For a person or couple to claim one or more persons as their qualifying child requirements such as. Income from these credits leads to benefits at virtually every stage of life.

Celebrating The Eitc Center On Budget And Policy Priorities

Celebrating The Eitc Center On Budget And Policy Priorities

how much is child earned income credit for 2013

how much is child earned income credit for 2013 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much is child earned income credit for 2013 content depends on the source site. We hope you do not use it for commercial purposes.

In some cases the eic can be greater than your total income tax bill providing an income tax refund to families that may have little or no income tax withheld from their paychecks.

How much is child earned income credit for 2013. Michelle cruz rosado 586048 views. Earned income credit eic is a tax credit available to low income earners. The earned income tax credit eitc first proposed in the early 1970s was signed by president ford.

Any refund you receive because of the eic cannot be counted as income when determining whether you or anyone else is eligible for benefits or assistance or how much you or anyone else can receive under any fed eral program or under any state or local program financed. If the parents of a child can but do not claim the child as a qualifying child for the earned income tax credit no one else can either. The truth about your mortgage secrets the banks dont want you to know duration.

Earned income tax credit 2013. In some cases the eic can be greater than your total income tax bill providing an income tax refund to families that. A tax credit means more money in your pocket.

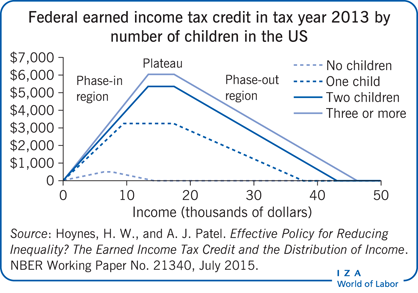

Eitc earned income tax credit is a benefit for working people who have low to moderate income. The amount of eitc benefit depends on a recipients income and number of children. It was later substantially expanded by president reagan who deemed it the best anti poverty the best pro family the best job creation measure to come out of congress snyder 1995.

What is eitc earned income tax credit. As a result the credit is reduced by approximately 16 percent of any income above 17530. Earned income credit eic is a tax credit available to low income earners.

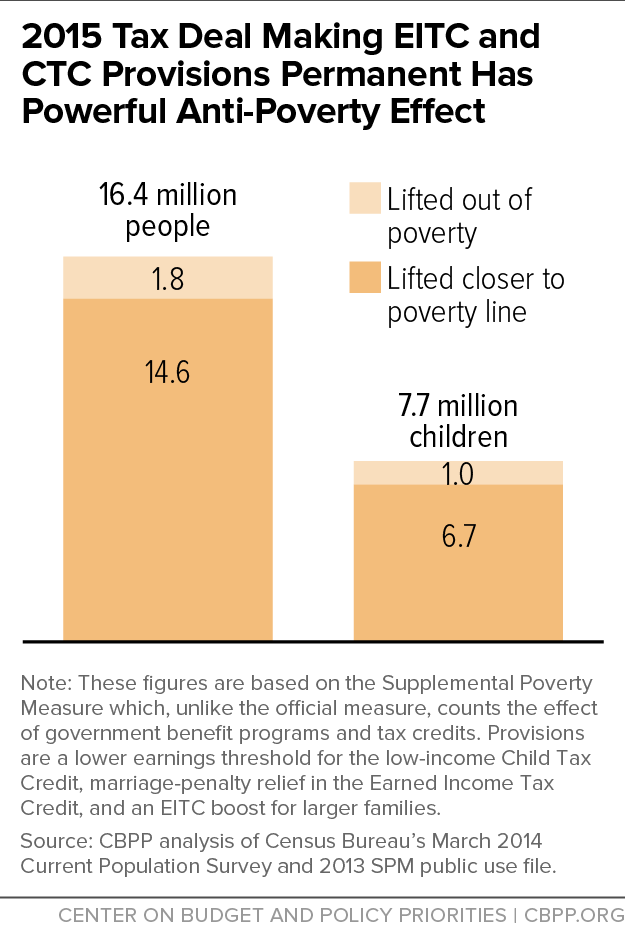

With one qualifying child. Earned income credit has no effect on certain wel fare benefits. The earned income tax credit eitc and child tax credit ctc are successful federal tax credits for low and moderate income working people that encourage work help offset the cost of raising children and lift millions of people out of poverty.

The phase out range begins at 22870 and is completed at 43210 for those with one qualifying child who file a joint return. The qualifying child cant file his own joint return unless it is only to claim a refund by the child and the childs spouse. It reduces the amount of tax you owe and may also give you a refund.

The united states federal earned income tax credit or earned income credit eitc or eic is a refundable tax credit for low to moderate income working individuals and couples particularly those with children. Eitc is also called eic or earned income credit.

Childless Workers Receive Much Smaller Average Earned Income

Childless Workers Receive Much Smaller Average Earned Income

Should The Earned Income Tax Credit Rise For Childless

Should The Earned Income Tax Credit Rise For Childless

The Federal Earned Income Tax Credit And The Minnesota

The Federal Earned Income Tax Credit And The Minnesota

The Federal Earned Income Tax Credit And The Minnesota

The Federal Earned Income Tax Credit And The Minnesota

Tax Aide Child Tax Credits Both A Non Refundable And A

Tax Aide Child Tax Credits Both A Non Refundable And A

Iza World Of Labor Do In Work Benefits Work For Low

Iza World Of Labor Do In Work Benefits Work For Low

2015 Tax Deal Making Eitc And Ctc Provisions Permanent Has

2015 Tax Deal Making Eitc And Ctc Provisions Permanent Has

2013 Eic Chart Cigit Karikaturize Com

2013 Eic Chart Cigit Karikaturize Com

Infographic How The Earned Income Tax Credit Helps Low

1 Promote The Earned Income Credit And Child Tax Credit

1 Promote The Earned Income Credit And Child Tax Credit

Irs Announces 2013 Tax Rates Standard Deduction Amounts And