varied by state. 83 of adults have at least one credit card.

One for the mom one for the dad and a business credit card for each. That is wrong the average household has eight credit cards and owes. 55 of credit card users dont always pay in full.

Residents of mississippi had the lowest number of credit cards opena state average of 169 credit cards per person. Hover over a state in order to display its average. I would say the average household has 4 credit cards.

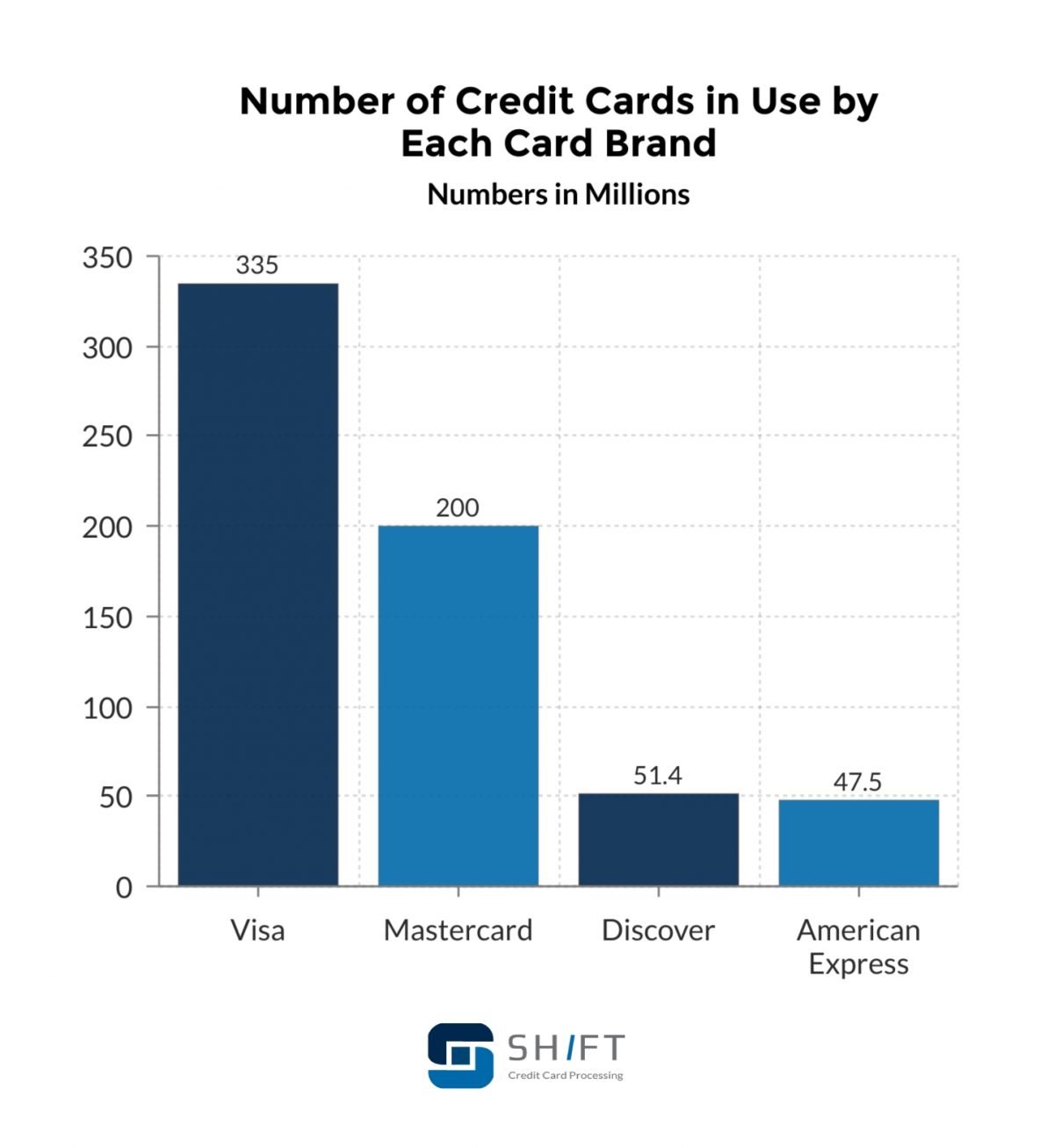

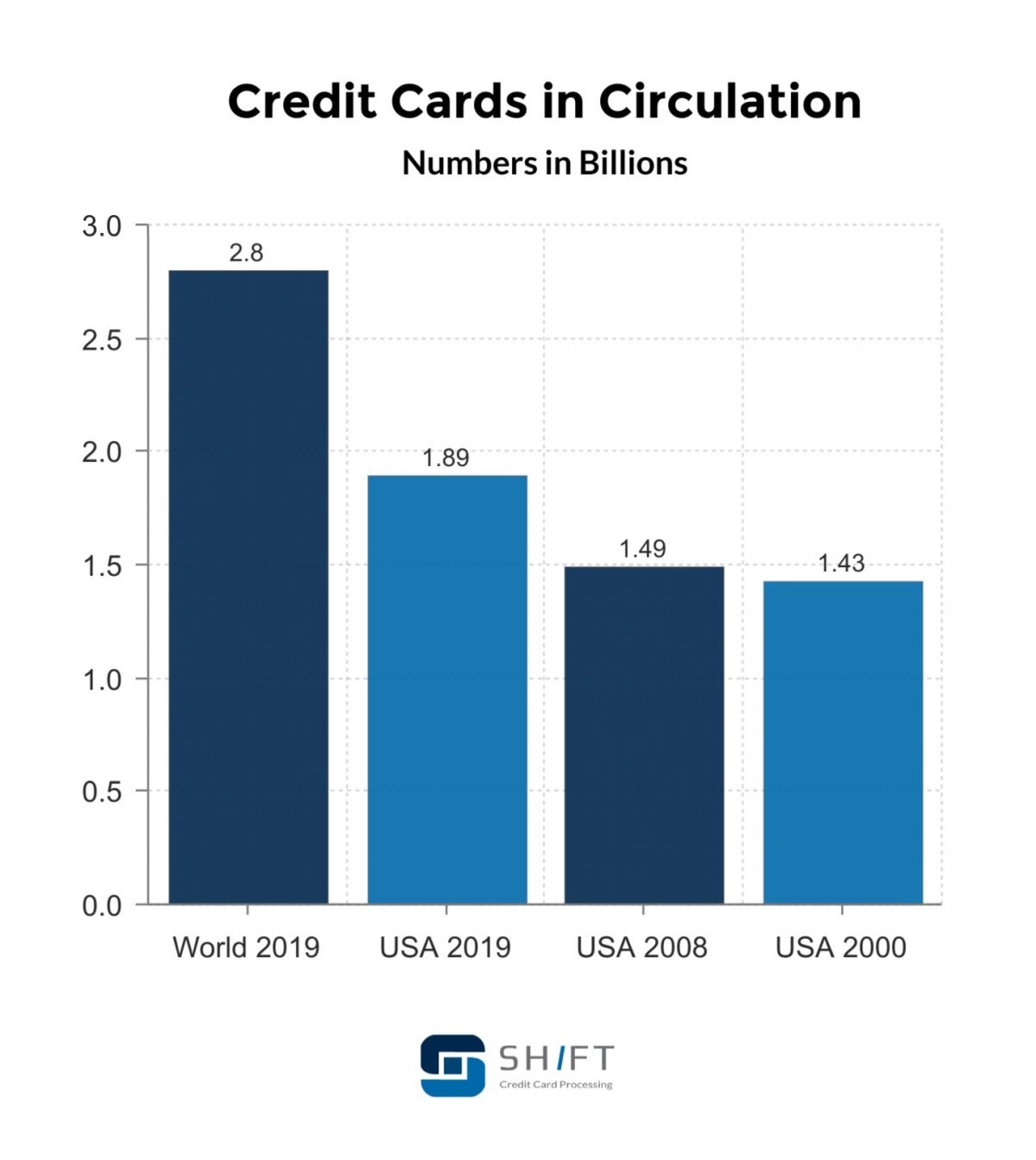

The average apr on credit card accounts assessed interest is 2125. However some of our partner offers may have expired. This statistic shows the average number of credit cards per household in selected countries worldwide in 2016.

