A debt consolidation loan can help you get back on track and save money over time. Personal loan or home equity loan may hurt your credit scores in the short or medium term.

Does A Debt Consolidation Loan Hurt Your Credit Score Loanry

Does A Debt Consolidation Loan Hurt Your Credit Score Loanry

does a debt consolidation loan hurt your credit score

does a debt consolidation loan hurt your credit score is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in does a debt consolidation loan hurt your credit score content depends on the source site. We hope you do not use it for commercial purposes.

Any time that happens your score takes a dip.

Does a debt consolidation loan hurt your credit score. Continue to make charges on your credit cards after you pay off your balances. Simply shifting credit card debt to an installment loan sounds. How debt consolidation affects credit scores.

It can give you the biggest credit score boost without paying a cent in interest. One inadvertent late payment on your debt consolidation loan can drop your credit score quickly and multiple late payments can sink it virtually into oblivion. Seeing a credit counselor and signing up for a debt management plan does not.

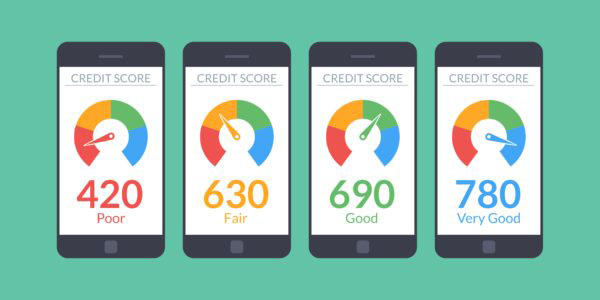

In fact you can improve your credit as you repay your consolidation loan. Does not appear on your credit report so it has no effect on your credit score. Debt consolidation has the potential to help or hurt your credit scoredepending on which method you use and how diligent you are with your repayment plan.

How debt consolidation affects your credit. Debt consolidation may raise your credit scores in the long run if you use it to pay off debt. Debt consolidation will not hurt your credit score and is also a good idea to think for then just going for chapter 7 or 13 bankruptcy.

Whether you opt for a loan or a credit card youre applying for new credit and that means a hard inquiry into your credit. Debt solutions california. The way debt consolidation affects your credit depends on the various options you choose.

But debt consolidation is also a loan to pay off others so try getting out of it fast. The strategy is considered in situations where people want to streamline the repayment of multiple high interest debt amountsoften with the hopes of saving money and lowering their debt burden. Debt consolidation may hurt your credit score if you.

While your credit score may take a small hit during the loan application process reducing your debt burden and lowering your credit utilization ratio can do wonders for your score in the long term especially if youre able to accelerate your progress by paying. I personally suggest you to go for it. The average cardholder in the us.

Has a balance of 5234according to the federal reserve the average interest rate on credit cards is over 1500 which can cause your debt to spiral out of control quickly. Credit card debt is a serious issue. Debt consolidation could be bad for your credit score in the long run without a spending plan.

Any gain from reducing your credit utilization will go away quickly when your balances go up again youre 30 days or more late on making your payments on the debt consolidation loan. Bankrates debt adviser explains why. However when considering debt consolidation its important to note that payment history works both ways when it comes to credit.

How Debt Consolidation Affects Your Credit

How Debt Consolidation Affects Your Credit

How Will A Debt Consolidation Loan Affect My Credit

How Will A Debt Consolidation Loan Affect My Credit

How Debt Consolidation Affects Your Credit

How Debt Consolidation Affects Your Credit

How Will A Debt Consolidation Loan Affect Your Credit Score

How Will A Debt Consolidation Loan Affect Your Credit Score

Debt Consolidation Management Debt Consolidation Loan 620

Debt Consolidation Management Debt Consolidation Loan 620

How To Consolidate Debt And Boost Your Credit Score

How To Consolidate Debt And Boost Your Credit Score

Does A Debt Management Plan Affect Your Credit Score

Does A Debt Management Plan Affect Your Credit Score

Free Debt Consolidation Programs Debt Consolidation

Free Debt Consolidation Programs Debt Consolidation

How Consolidating Loans Could Help You Save Money

How Consolidating Loans Could Help You Save Money

/GettyImages-183384739-5c254a6cc9e77c000124b1b4.jpg) Best Debt Consolidation Loans Of 2020

Best Debt Consolidation Loans Of 2020

Pay Off Your Debts Schemes That Help You Get Out Of Debt

Pay Off Your Debts Schemes That Help You Get Out Of Debt