I was expecting it though. Their job is to collect money that is owed to hmrc.

Iras Tax Season 2019 About Your Tax Bill

Iras Tax Season 2019 About Your Tax Bill

can you pay back tax credits in installments

can you pay back tax credits in installments is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you pay back tax credits in installments content depends on the source site. We hope you do not use it for commercial purposes.

If the tax credit office think you have to pay back some of your tax credits directly they will usually ask the debt management part of hmrc to do this.

Can you pay back tax credits in installments. You can read more about the pta and how to create an account on the litrg website. Once in the pta claimants will need to click on tax credits and on the first page there is a list of tax credit forms that can be filled in and submitted through the pta. When are you supposed to pay it back by.

You can also ask for your account to be reviewed every year to ensure that you are paying back what you can afford. Youve prepared your income tax return and you discover that you owe more than you can afford to pay right now. If hmrc has reduced your tax credits to pay back an overpayment you can ask them to reconsider.

How can i pay a tax credit debt. If you cant pay it all at once i thought they would just reduce your payments or you can apply to pay by installments. You are right not to ignore as the tax man never goes away.

Tax credits overpayments. How to pay back taxes in installments. If your circumstances change after you have exited the system and you expect to earn over the threshold amount or you want to plan ahead and budget again for your income tax you can re enter.

Online you need your government gateway user id and password if. Your future payments will be reduced until youve paid back the money you owe. If youre not working and you get the maximum amount of tax credits your payments will usually be reduced by 10 until the overpayment is cleared.

I wish you all the bestbtw i too am paying back an overpayment so i understand how you feel. Hmrc often use private companies including debt collection companies to do work for them. The most common ways tax debt can be collected are by.

You pay penalties for not filing a tax return and for failure to pay along with interest on unpaid taxes. If you think you no longer need to pre pay your income tax using payg instalments you may be able to exit the system. If you do not get tax credits or.

I will have to pay some back dont know the exact amount yet but likely to be a few hundred. The internal revenue service is not a finance company but it has systems in place if you cannot pay your taxes timely. A request for an extension of time to file your tax.

Reducing your future tax credit payments until the overpayment has been paid. Can i pay the irs in installments. If you still get tax credits.

You can pay by cheque made payable to hm.

Four Expenses You Could Be Earning Credit Card Rewards For

Four Expenses You Could Be Earning Credit Card Rewards For

You Should Never Use Credit Card 0 Instalment Plan For

You Should Never Use Credit Card 0 Instalment Plan For

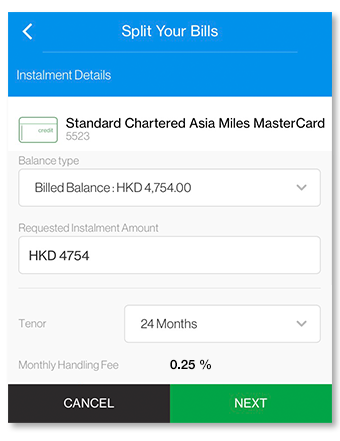

Credit Card Instalment Plan Standard Chartered Hk

Credit Card Instalment Plan Standard Chartered Hk

Surprise No Tax Refund For You What Not To Do If You Owe

Surprise No Tax Refund For You What Not To Do If You Owe

You Need To Pay Your Taxes Quarterly If Marketwatch

You Need To Pay Your Taxes Quarterly If Marketwatch

What To Do If You Can T Pay Your Taxes Marketwatch

What To Do If You Can T Pay Your Taxes Marketwatch

3 Ways To Calculate An Installment Loan Payment Wikihow

3 Ways To Calculate An Installment Loan Payment Wikihow

Having Trouble With Debts In Singapore Here Is Your Roadmap

Having Trouble With Debts In Singapore Here Is Your Roadmap

Thousands Chased By Hmrc Debt Collectors Due To Overpaid Tax

Thousands Chased By Hmrc Debt Collectors Due To Overpaid Tax

How Much Must I Earn To Afford A Hdb Flat In Singapore

How Much Must I Earn To Afford A Hdb Flat In Singapore

:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)