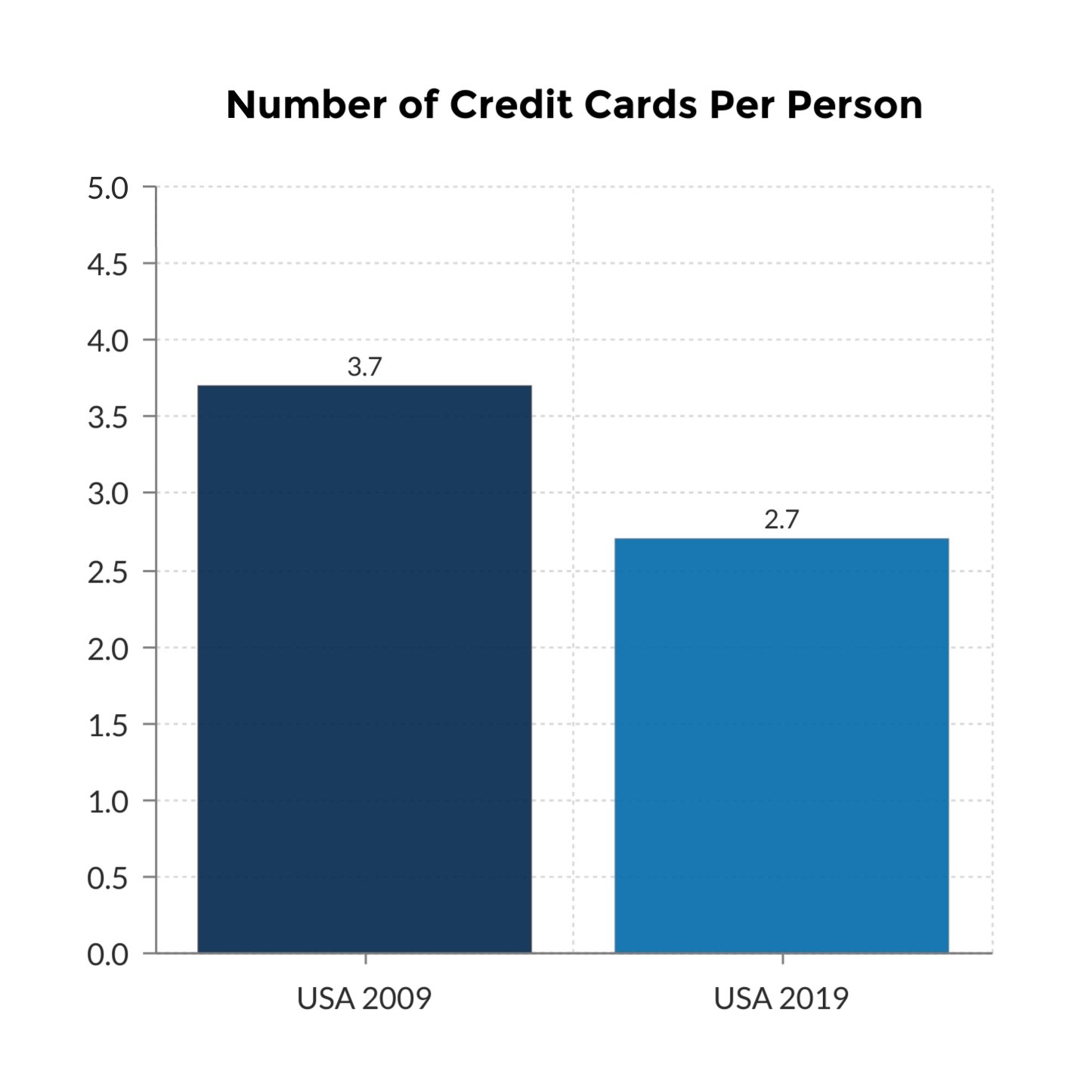

According to data from gallup the average american has 26 credit cards although this includes the 29 of americans who dont have any credit. The content on this page is accurate as of the posting date. The current outstanding revolving debt in the us.

To see the average credit card debt throughout the nation use the interactive map below. Weve compiled industry statistics to answer those questions and more about whos carrying what cards. South carolina and maine were among other states that had low average credit card debt per household.

The average household in ohio holds just 5446 in credit card debt which is the least of any state. Credit card debt continues to rise but so does income for many americans. The average consumer has 1841 in balances on retail cards and we estimate combining all consumers with retail or credit card debt the average is approximately 5000 per individual.

Another way to analyze the credit card debt statistics is to look at how the numbers stack up for those who are actually carrying all that debt. Our annual analysis includes tips on reducing interest costs. How many credit cards does the average american have and what types do they have.

The average credit card debt is 6028.

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

Average Credit Card Debt In America January 2020 Valuepenguin

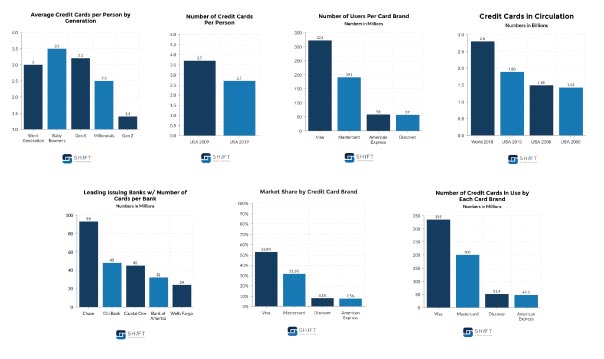

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing

How Much Debt Americans Have At Every Age

How Much Debt Americans Have At Every Age

Credit Card Statistics Updated September 2019 Shift Processing

Credit Card Statistics Updated September 2019 Shift Processing