Please see irs tax tip 2017 11 february 8 2017five things to know about the child tax credit for updated information. We will select the right form and fill it out in order for you to get your maximum credit amount.

Earned Income Tax Credit And Child Tax Credit 101 Center

how do you qualify for a child tax credit

how do you qualify for a child tax credit is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how do you qualify for a child tax credit content depends on the source site. We hope you do not use it for commercial purposes.

The child tax credit can significantly reduce your tax bill if you meet all seven requirements.

How do you qualify for a child tax credit. The child tax credit is an important tax credit that may be worth as much as 1000 per qualifying child depending upon your income. Paying for childcare and dependent care can be very expensive. They must be your child or you must be their legal guardian.

The child tax credit what it is and how much you can get. Whether you can claim the person as a dependent. The persons date of birth.

This credit reduces your federal income tax bill by up to 2000 per child for the 2019 tax year what you file in early 2020. To qualify for the tax credit your child must meet the following requirements. Calculate how much tax credit including working tax credits and child tax credits you could get in total from todays date to the end of the 2019 to 2020 tax year.

In the past two years there have been notable changes to this tax credit. Keep in mind that this is not a deduction it is a credit. You must have claimed them as a dependent.

If you had to pay someone to care for your child dependent or spouse so you could work look for work go to school or because of a disability then the child and dependent care credit may be for you. You andor your child must pass all seven to claim this tax credit. Length of residency and 7.

The child tax credit offers up to 2000 per qualifying dependent child 16 or younger at the end of the calendar year. This interview will help you determine if a person qualifies you for the child tax credit or starting in 2018 the credit for other dependents. If you have young children or other dependents there is a good chance you qualify for the child tax credit.

There is a 500. If you qualify for the credit the exact amount will be calculated for you. Fortunately there is a tax credit to help defray the costs.

Irs tax tip 2011 29 february 10 2011. Taxpayers that qualify for the child tax credit can claim a maximum of 2000 per qualifying child. Tax credits reduce the amount of tax you pay.

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Claiming The Child Tax Credit Everything You Need To Know

Claiming The Child Tax Credit Everything You Need To Know

The Child Tax Credit Current Law Everycrsreport Com

The Child Tax Credit Current Law Everycrsreport Com

Child Tax Credit Guide 2019 Tax Year How Much Are You

Child Tax Credit Guide 2019 Tax Year How Much Are You

7 Requirements For The Child Tax Credit Turbotax Tax Tips

7 Requirements For The Child Tax Credit Turbotax Tax Tips

A New Child Tax Credit Would Put Us On The Road To A

A New Child Tax Credit Would Put Us On The Road To A

Child Tax Credit 2019 2020 How To Qualify How Much It Is

Child Tax Credit 2019 2020 How To Qualify How Much It Is

New Child Tax Credit Claiming Under 2018 Rules

New Child Tax Credit Claiming Under 2018 Rules

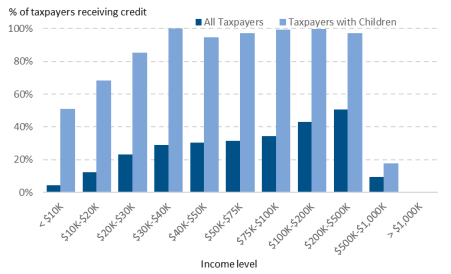

Chart Book The Earned Income Tax Credit And Child Tax

Chart Book The Earned Income Tax Credit And Child Tax

Publication 972 2018 Child Tax Credit Internal Revenue

Publication 972 2018 Child Tax Credit Internal Revenue