Can i get a car loan with a repossession on my credit report. Rather than fighting to remove a repossession from your credit report avoid repossession altogether.

How To Remove A Repossession From Your Credit Report

How To Remove A Repossession From Your Credit Report

can a repossession be removed from your credit report

can a repossession be removed from your credit report is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can a repossession be removed from your credit report content depends on the source site. We hope you do not use it for commercial purposes.

Work to avoid repossession.

Can a repossession be removed from your credit report. Any mistake even a small one can be enough to ask a credit bureau to correct or remove the repossession from your credit report. When repairing your credit after a repossession make sure you pay back any outstanding loan balance you owe. Lenders will consider your payment habits of different loan types.

Nearly everyone falls into financial difficulty once or twice in their lives. Removing a repossession from your credit report may seem to be a daunting task but it is possibleyou just need to meet a certain set of criteria. Repossessions note the seizure of any assets due to late or delinquent payments.

Review each of them for any inaccurate or erroneous information and highlight any mistakes you see. Each credit report can contain different information. If youre going to get the repossession removed by yourself there are a couple of ways you can go about it.

Plus itll lower your overall amounts owed which also contributes to a better score. The best battle is the one you dont have to fight. If the lender cant verify that the repossession is valid or fails to answer the dispute within 30 days then they must remove it from your credit report.

While credit repair is hardly a guarantee filing a credit report dispute may allow you to remove an erroneous or unsubstantiated repossession mark from your credit report. The circumstances that can lead to a tough money situation are many and varied ranging from a contentious divorce serious illness or the loss of a job to a natural disaster. They will do this when deciding whether to lend money to a loan applicant.

If a repossession is listed on your credit report there is still a way to rebuild your credit and potentially remove the listing from your credit report. If the repossession on your credit reports is accurate your credit score could drop anywhere from 60 to 240 points depending on your situation. Inspect your credit reports carefully.

Credit disputes can be filed yourself though an experienced credit repair company may have more success. How to remove repossessions from your credit report. Generally the higher your score is the bigger the drop.

Steps to remove a repossession from your credit report. You can either attempt to remove it yourself or you can have a professional remove the repossession. Repossessions are a negative item listed on your credit report that can hurt your credit score.

The delinquent loan will be marked as paid or satisfied on your credit report which gives your fico score a boost. Heres what you can do to remove repossession from your credit report and gain control of your financial life. There are good companies out there like lexington law that can help you remove negative items like repossessions from your credit reports.

How To Remove A Car Repossession From Your Credit Report

How To Remove A Car Repossession From Your Credit Report

How To Remove A Repossession From Your Credit Report 2020 Tips

How To Remove A Repossession From Your Credit Report 2020 Tips

How To Remove A Repossession From Your Credit Report

How To Remove A Repossession From Your Credit Report

How To Get A Repo Off Your Credit Report 2020 Badcredit Org

How To Get A Repo Off Your Credit Report 2020 Badcredit Org

/credit-report-157681670-577570565f9b5858759f6f0d.jpg) Understanding Your Credit History

Understanding Your Credit History

Need Repossessions Removed From Your Credit Report Credit

How To Get Items Removed From A Credit Report Money Com

How To Get Items Removed From A Credit Report Money Com

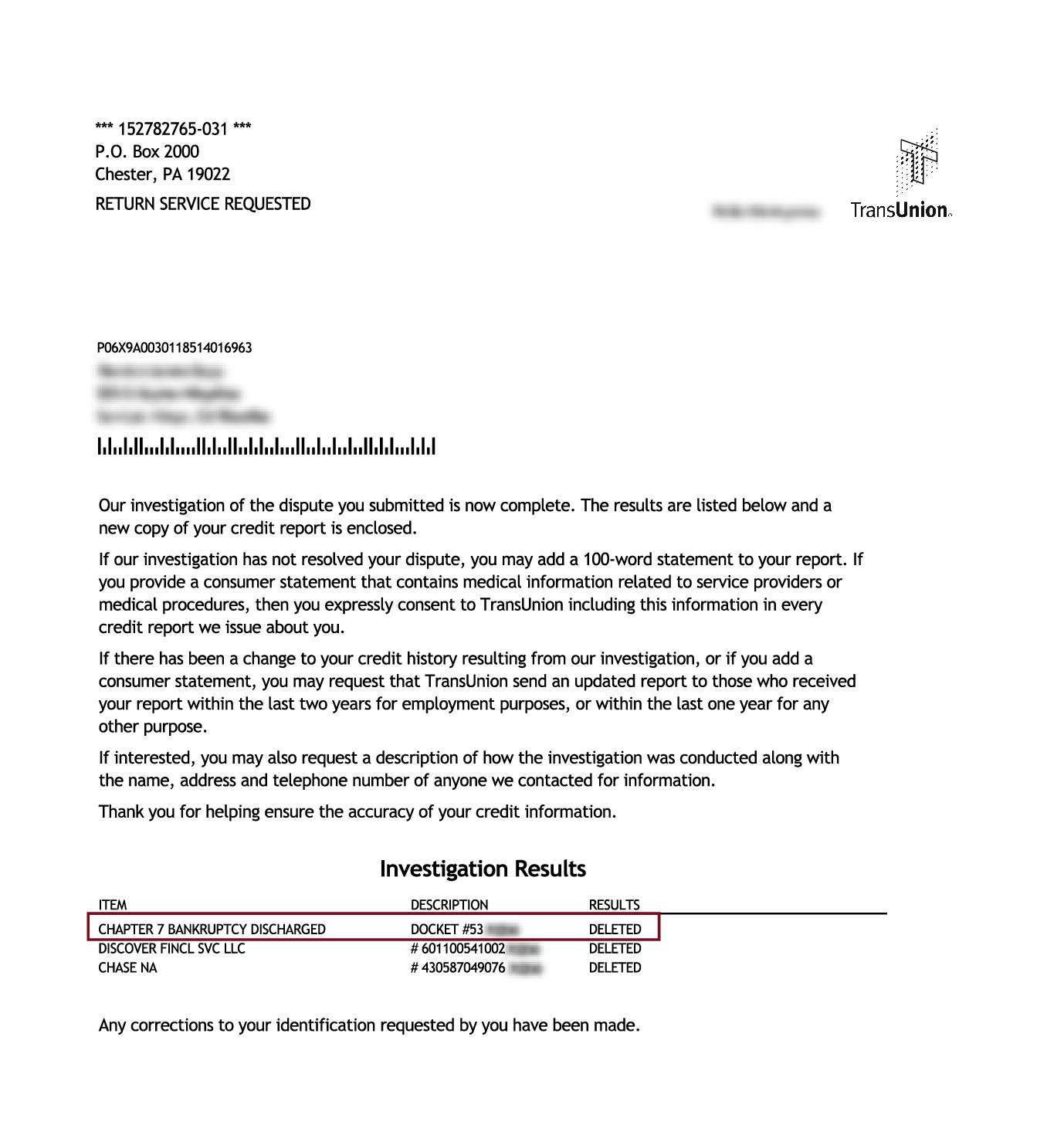

How To Remove A Bankruptcy From Your Credit Report See Proof

How To Remove A Bankruptcy From Your Credit Report See Proof

What Is A Charge Off On My Credit Report How To Get Charge

How To Remove Repossession From Credit Report

3 Credit Reporting Agencies Contact Information Can Charge